Introduction

Deploying real-world financial instruments such as stocks, bonds, and funds on public blockchains is not just a technical challenge. It is fundamentally a regulatory and market-structure problem. Financial products must comply with securities law, investor protection rules, identity requirements, and settlement standards before they can be trusted by institutions.

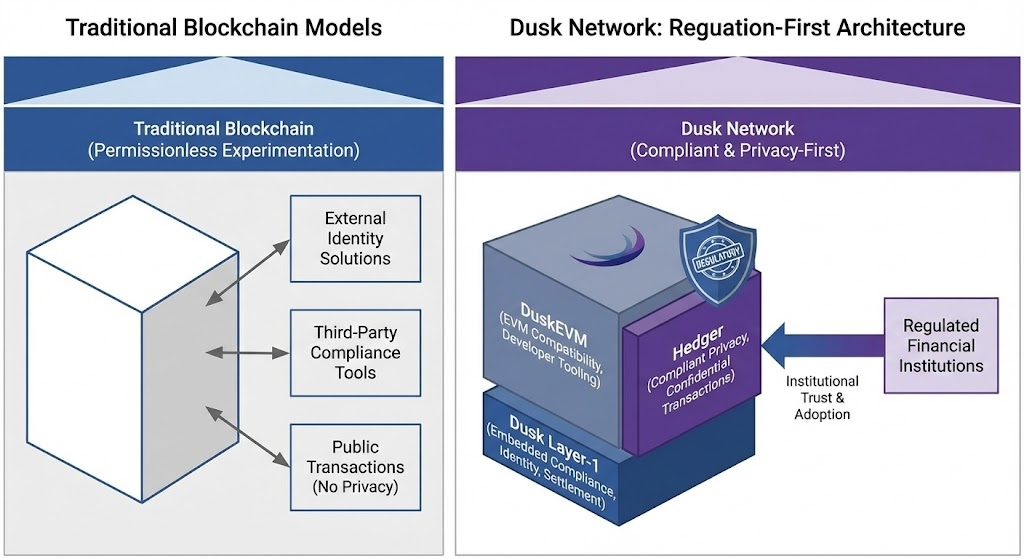

Most blockchain projects attempt to bypass these constraints through permissionless experimentation. Dusk Network has taken a different path. Since its founding in 2018, Dusk has focused on designing a Layer-1 blockchain explicitly for regulated finance, embedding compliance, privacy, and auditability directly into the protocol.

As Europe moves toward clearer frameworks for tokenized securities and real-world assets (RWAs), Dusk is positioning itself not as a DeFi experiment, but as core financial infrastructure for on-chain capital markets.

Regulation-First Architecture, Not Regulatory Arbitrage

Dusk’s strategy is grounded in the assumption that large-scale adoption of blockchain finance will come from regulated institutions, not from avoiding oversight. This philosophy informs every layer of the network.

Rather than pushing compliance obligations onto application developers, Dusk integrates regulatory logic at the network and smart-contract level. Identity checks, asset eligibility, auditability, and legal controls are treated as first-class features, not external add-ons.

This design choice makes Dusk attractive to exchanges, issuers, and financial intermediaries that cannot accept legal ambiguity or custodial risk.

NPEX and DuskTrade: Bringing €300M+ of Securities On-Chain

A central pillar of Dusk’s real-world adoption is its collaboration with NPEX, a Dutch regulated exchange holding MTF, Broker, and ECSP licenses.

Together, Dusk and NPEX are launching DuskTrade in 2026, a compliant trading and investment platform designed specifically for tokenized securities. DuskTrade represents Dusk’s first large-scale RWA application and is expected to bring over €300 million in tokenized securities on-chain.

Unlike experimental tokenization platforms, DuskTrade operates within existing European financial regulations. Securities are issued, traded, and settled through a licensed market structure, while Dusk provides the blockchain settlement and compliance layer.

The platform allows:

Regulated issuance of tokenized securities

Secondary market trading under licensed conditions

On-chain settlement with embedded compliance

Privacy-preserving transactions suitable for institutional investors

The waitlist for DuskTrade opens in January, marking a concrete step from infrastructure development to live market activity.

DuskEVM: Bridging Institutional Finance and the Ethereum Ecosystem

To reduce integration friction, Dusk is launching DuskEVM mainnet in the second week of January. DuskEVM is an EVM-compatible application layer that allows developers and institutions to deploy standard Solidity smart contracts while settling transactions on Dusk’s Layer-1.

This modular architecture is critical. Institutions do not want to learn new programming paradigms or abandon existing tooling. With DuskEVM, projects can reuse Ethereum-native workflows while benefiting from Dusk’s privacy, compliance, and settlement guarantees.

DuskEVM unlocks:

Compliant DeFi applications

Regulated RWA protocols

Institutional integrations using familiar EVM tooling

Reduced time-to-market for financial applications

By separating execution from settlement, Dusk combines Ethereum compatibility with a purpose-built financial base layer.

Compliant Privacy on EVM: Hedger and Confidential Transactions

Privacy remains one of the most misunderstood aspects of regulated blockchain finance. Institutions require confidentiality for large trades and sensitive positions, while regulators require auditability and oversight.

مقالة

Dusk Network: Building Compliant, Privacy-First Infrastructure for On-Chain Capital Markets

إخلاء المسؤولية: تتضمن آراء أطراف خارجية. ليست نصيحةً مالية. يُمكن أن تحتوي على مُحتوى مُمول. اطلع على الشروط والأحكام.

0

4

92

استكشف أحدث أخبار العملات الرقمية

⚡️ كُن جزءًا من أحدث النقاشات في مجال العملات الرقمية

💬 تفاعل مع صنّاع المُحتوى المُفضّلين لديك

👍 استمتع بالمحتوى الذي يثير اهتمامك

البريد الإلكتروني / رقم الهاتف