Trading can feel exciting watching markets swing, seeing profits grow, and making fast decisions. But behind every successful trader is a solid foundation of risk management. Without it, even the most promising trades can turn into devastating losses.

Whether you’re interested in stocks, crypto, or forex, understanding risk management is the key to survival in trading. Here’s what beginners need to know.

1. Understand Risk Before You Trade

Risk is the possibility of losing money, and it’s unavoidable in trading. The first step is accepting that losses happen even to professionals.

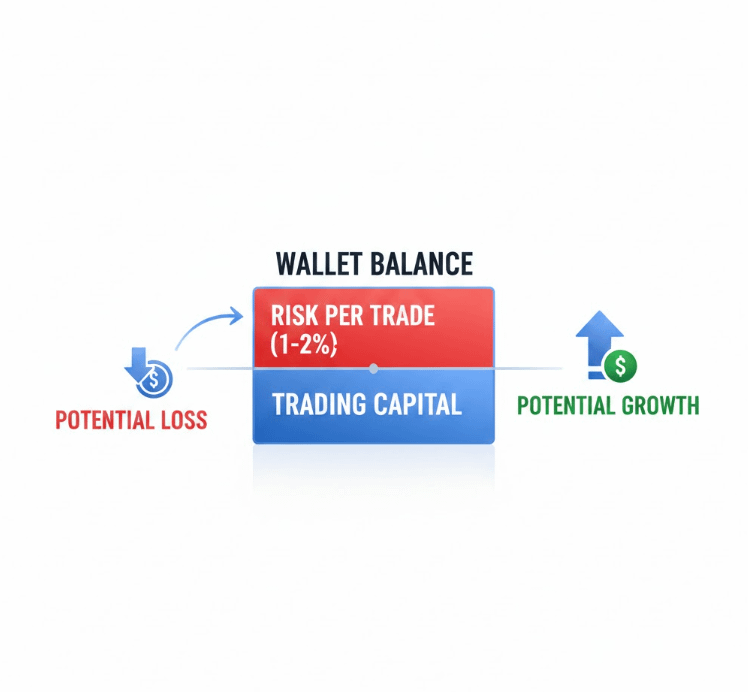

Set a risk tolerance: Decide how much of your capital you’re willing to risk on a single trade. A common beginner rule is 1–2% of your account per trade.

Know your limits: If you’re uncomfortable with losing a certain amount, reduce your position size or skip the trade. Emotional decisions often lead to bigger losses.

2. Use Stop-Loss Orders

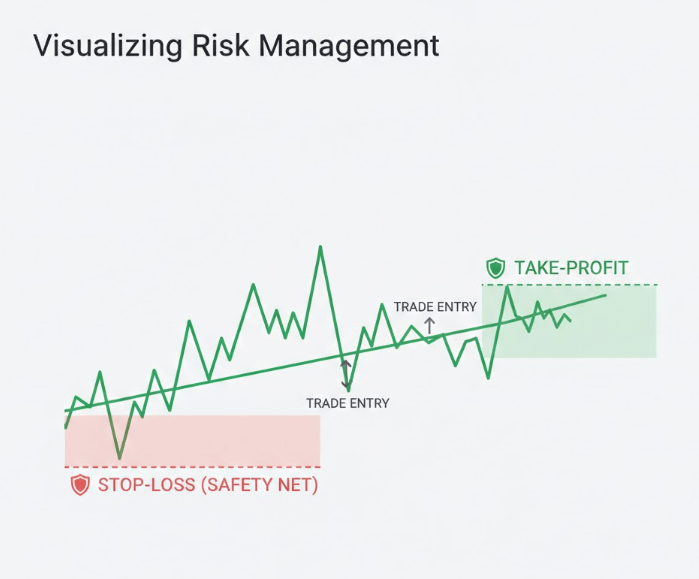

A stop-loss is an automatic order that closes a trade if the price moves against you. Think of it as a safety net.

Protects capital: Limits losses before they spiral out of control.

Prevents emotional decisions: You don’t have to decide in the heat of the moment whether to exit.

Beginners’ tip: Place your stop-loss at a logical level based on market structure, not just a random number.

3. Don’t Overleverage

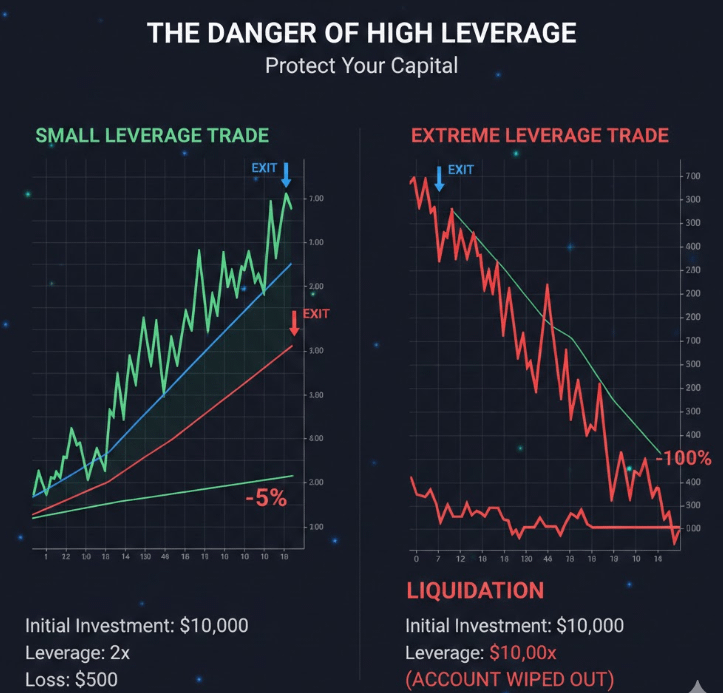

Leverage lets you control a bigger position with a smaller amount of money. Sounds tempting but it can wipe out your account fast if you’re not careful.

Example: Using 10x leverage means a 10% price move against you could erase your entire trade.

Rule of thumb: Start with low or no leverage until you fully understand how it affects your gains and losses.

4. Diversify Your Trades

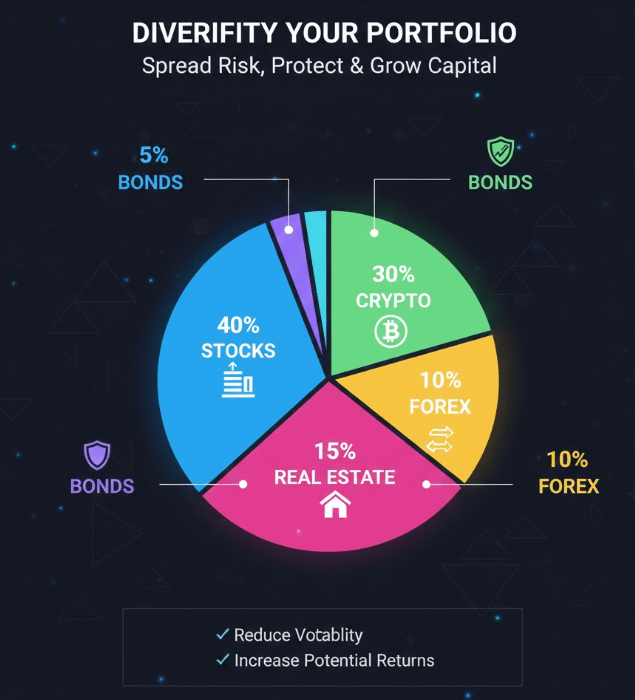

Never put all your eggs in one basket. Diversifying means spreading risk across different assets or positions.

Helps reduce impact of a single loss.

Provides exposure to opportunities across the market.

Even a small allocation to a different asset can protect your account during volatility.

5. Plan Your Trades and Stick to the Plan

A trade plan defines entry, exit, and risk limits before you even open a position.

Entry point: Where you buy or sell.

Stop-loss: Where you cut losses.

Take-profit: Where you exit for gains.

Following your plan prevents emotional decisions and keeps losses under control.

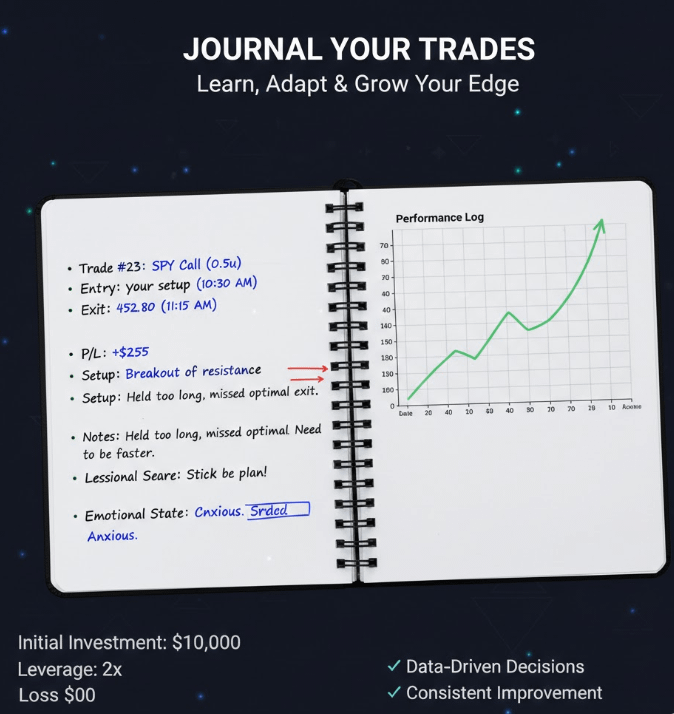

6. Keep Learning and Reviewing

Markets are always changing, and so is risk.

Review trades regularly to see what worked and what didn’t.

Keep a trading journal to track mistakes and successes.

Education is a continuous process read, watch tutorials, and stay updated.

Conclusion

Risk management is not optional it’s survival insurance for traders. Beginners often focus on profits but forget that protecting capital is the first priority.

By understanding risk, using stop-losses, controlling leverage, diversifying, and sticking to a plan, you keep yourself alive in the markets long enough to grow your skills and your account.

Remember: trading isn’t about being lucky it’s about trading smart, managing risk, and staying in the game.