🇨🇳 China’s $18 Trillion Property Crash – Why It Matters 🌍💥

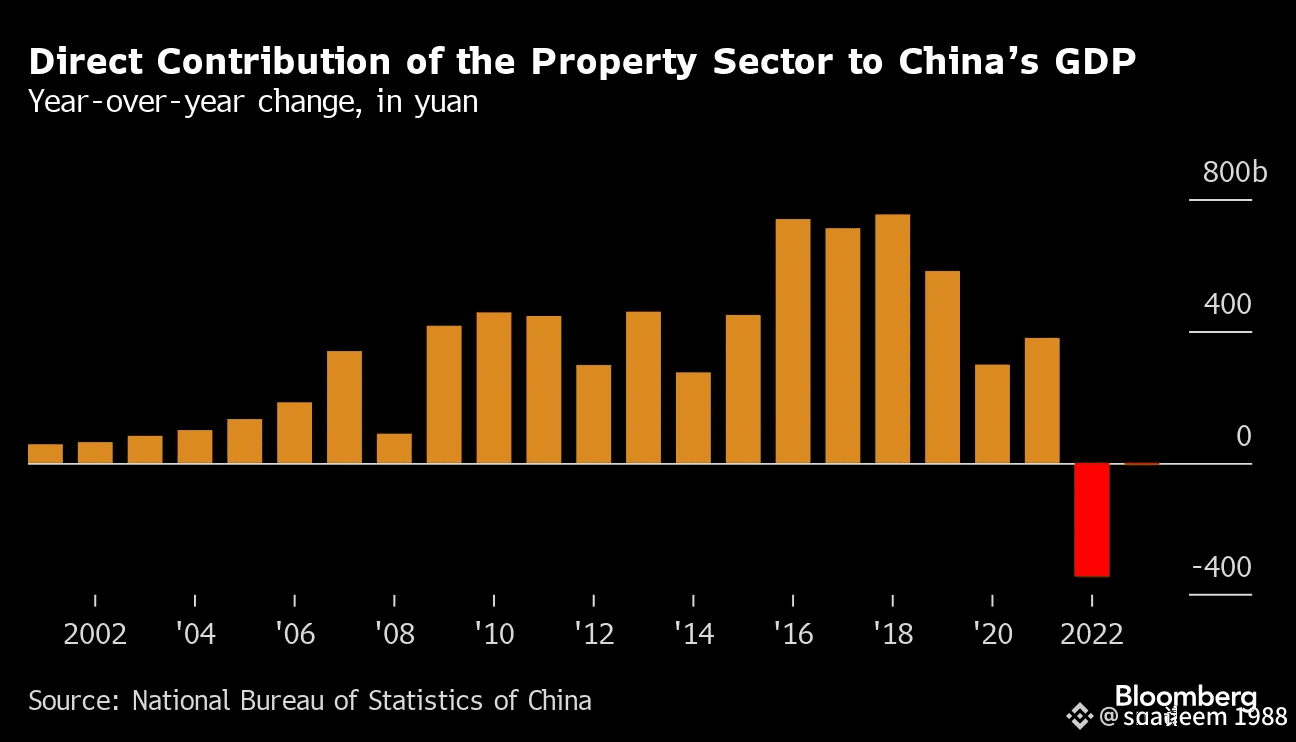

China’s real estate market has crashed, losing over $18 trillion since 2021 😱. That’s more than the 2008 U.S. crisis! This shows that China’s economy is facing big problems 📉.

---

💣 What Happened?

🔹 Big property companies (like Evergrande) borrowed too much money 💸

🔹 They couldn’t pay it back, and people stopped buying homes 🏠

🔹 China’s economy slowed down, and the government made strict rules 📊

🔹 Now the whole real estate market is falling 🚨

---

🌐 Why the World Should Care:

📌 Real estate is 25–30% of China’s economy

📌 Most of China’s middle class invested in property – now they’re losing money 😓

📌 Less spending in China = lower demand for global goods, crypto, tech, etc. 📉🌍

---

🔮 What’s Next?

👨💼 The government might add some help (stimulus), but that won’t fix deep problems

🕐 A quick recovery is not expected

💹 Investors are now looking at crypto, tech, and international markets as better options

---

✅ Bottom Line:

The China property bubble has popped. Recovery will be slow.

🌎 Global markets, including crypto, are watching closely.$SOL