In crypto markets, price movements are often explained by headlines. Traders look for news about regulations, macroeconomic data, or major announcements to understand why prices rise or fall.

However, in practice, markets frequently move before any news becomes public. This is because the primary driver of short-term price action in crypto is not news itself, but liquidity.

This article explains what liquidity means, where it exists, and how traders can use this understanding to make better decisions.

Understanding Liquidity in Simple Terms

Liquidity refers to how easily an asset can be bought or sold without causing a large price change.

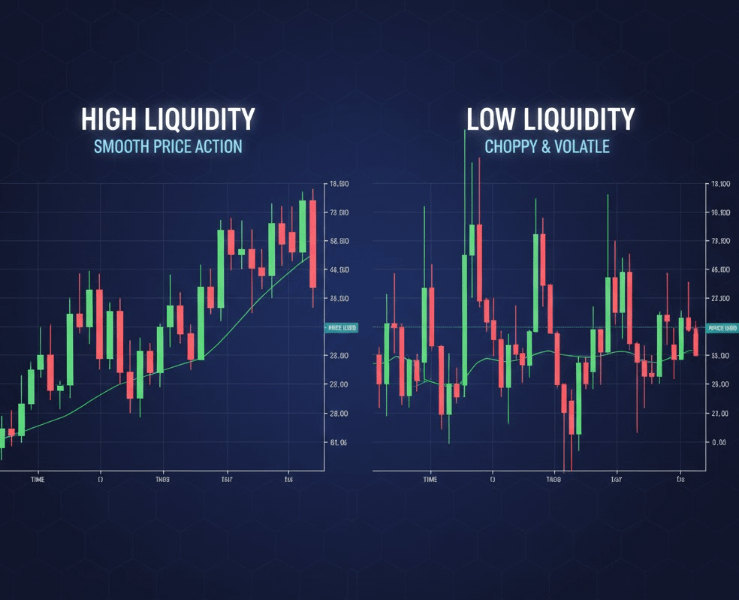

In highly liquid markets:

There are many buyers and sellers

Orders are filled quickly

Price movement is smoother and more controlled

In less liquid conditions, even small orders can move price sharply. In crypto markets, liquidity is not evenly distributed. Instead, it concentrates around specific price levels.

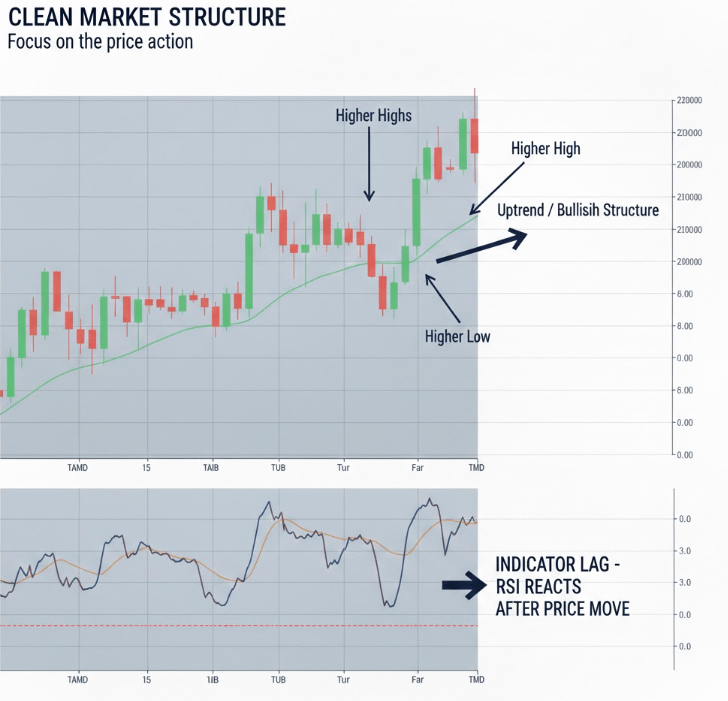

Where Liquidity Exists in Crypto Markets

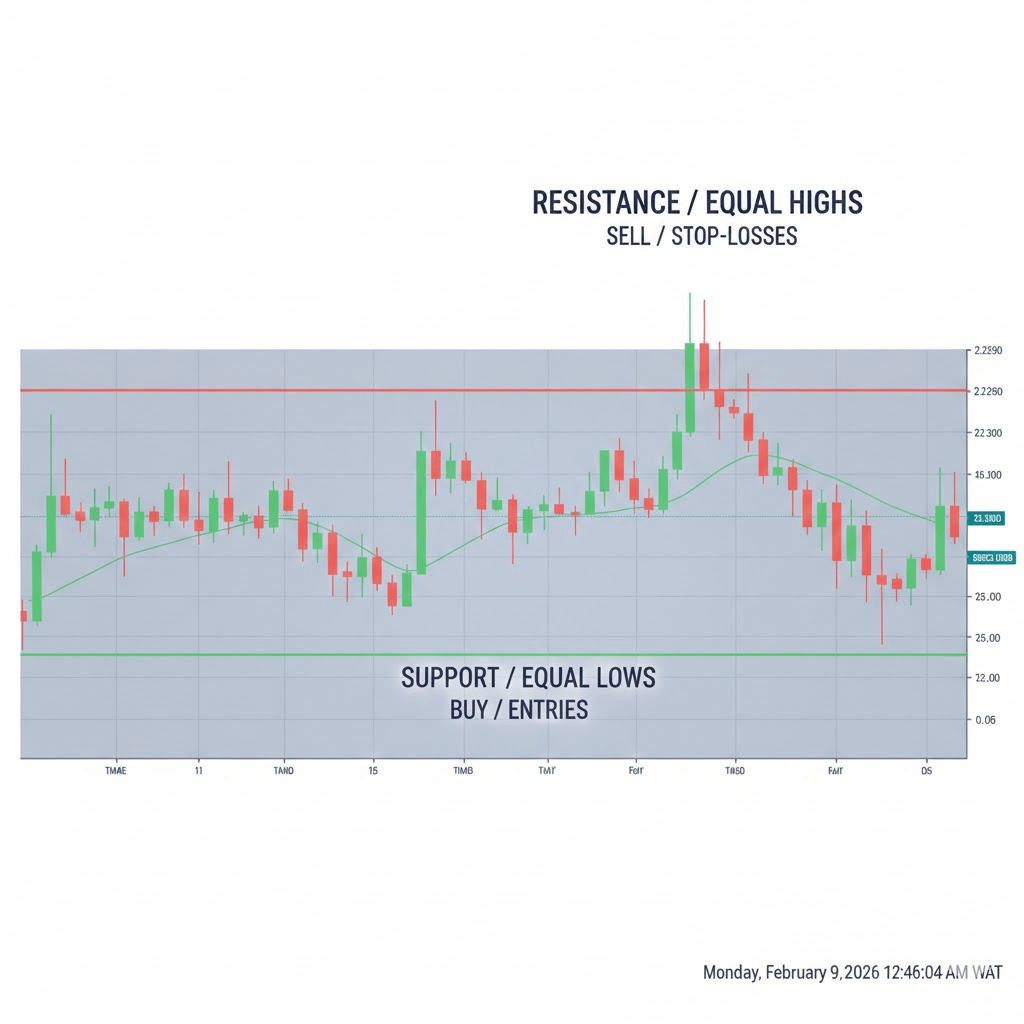

Liquidity forms where many traders place orders. These areas are usually easy to identify on a chart.

Common liquidity zones include:

Above recent highs

Below recent lows

Around widely watched support and resistance levels

At these levels, traders place stop-loss orders, liquidation thresholds, and breakout entries. As a result, price is naturally drawn toward these areas.

Buy-Side and Sell-Side Liquidity

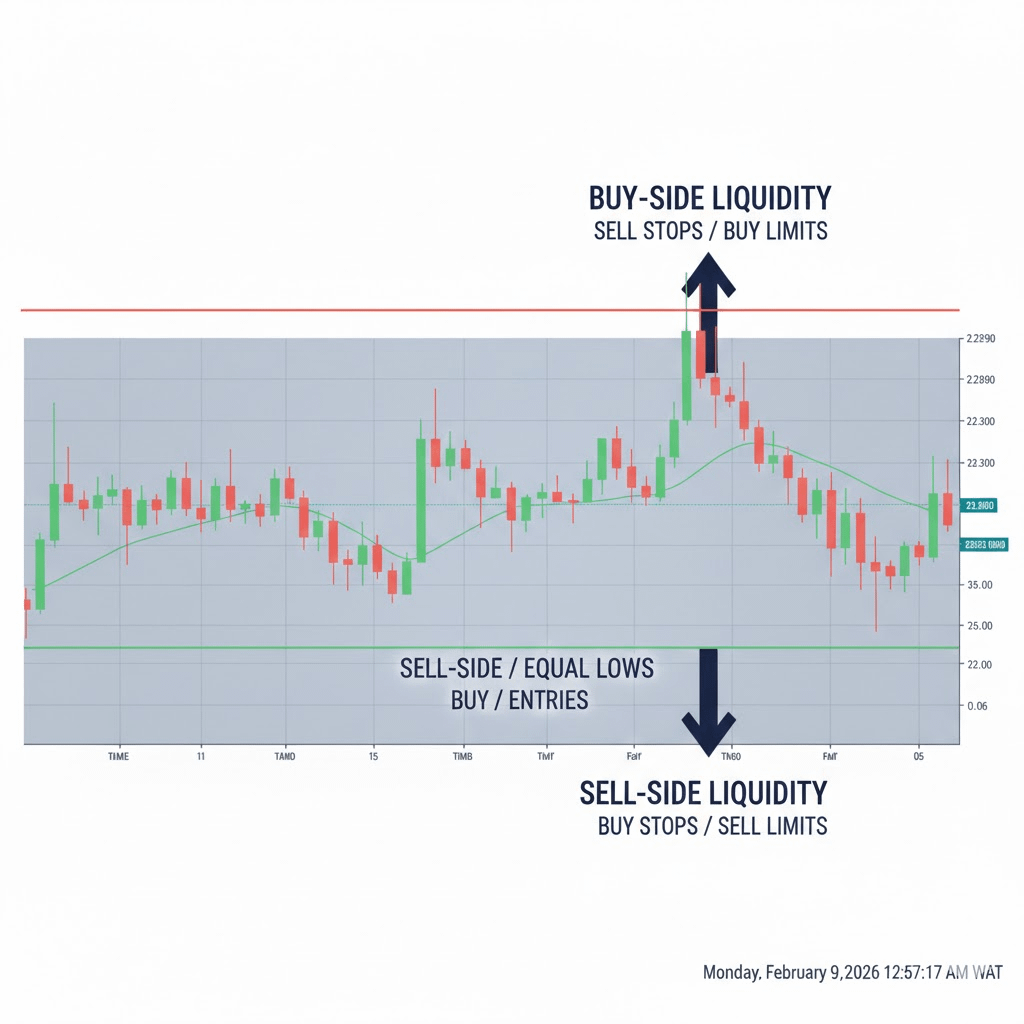

To better understand market behavior, liquidity is often grouped into two categories.

Buy-side liquidity

Located above the current price

Consists of buy orders from breakout traders and stop-losses from short positions

Sell-side liquidity

Located below the current price

Consists of sell orders from long traders’ stop-losses and liquidation levels

Price moves through the market by seeking these pools of liquidity.

Why Markets Often Move Before the News

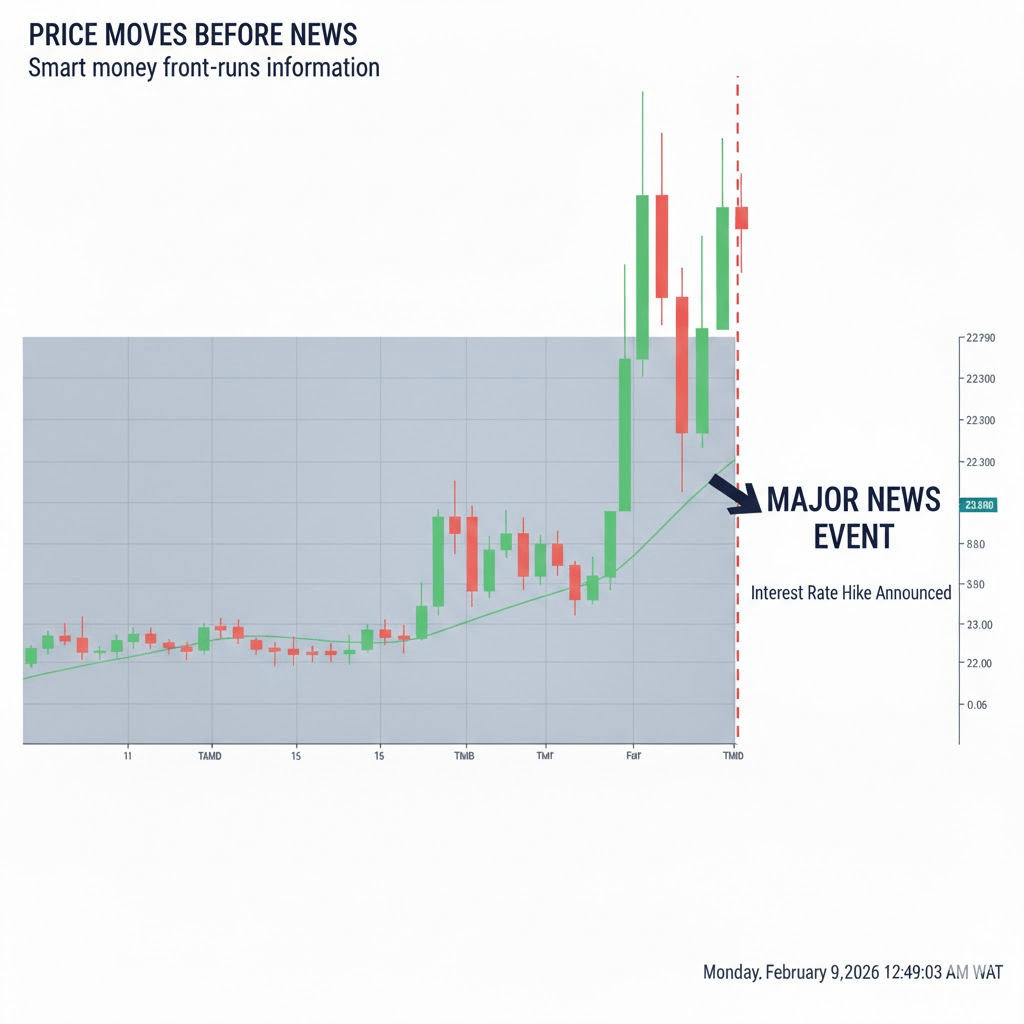

Many beginners assume news causes price movement. In reality, news often explains a move after it has already occurred.

Large market participants typically:

Position themselves in advance

Accumulate assets in low-volatility ranges

Use high-liquidity events to enter or exit positions

By the time news reaches the public, price may already be near a key liquidity level.

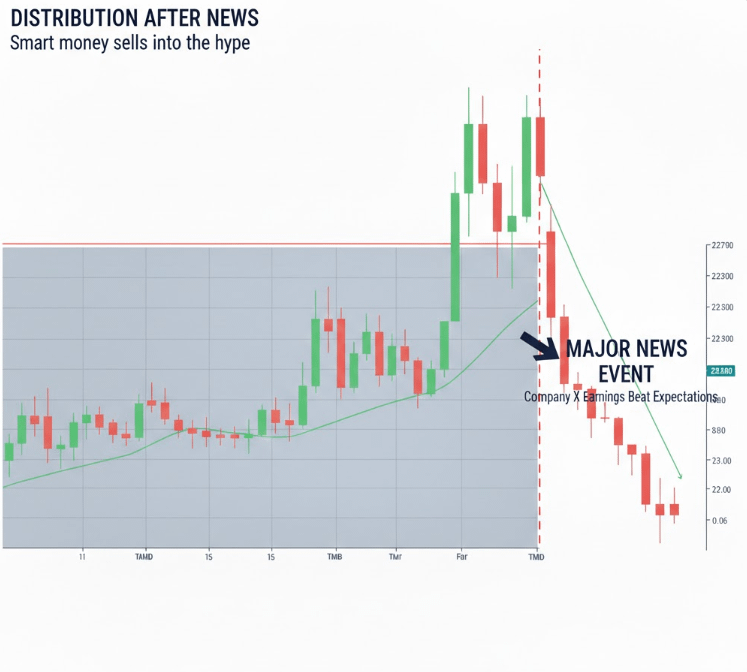

Why Positive News Can Lead to Price Declines

In some cases, markets fall even after positive news is released. This behavior can be confusing for new traders.

When price moves upward into a liquidity zone before an announcement:

Early participants may already be in profit

News increases buying pressure from late entrants

Large traders may use this demand to exit positions

This process is often described as using retail buying pressure as exit liquidity.

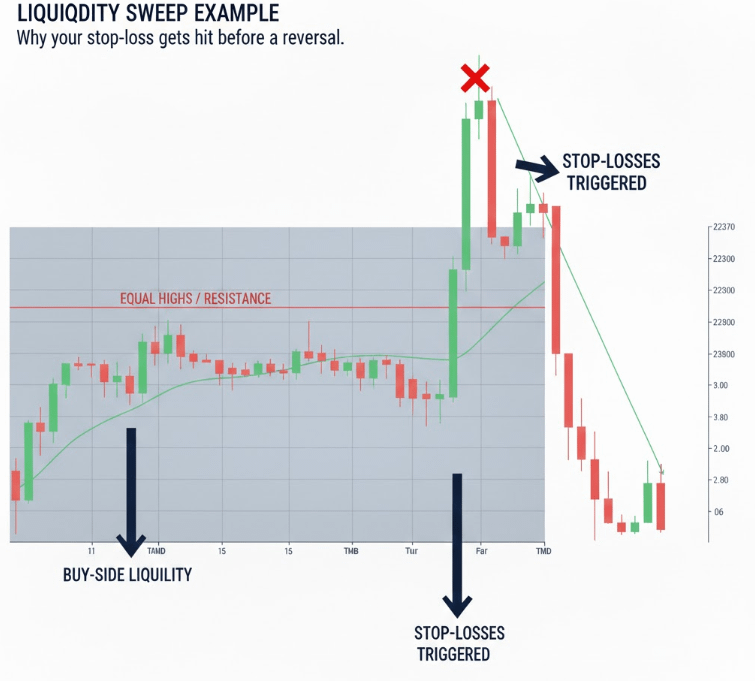

Liquidity Sweeps Explained

A liquidity sweep occurs when price:

Briefly breaks above a high or below a low

Triggers stop-loss orders and liquidations

Quickly reverses direction

To inexperienced traders, this can appear as a breakout or breakdown. In reality, it is often the market collecting liquidity before continuing its primary trend.

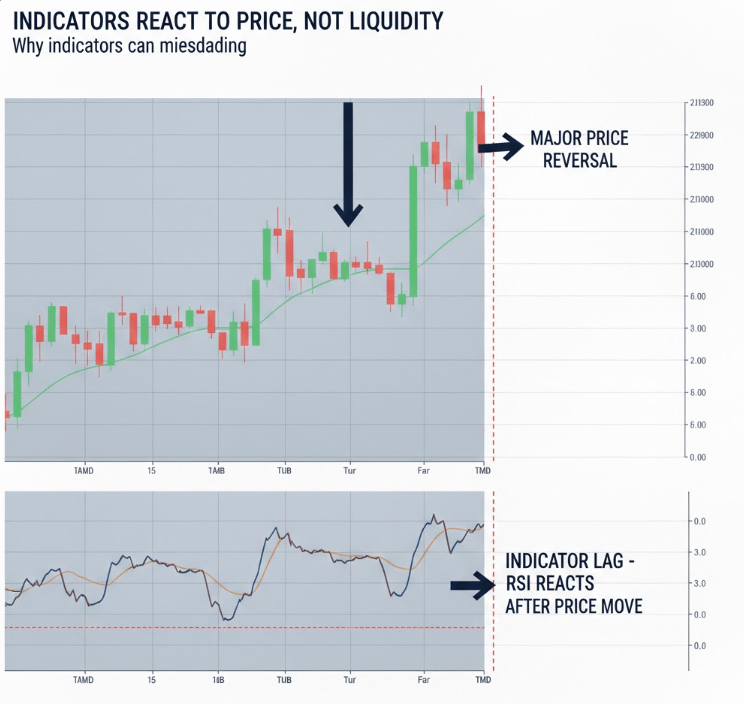

Why Indicators Should Be Used With Caution

Technical indicators are calculated using past price data. While useful, they do not identify where liquidity is concentrated.

Without liquidity context:

Indicators may give delayed signals

Breakouts may fail unexpectedly

Overbought or oversold readings may persist

For this reason, indicators are most effective when combined with an understanding of market structure and liquidity.

How Beginners Can Apply Liquidity Concepts

Traders do not need advanced tools to begin using liquidity concepts.

Practical steps include:

Identifying recent highs and lows on higher timeframes

Observing price behavior near key support and resistance levels

Avoiding impulsive trades after sudden news releases

Managing risk carefully during periods of high volatility

These steps help traders focus on structure rather than emotion.

Conclusion

News influences sentiment, but liquidity drives price movement.

Markets move toward areas where orders are concentrated. By understanding this process, traders can reduce emotional decisions, improve risk management, and gain a clearer view of market behavior.

In crypto trading, learning how liquidity works is an important step toward long-term consistency.