Analysis of Your Trade and Recovery Strategy

1. Current Trade Overview

Based on the screenshots you provided:

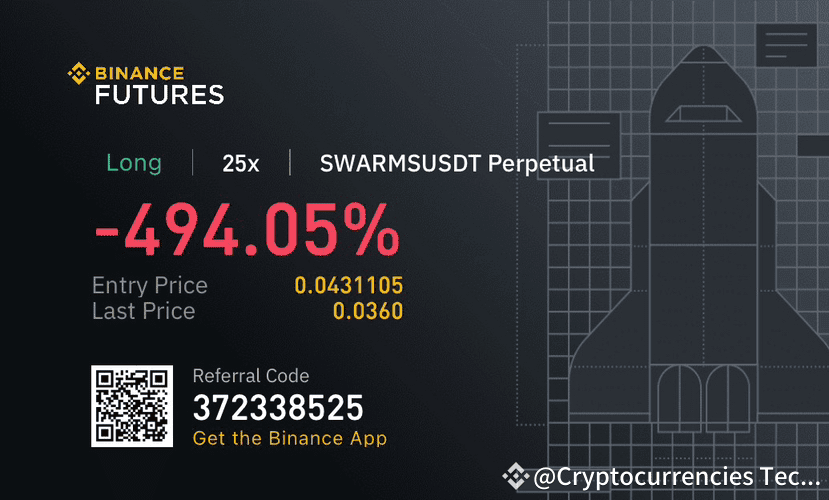

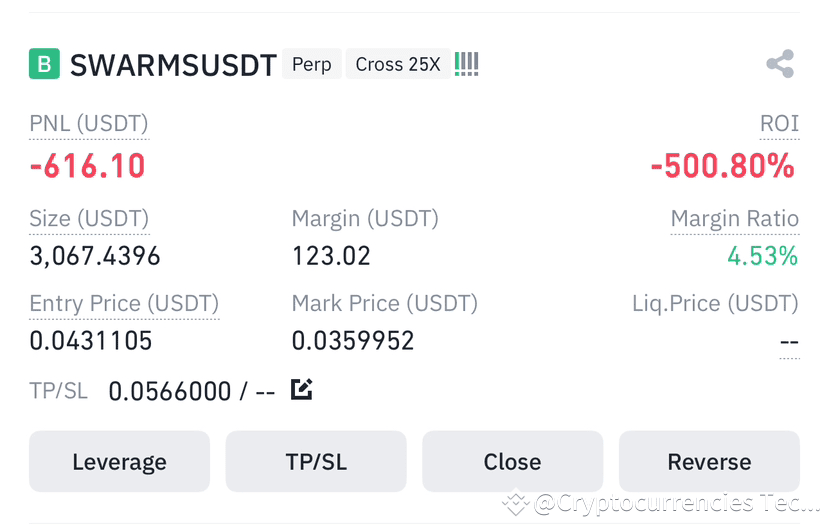

• Trading Pair: SWARMSUSDT Perpetual

• Leverage: 25x

• Position: Long

• Entry Price: 0.0431105 USDT

• Current Price (Mark Price): 0.0359952 USDT

• Unrealized PNL: -616.10 USDT

• ROI: -500.80%

• Margin Remaining: 4.53%

2. What Went Wrong?

• You entered a long position with high leverage (25x), which means your margin is very sensitive to price changes.

• The price has dropped significantly (~16.5%) from your entry point, amplifying losses due to leverage.

• With a margin ratio of 4.53%, you are very close to liquidation.

3. Strategies to Recover Your Trade

You have a few options, but each comes with risks:

Option 1: Wait for Price Recovery

• If you believe in the fundamentals of SWARM, the price may recover over time.

• However, since you’re on cross-margin with high leverage, there is a risk of liquidation before a rebound.

🔹 Risk: If the price drops further, your position might be automatically liquidated.

Option 2: Add Margin to Avoid Liquidation

• Since your margin ratio is 4.53%, adding more funds can reduce the risk of liquidation.

• This will extend your liquidation price lower, giving more room for price recovery.

🔹 Risk: You are putting in more capital into a losing trade, which may lead to bigger losses if the price continues to fall.

Option 3: Hedge with a Short Position

• Open a small short position to offset losses in case the price keeps dropping.

• This helps balance out potential further losses.

🔹 Risk: If the price recovers, your short trade will lose money while your long position gains.

Option 4: Exit the Trade and Re-enter Lower

• Cut partial or full losses, then wait for a better re-entry at a lower price.

• This helps you reduce further risks while keeping capital available for re-entry.

🔹 Risk: If you exit and the price immediately rebounds, you might miss out on the recovery.

4. How Long Will It Take to Recover?

• Short-Term Outlook: Based on market conditions, a quick recovery is unlikely unless there’s a sudden price spike.

• Medium to Long-Term: If the project has strong fundamentals, it may recover over weeks or months.

To predict recovery time, check:

✔ Market Sentiment (Bearish or Bullish)

✔ Trading Volume & Liquidity (Increasing volume may indicate reversal)

✔ Support & Resistance Levels (If price stabilizes and finds support, recovery is possible)

5. Conclusion & Best Approach

✔ If you have extra funds, add margin to prevent liquidation.

✔ If not, consider closing part of your position to lower exposure.

✔ Monitor price action closely—if it starts an uptrend, you may recover.

✔ Set a stop loss for future trades to avoid such large drawdowns.

$