Market Analysis: Institutional Capital vs. Retail Sentiment

While recent market volatility has led to significant liquidations in the retail sector—totaling approximately $2.7 billion this week—on-chain data reveals a different narrative among major institutional players.

Despite the price correction, two significant market entities, BlackRock and Binance, have executed substantial accumulation strategies, suggesting confidence in the asset's longer-term value proposition.

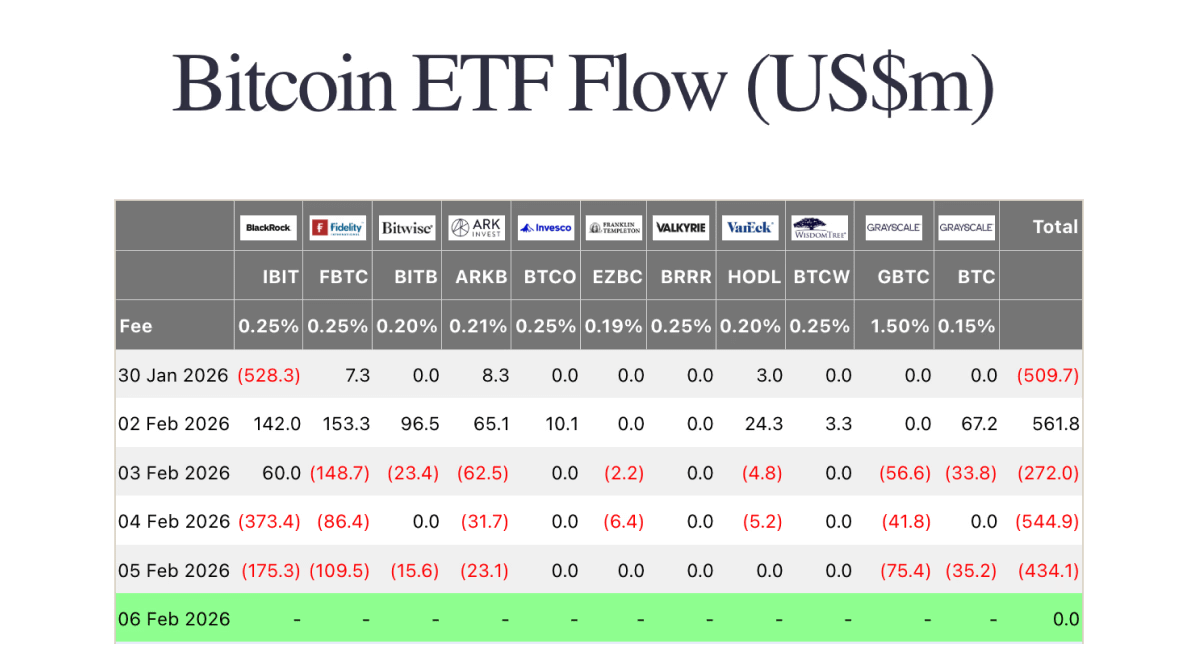

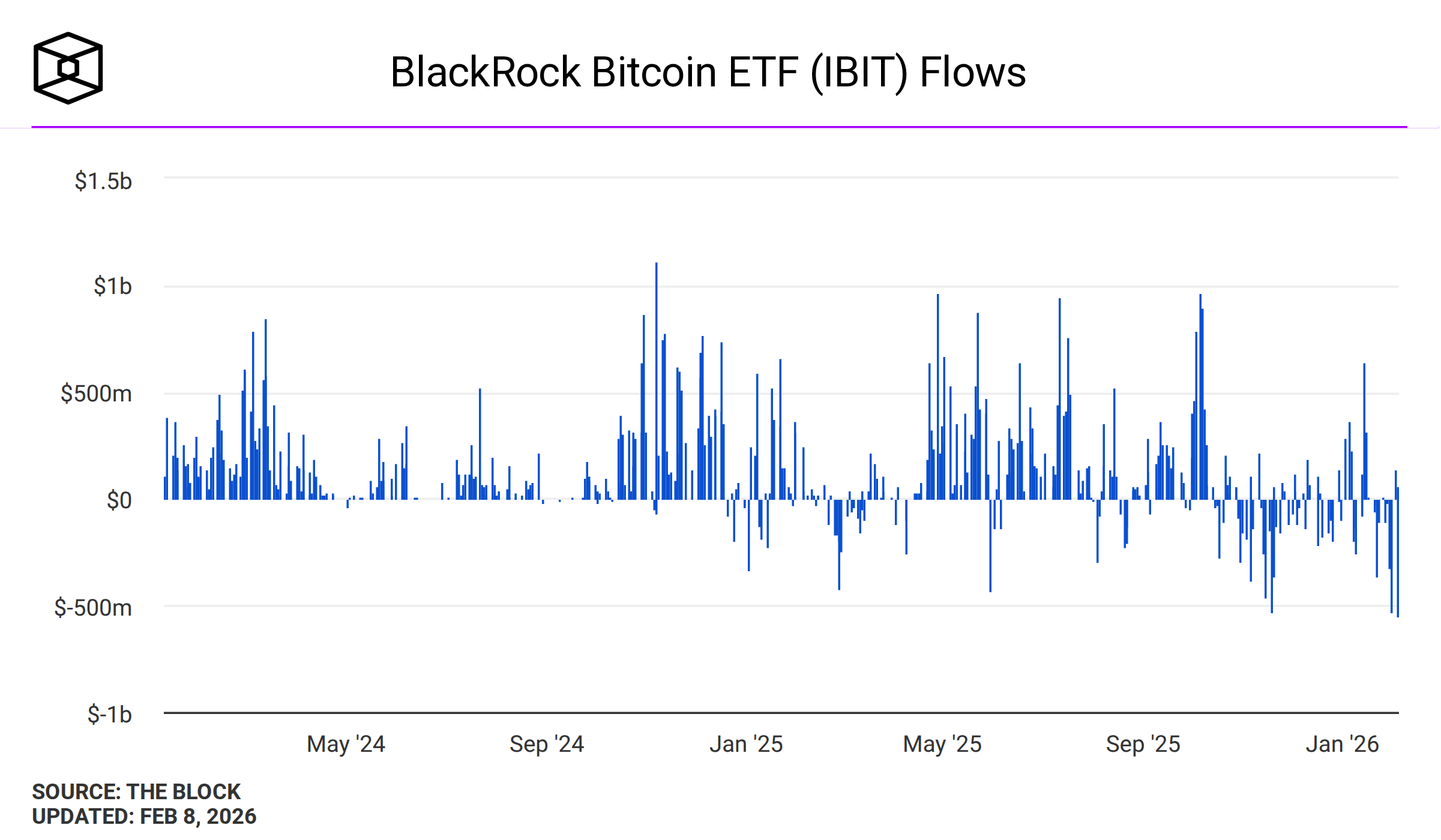

1. BlackRock's Net Inflows (Contrarian Indicator)

The latest flow data for the BlackRock Bitcoin ETF (IBIT) provides a critical signal regarding institutional sentiment.

Analysis:

The chart above illustrates daily net inflows. Notably, the final green bar represents the trading session on Friday, February 6 (reported on the weekend of Feb 8).

The Signal: While the broader market faced "extreme fear," BlackRock's IBIT ETF recorded net inflows (the green spike). This suggests that institutional clients utilized the liquidity from retail panic-selling to build their positions at a discount.

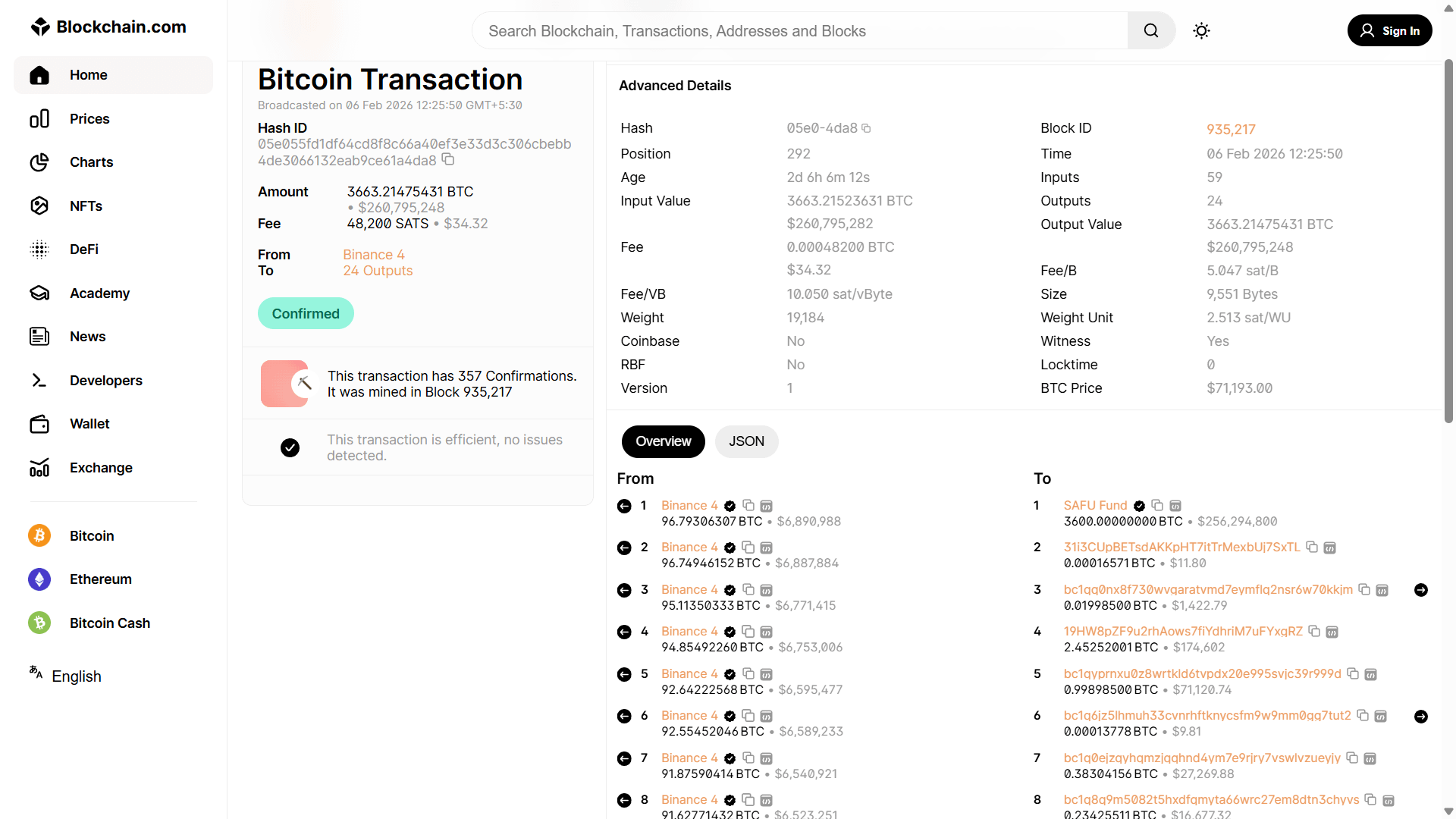

2. Binance SAFU Fund Allocation

In addition to traditional finance (TradFi) movements, major crypto-native infrastructure is also securing reserves. Binance recently announced the conversion of its Secure Asset Fund for Users (SAFU) into Bitcoin to enhance reliability. On-chain records now confirm the execution of this strategy.

Transaction Details:

Date: February 6, 2026

Asset: Bitcoin (BTC)

Volume: 3,663 BTC

Value: Approximately $260.7 million

This transaction represents a tangible injection of capital into Bitcoin, effectively removing over $260 million worth of supply from the circulating market to be held in long-term reserve.

Conclusion: A Shift in Ownership

The data presents a clear dichotomy in market behavior:

Retail Traders: heavily selling and facing liquidations due to short-term volatility.

Institutional Giants: actively accumulating assets (BlackRock via ETFs, Binance via Reserves).

Historically, this transfer of assets from short-term speculators to long-term holders often precedes a stabilization in price. Investors should weigh the emotional sentiment of the market against the verifiable actions of these major entities.