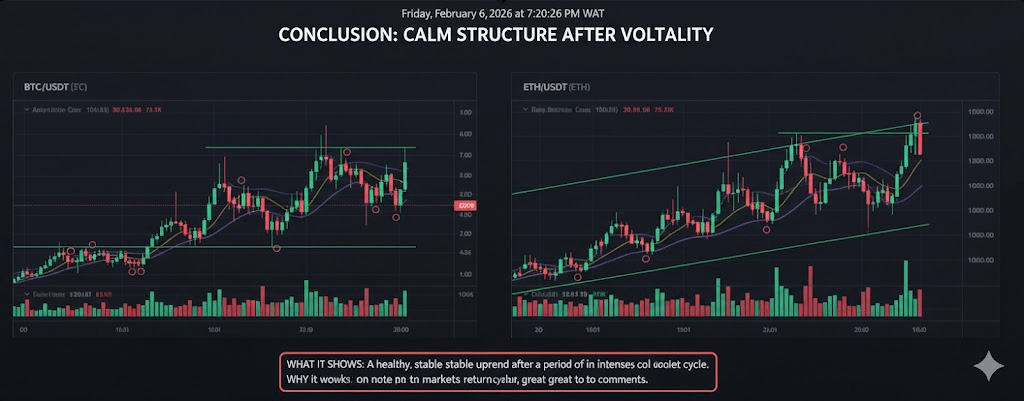

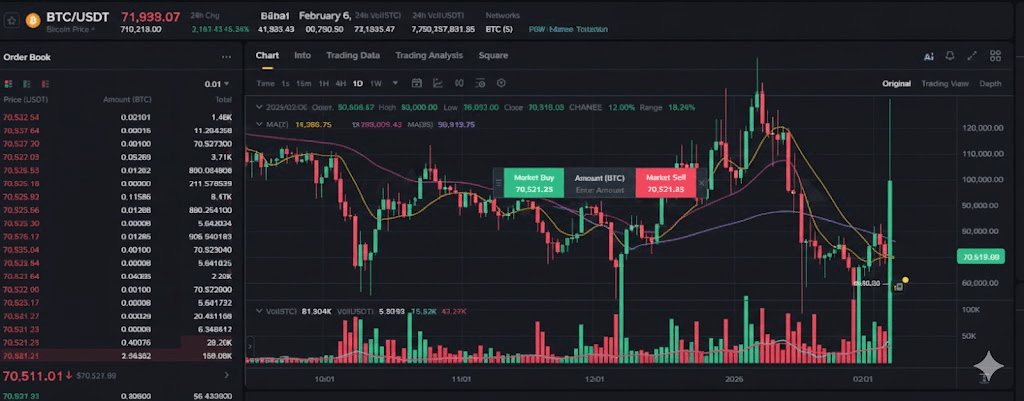

Volatility defines the crypto market. Unlike traditional assets that move in gradual cycles, crypto prices can swing aggressively within minutes. These sharp movements create massive opportunity, but they also expose poor decision-making faster than any other market. For most traders, losses during volatile periods don’t come from bad luck they come from weak structure.

Understanding Volatility Beyond Price Swings

Volatility is not just about large candles on a chart. It reflects uncertainty, shifting liquidity, and aggressive positioning from both retail traders and institutions. When volatility increases, mistakes become more expensive. Slippage widens, emotions intensify, and timing becomes critical. Traders who don’t adapt their strategy often find themselves reacting instead of executing.

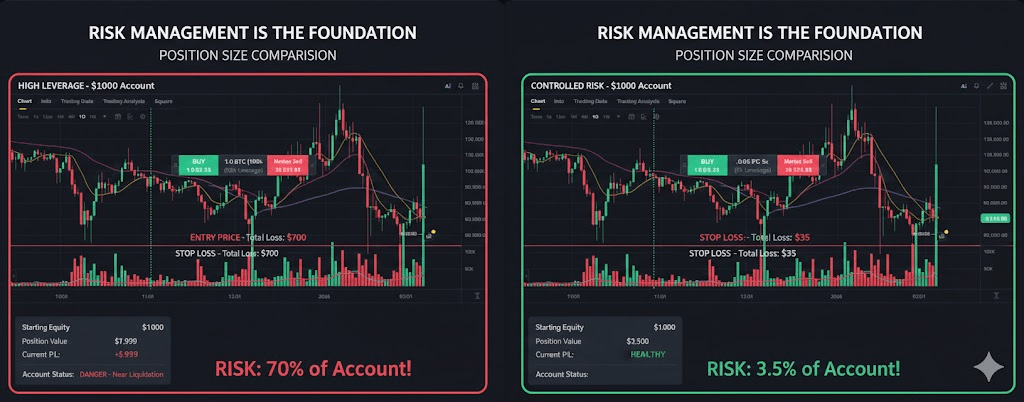

Risk Management Is the Foundation, Not an Afterthought

Many traders believe success comes from finding high-probability setups. In reality, success starts with controlling downside risk. Position sizing determines survival. During volatile conditions, reducing exposure is often smarter than increasing leverage. Professionals accept small, controlled losses because they understand that one oversized trade can erase weeks of gains.

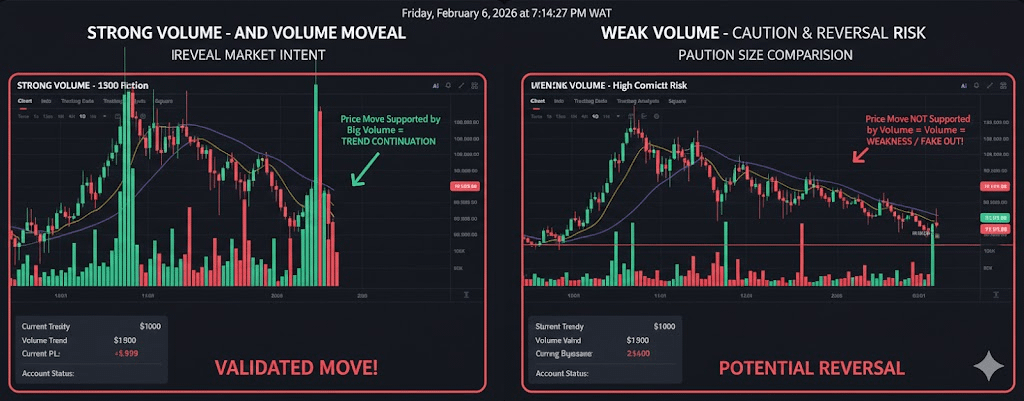

Liquidity and Volume Reveal Market Intent

Price movement without volume is unreliable. Strong volume confirms conviction, while thin liquidity creates deceptive breakouts and sudden reversals. High-volume zones tend to attract institutions, making price behavior more structured and predictable. Traders who track volume gain insight into whether a move is being supported or simply pushed by short-term speculation.

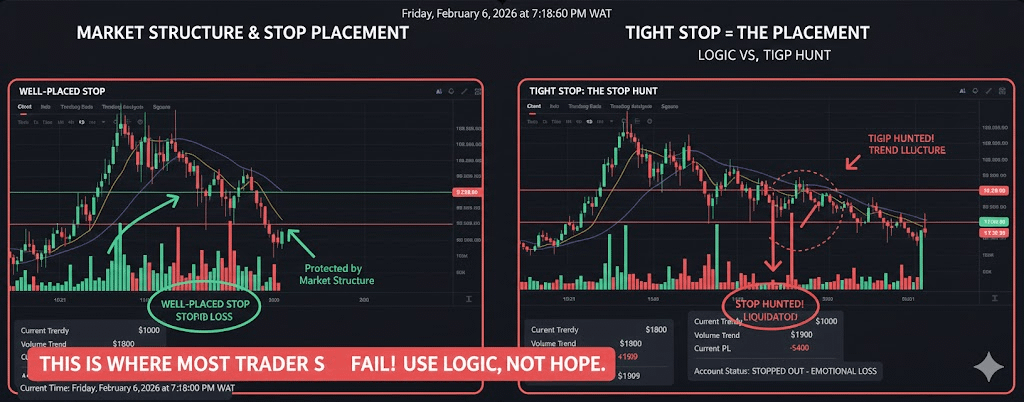

Stop-Loss Placement Is a Strategic Decision

A stop-loss should represent the point where a trade thesis is proven wrong. Placing stops too tightly invites unnecessary exits, while placing them too far increases risk beyond reason. Logical stop placement is based on market structure, not fear. Consistency here is what allows traders to stay disciplined during drawdowns.

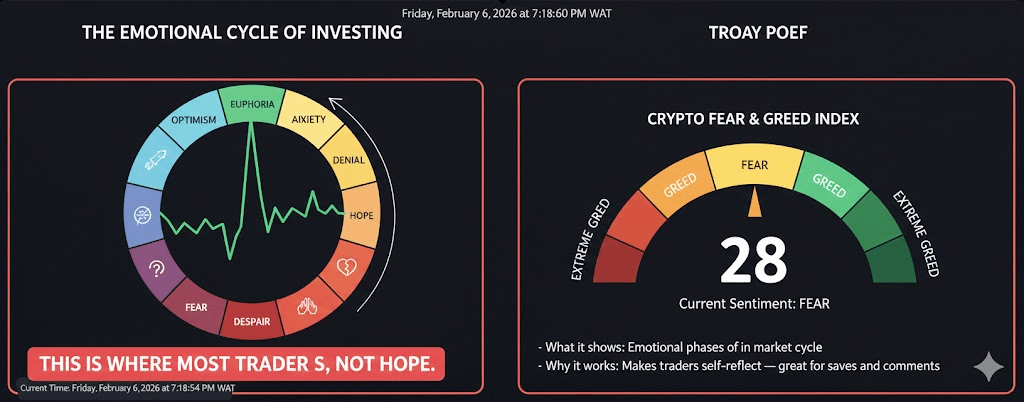

Psychology Becomes the Hidden Battlefield

Volatility amplifies emotion. Fear leads to premature exits, while greed encourages chasing extended moves. Traders who lack a defined plan often overtrade in these conditions, confusing activity with progress. A written strategy, clear rules, and patience are often more powerful than any indicator.

Capital Preservation Creates Longevity

The goal in crypto trading is not to catch every move it is to remain active long enough to capitalize on the best ones. Protecting capital during chaotic periods ensures traders can participate when conditions stabilize and high-probability setups return. Survival is the real competitive edge.

In crypto, volatility rewards discipline, preparation, and patience. Traders who respect risk and structure don’t fear volatility they use it as a filter to separate opportunity from noise.