Drawdowns don’t end accounts.

Bad reactions to them do.

Most traders don’t blow up during trends. They bleed out slowly while trying to fix drawdowns.

Why Drawdowns Trigger Overtrading

Losses create urgency.

After a drawdown:

Traders want to recover quickly

Patience disappears

Standards drop

Every small move starts to look like an opportunity. In reality, it’s usually just noise.

Overtrading feels productive.

It rarely is.

The First Rule: Protect Mental Capital

Capital isn’t just money.

It’s clarity.

During drawdowns:

Reduce frequency

Reduce size

Increase selectivity

You don’t need to trade more.

You need to trade better.

Why Less Trading Improves Results

Crypto opportunities cluster.

They don’t arrive evenly.

When conditions are poor:

Trends are absent

Ranges dominate

Fake moves increase

Forcing trades here only deepens the drawdown.

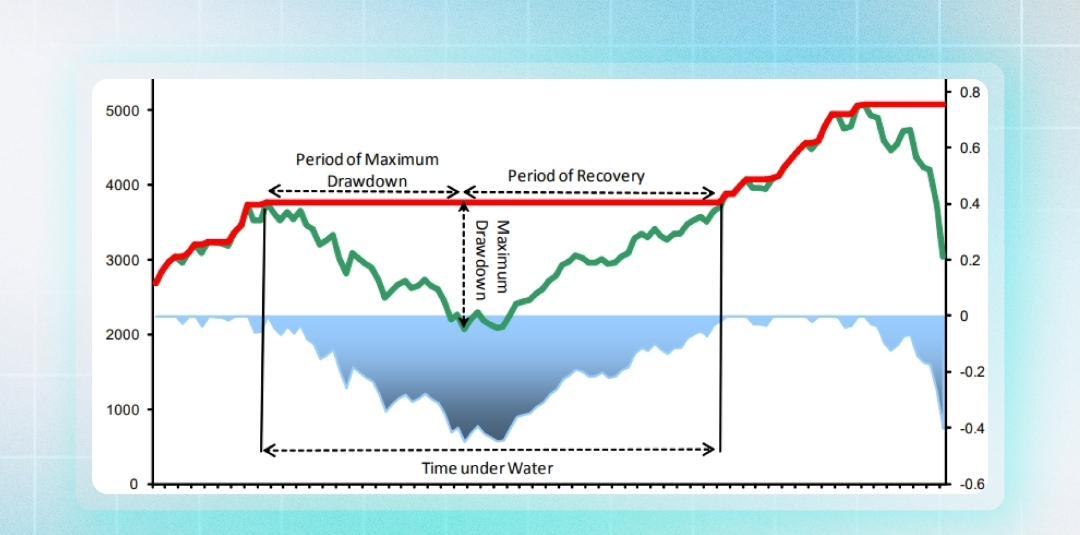

Surviving drawdowns is about not adding damage.

The Professional Adjustment

Professionals don’t try to win back losses.

They:

Accept the drawdown

Slow down

Focus on execution, not PnL

They understand that opportunity will return — but only if capital and confidence are intact.

The Psychological Trap

Traders think:

“I need to make it back.”

Professionals think:

“I need to stop digging.”

That difference decides who survives.

Why This Matters in Crypto

Crypto rewards patience violently.

Those who survive the quiet, frustrating periods are present for the explosive ones. Those who overtrade drawdowns arrive exhausted and undercapitalized.

Drawdowns are not problems to solve.

They’re conditions to endure.

If you can slow down when emotions speed up, you give yourself a real edge.