Trading is exciting, fast-paced, and full of opportunities but the truth is, most traders end up losing money. It’s not because the market is “unfair” or luck wasn’t on their side it’s because certain avoidable mistakes keep repeating. Understanding these mistakes can save you time, money, and stress.

1. Trading Without a Plan

Jumping into trades without a clear strategy is like sailing a ship without a compass. Many traders rely on tips, rumors, or gut feelings instead of a structured plan. A solid plan includes:

Entry and exit rules

Risk management strategies

Profit targets and stop-loss levels

Without this framework, decisions become reactive instead of calculated.

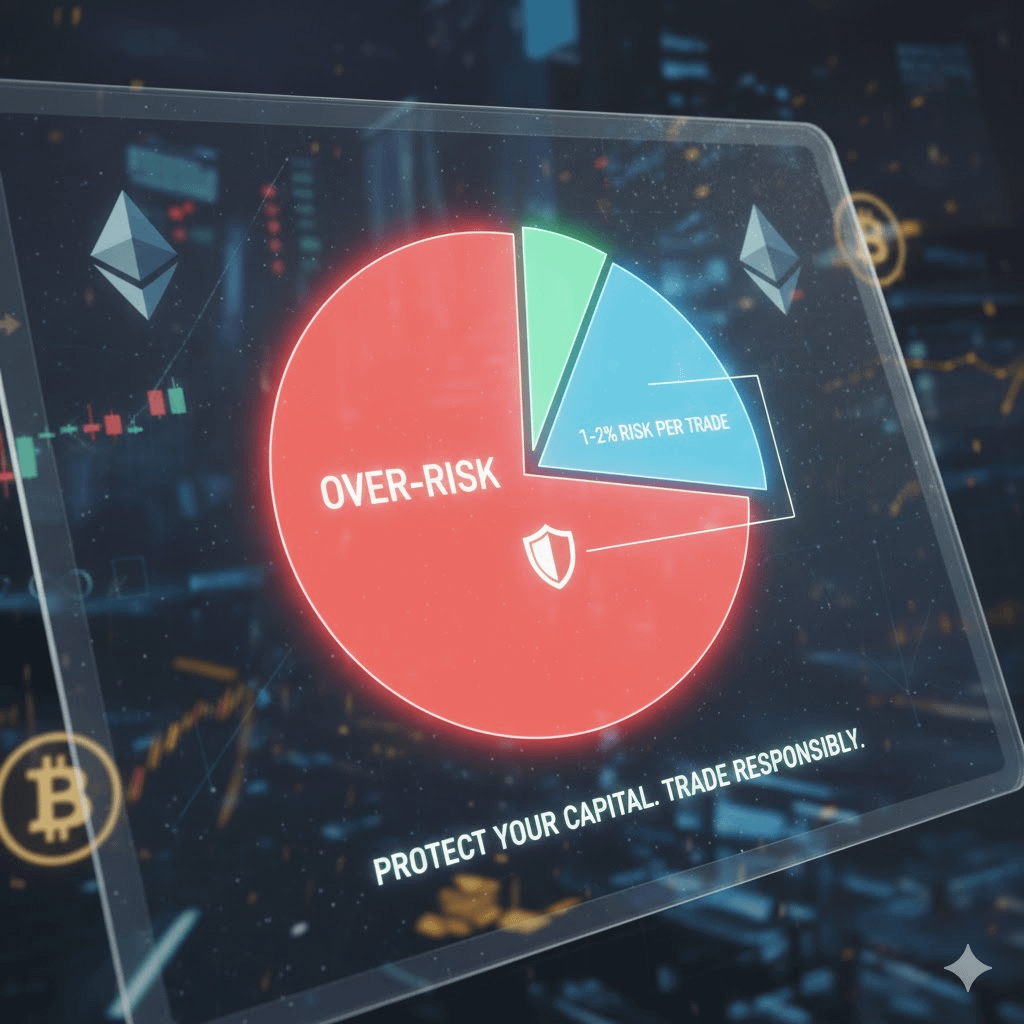

2. Poor Risk Management

One of the biggest reasons traders fail is risking too much on a single trade. Even profitable strategies fail if one bad trade wipes out weeks of gains. Protect your capital by:

Limiting risk per trade (1–2% of total capital is a common rule)

Using stop-losses and position sizing

Avoiding over-leveraging

3. Emotional Trading

Fear and greed are the silent killers of accounts. Panic-selling during a dip, revenge-trading after a loss, or chasing a pump often leads to repeated mistakes. Emotional control isn’t optional it’s essential.

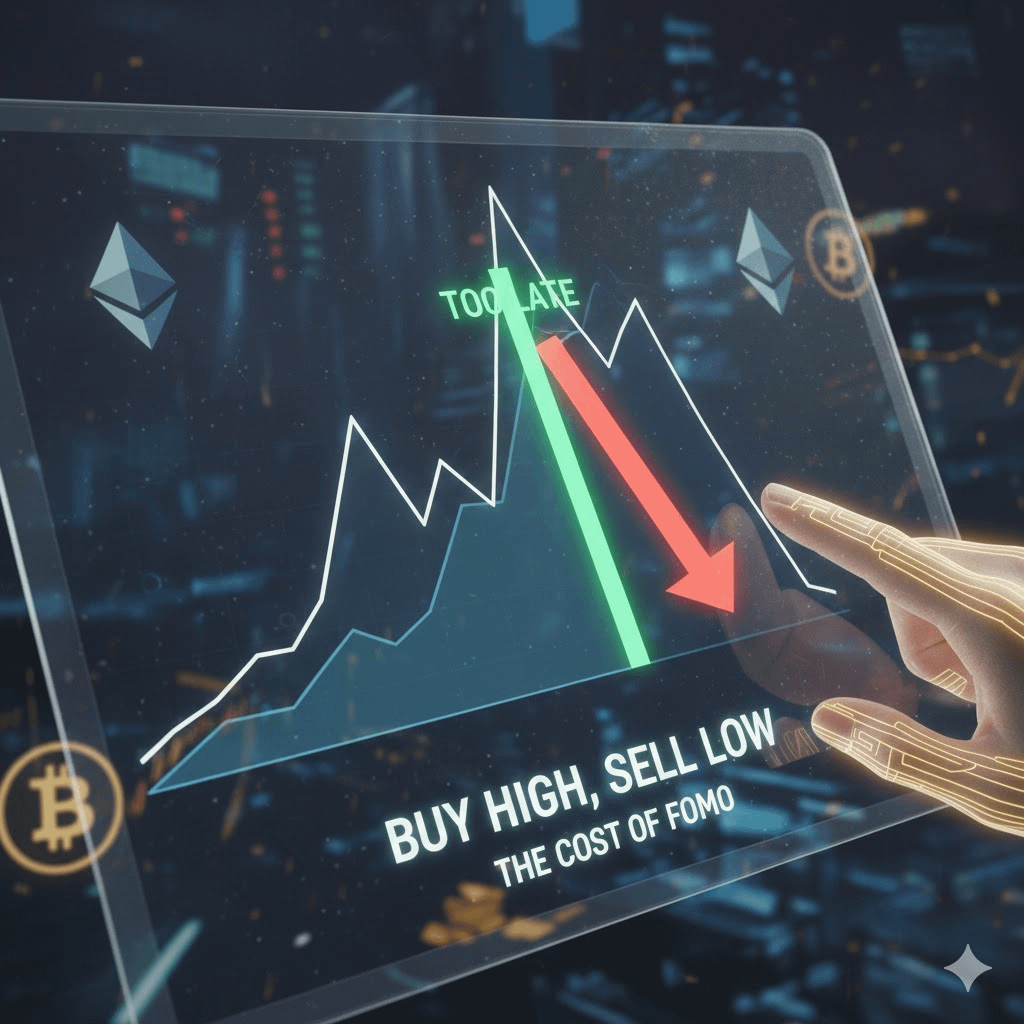

4. Chasing the Market (FOMO)

Buying after a price surge or chasing a breakout seems tempting, but it often results in buying high and selling low. Patience and waiting for the right setup usually yield better results than reacting to hype.

5. Overtrading

Some traders trade too often, either out of boredom or impatience. Every trade carries cost, both in fees and in psychological stress. Fewer, well-planned trades with higher probability setups often outperform constant activity.

6. Ignoring Education

Markets evolve, and strategies that worked yesterday may fail tomorrow. Traders who skip continuous learning rely on luck, which is rarely sustainable. Study technical analysis, market psychology, and macro factors regularly.

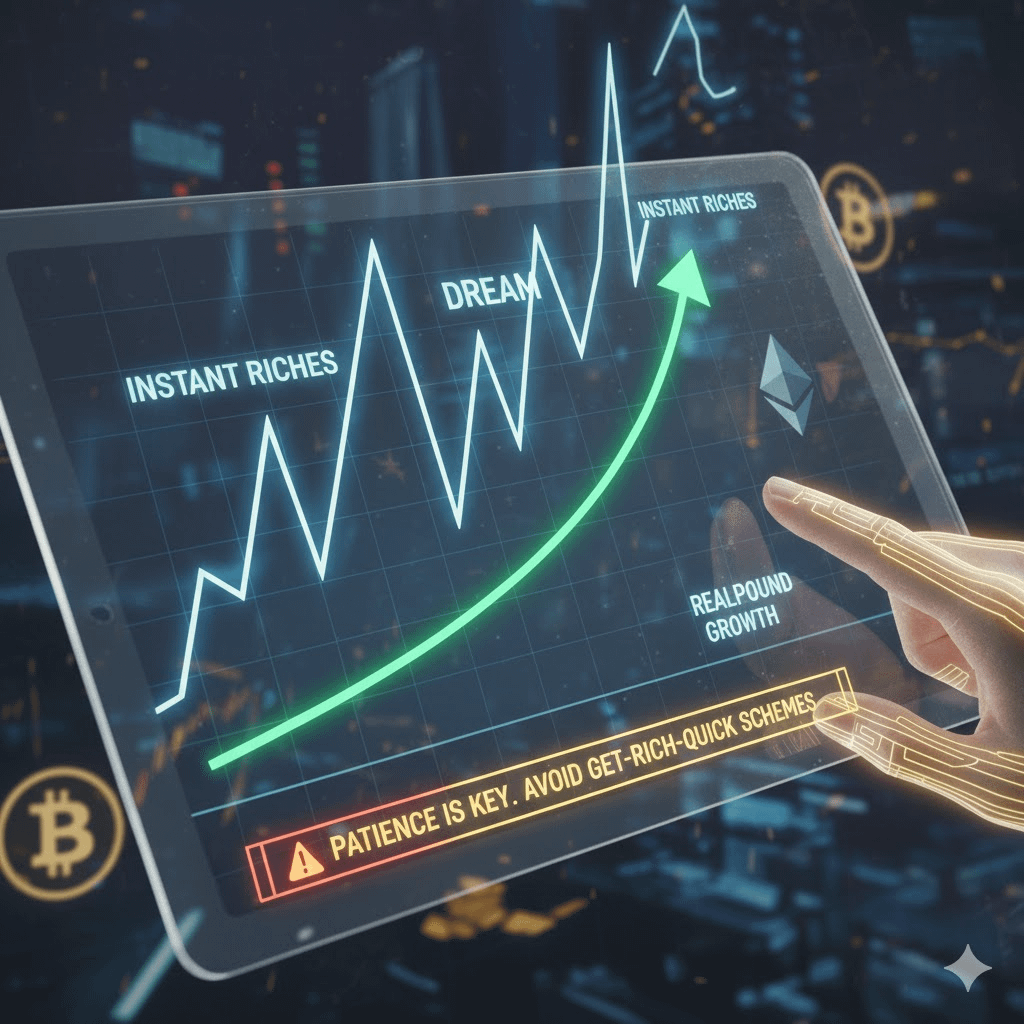

7. Unrealistic Expectations

Many new traders expect overnight wealth. When results don’t appear immediately, frustration sets in, leading to impulsive decisions. Successful trading is about consistency, not jackpots.

The Bottom Line

Most traders fail not because the market is too complex, but because they approach it like gambling rather than skill-building. Consistent success comes from:

A clear plan

Proper risk management

Emotional discipline

Continuous learning

💡 Pro Tip: Keep a trading journal. Record your trades, note mistakes, and refine your strategy over time. Small improvements compound into significant results.