Market crashes are some of the most stressful experiences for investors. Seeing the value of your portfolio drop sharply can trigger panic, impulsive decisions, and financial losses. But with preparation, discipline, and strategy, crashes don’t have to be catastrophic they can even create opportunities. This guide breaks down how to survive and thrive during market downturns.

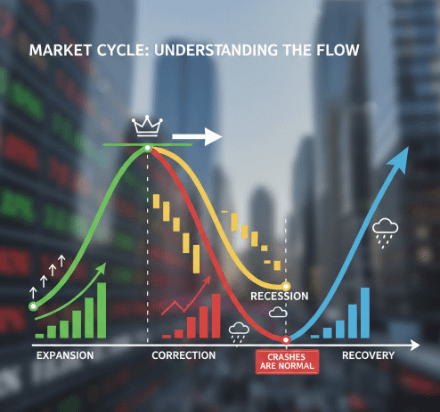

1. Understand Market Cycles and Why Crashes Happen

Markets move in cycles: expansions, peaks, corrections, and recessions. Crashes occur when asset prices fall rapidly, often triggered by:

Economic slowdowns or recessions

Geopolitical events (wars, trade conflicts)

Policy changes (interest rate hikes, regulation)

Market bubbles bursting (tech bubble, crypto booms)

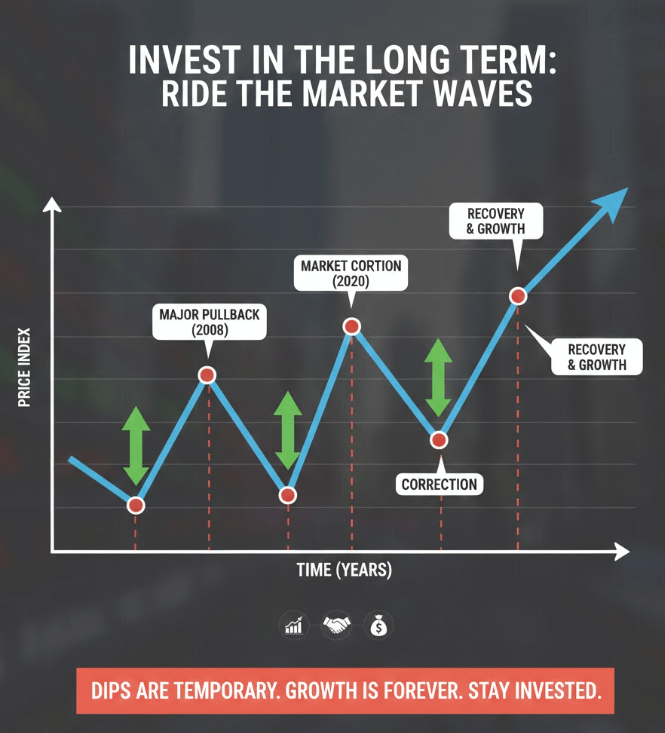

Key Insight: Short-term market drops are normal. Historically, markets have always recovered, sometimes stronger than before. Understanding this reduces panic and emotional decision-making.

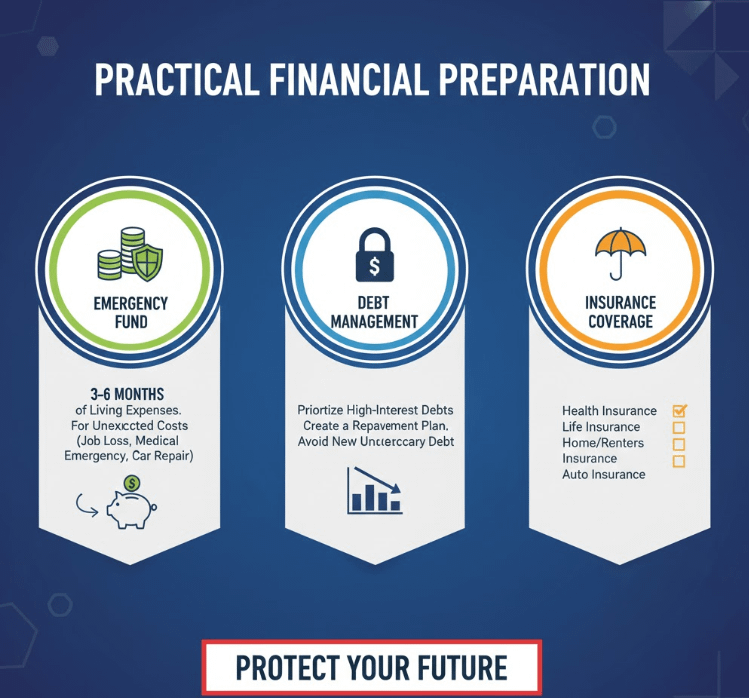

2. Build a Strong Financial Foundation

Before worrying about crashes, ensure your personal finances are stable:

Emergency fund: Keep 3–12 months of living expenses in a liquid account. This prevents you from selling investments at a loss during a crisis.

Debt management: High-interest debt can worsen financial stress during downturns. Pay off or minimize it.

Insurance: Health, life, and property insurance can protect you from unforeseen costs that might force premature asset liquidation.

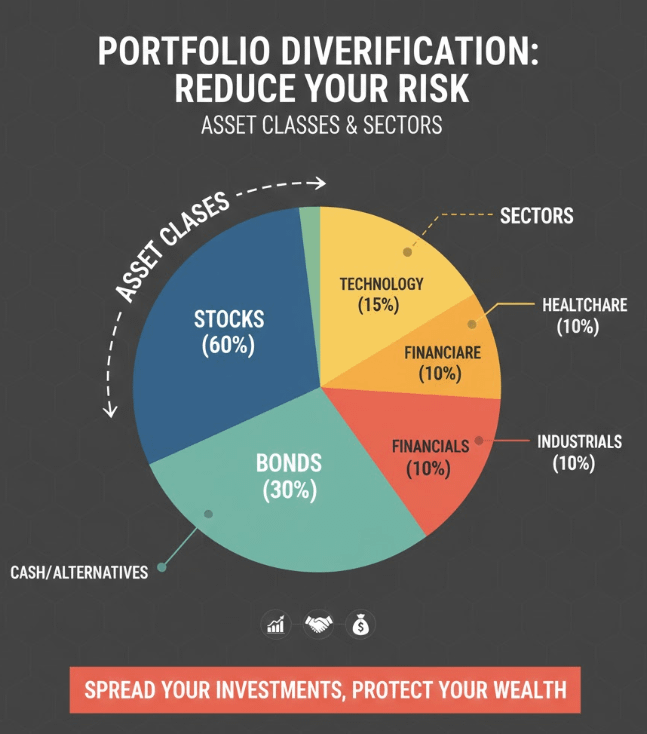

3. Diversify Strategically

Diversification spreads your risk across multiple asset classes, sectors, and geographies:

Asset classes: Stocks, bonds, commodities (gold, silver), and crypto.

Sectors: Tech, healthcare, consumer goods, energy. Different sectors react differently to crises.

Geographies: Global exposure reduces risk from a single country’s economic issues.

Pro Tip: Include “defensive” assets like gold, treasury bonds, or stablecoins that tend to hold value or rise during crises.

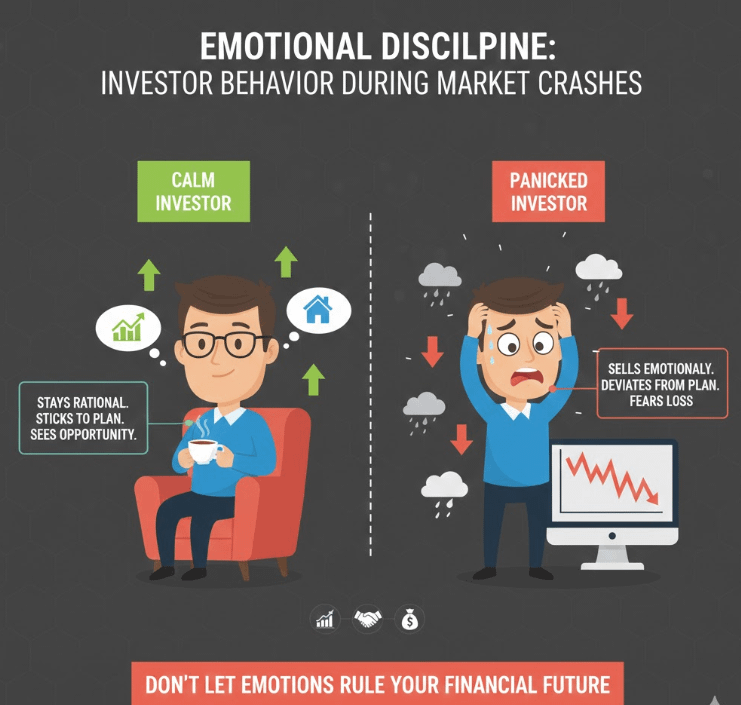

4. Avoid Panic Selling

Emotions are investors’ biggest enemies. Panic selling locks in losses. Instead:

Pause and analyze the situation. Is the asset still fundamentally strong?

Remember: Market crashes are often temporary. Selling during a dip can prevent you from benefiting from eventual recovery.

Use checklists to make decisions logically, not emotionally. For example, review earnings, debt levels, and growth potential before acting.

5. Identify Opportunities in Crashes

While crashes are scary, they can also be ideal times to buy high-quality assets at discounted prices:

Dollar-cost averaging (DCA): Invest a fixed amount regularly, regardless of price, reducing your average cost over time.

Focus on strong fundamentals: Companies or projects with solid balance sheets, consistent revenue, and competitive advantages often recover faster.

Diversified crypto strategy: Top-tier crypto (like BTC or ETH) can rebound significantly after market slumps, offering long-term gains.

Example: During the 2008 crash, investors who bought blue-chip stocks like Apple and Amazon saw massive gains over the next decade.

6. Use Risk Management Tools

Protecting your portfolio during high volatility is crucial:

Stop-loss orders: Automatically sell an asset if it drops to a certain price to limit losses.

Position sizing: Only allocate a portion of your capital to high-risk investments.

Hedging: Use options, inverse ETFs, or stablecoins to offset potential losses.

Remember: Risk management isn’t about avoiding losses entirely—it’s about limiting damage.

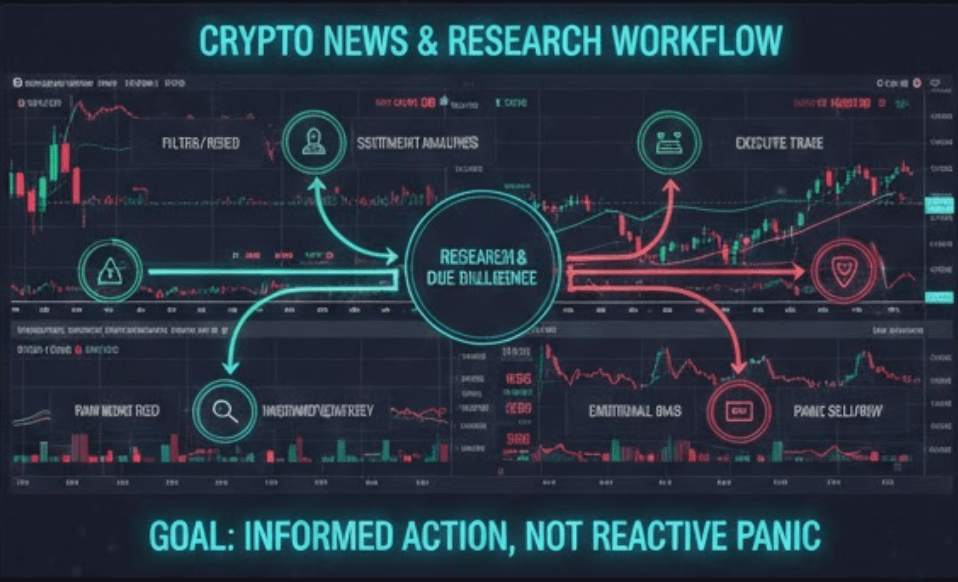

7. Stay Calm, Informed, and Objective

Too much news can heighten fear. Instead:

Focus on credible sources and market analysis.

Avoid social media panic. Viral posts often exaggerate risks.

Track only metrics that matter: asset fundamentals, market trends, and economic indicators.

Pro Tip: Set aside a weekly review instead of checking prices hourly. This reduces emotional trading.

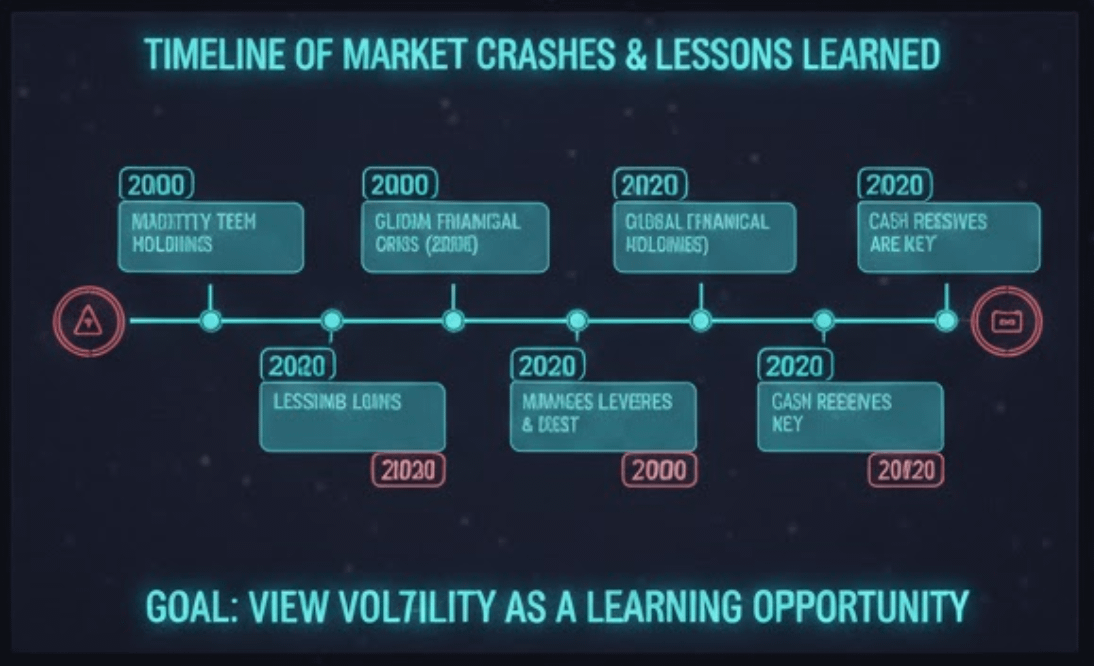

8. Learn From Every Market Downturn

Every crash is a learning opportunity:

Track what worked and what didn’t in your strategy.

Analyze sectors or assets that performed better during the downturn.

Adjust your portfolio to be more resilient next time.

Insight: Experience builds discipline. Investors who navigate crashes calmly are often more successful long-term.

9. Maintain a Long-Term Mindset

Crashes test patience, but long-term thinking is your best defense:

Compounding works best when you don’t panic.

Markets historically trend upward despite periodic declines.

Avoid chasing short-term trends during volatility.

10. Practical Tools for Surviving Crashes

Spreadsheets or apps: Track asset allocation and performance.

Alerts: Set price alerts for key investments.

Rebalancing plan: Adjust allocations periodically to maintain target risk levels.

Key Takeaways

Market crashes are inevitable; preparation is essential.

Financial stability, diversification, and risk management are your first line of defense.

Avoid panic selling focus on fundamentals and opportunities.

Use crashes to your advantage with dollar-cost averaging and strategic buying.

Keep learning and maintain a long-term mindset.