For a long time, active trading on crypto exchanges came with a strange contradiction.

Platforms gave traders more leverage, more products, more flexibility but risk management stayed clunky and fragmented. Each position lived in its own box. One bad move in a single market could force liquidations, even when the rest of the portfolio was healthy.

Portfolio Margin didn’t arrive with much noise, but it quietly rewired how risk is calculated, shared, and controlled for serious traders.

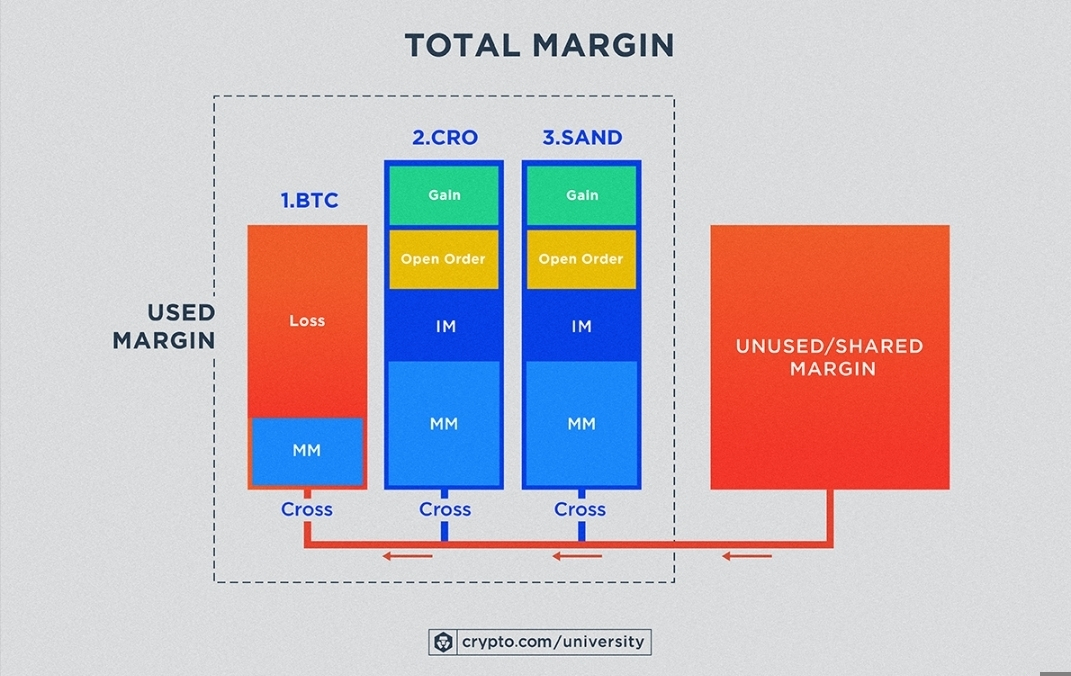

To understand why this matters, it helps to think about how risk used to work. In traditional margin setups, every position is isolated. Your BTC perpetual has its own margin requirement. Your ETH options sit somewhere else. Spot balances often don’t help much once volatility spikes. This structure is simple, but it’s also rigid. It treats positions as if they exist in isolation, even when traders clearly manage them as part of one strategy.

Portfolio Margin flipped that logic.

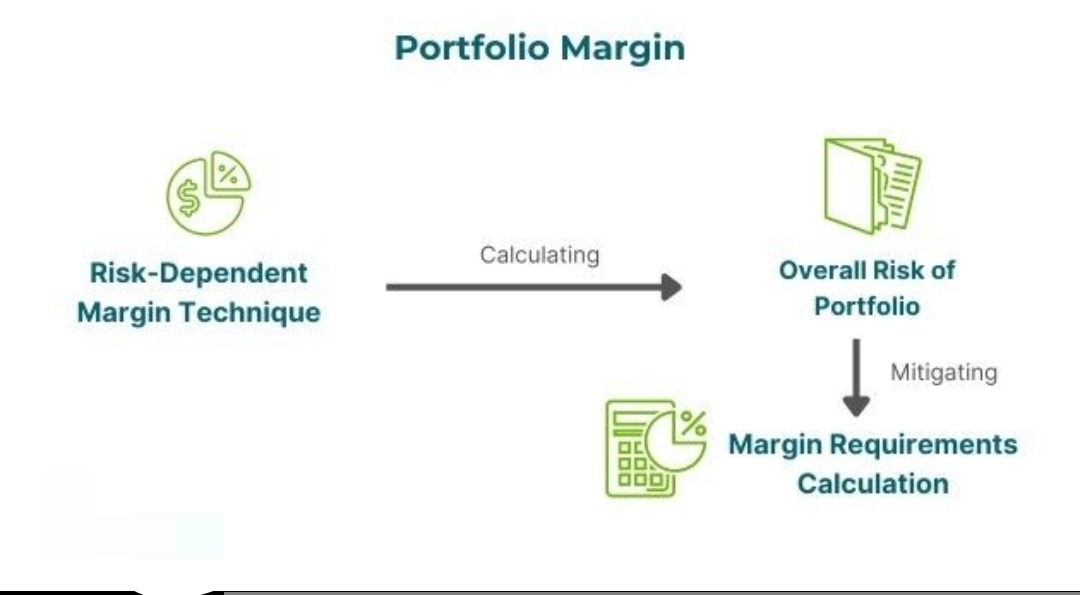

Instead of asking “Is this one position safe?”, the system asks a more realistic question: “How risky is the entire portfolio if markets move?” That shift alone changes everything.

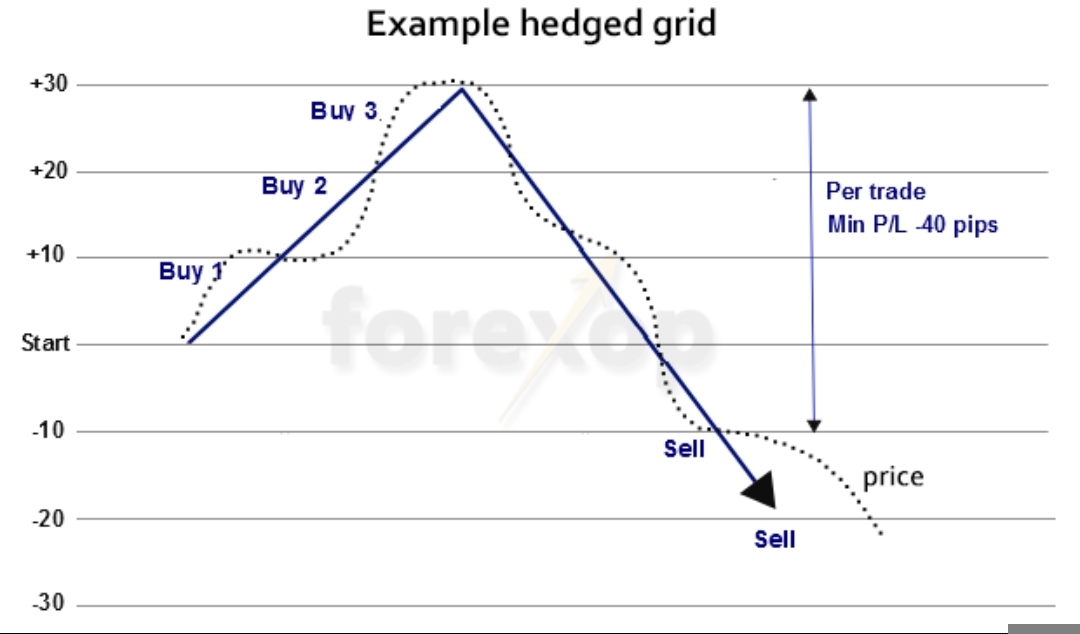

Under Portfolio Margin, margin requirements are calculated based on overall exposure and potential loss across all positions. Gains in one instrument can offset risks in another. Hedged positions finally behave like hedges instead of ignored decorations on a dashboard. For traders running multi-leg strategies that spot plus futures, options spreads, delta-neutral setups.This feels less like a feature upgrade and more like a correction.

What makes this powerful isn’t higher leverage. In fact, many traders discover the opposite. Portfolio Margin often reduces unnecessary margin usage, freeing up capital rather than encouraging reckless risk. When margin reflects real exposure instead of worst-case isolation, capital efficiency improves naturally.

That efficiency changes behavior.

Traders who once avoided hedging because of margin costs can now structure positions more thoughtfully. Instead of closing profitable legs early just to protect margin, they can let strategies play out. This reduces emotional decision-making, which is one of the biggest hidden risks in active trading.

Another quiet benefit is how Portfolio Margin handles volatility. In isolated systems, sudden price swings can trigger liquidations even when the portfolio, as a whole, isn’t in danger. Portfolio-based risk models focus on potential portfolio loss, not headline volatility in a single market. That doesn’t eliminate risk but it aligns liquidation logic with reality.

There’s also a psychological shift here that doesn’t get talked about enough. When traders see their portfolio risk as a unified number, they start thinking in probabilities instead of positions. Risk stops being reactive and becomes something you manage intentionally. That mindset is standard in professional trading environments, but rare in retail crypto until recently.

Of course, this isn’t magic.

Portfolio Margin doesn’t protect against bad strategy. When everything moves the wrong way at the same time, the damage can add up quickly. Because all positions are linked, losses don’t stay contained to one trade. That’s also why Portfolio Margin isn’t open to everyone by default. It’s usually reserved for traders with larger balances and enough experience to understand how fast risk can stack when markets turn together.It’s designed for traders who understand correlations, tail risk, and stress scenarios.Not casual leverage chasing.

But that’s exactly the point.

Binance didn’t introduce Portfolio Margin to make trading more exciting. It introduced it to make advanced trading more realistic. The system assumes traders behave like portfolio managers, not gamblers clicking isolated bets. That assumption alone signals a maturing market.

What’s especially interesting is how quietly this change happened. No flashy marketing. No loud promises. Yet for active traders who use it properly, Portfolio Margin reshapes daily decision-making. Capital lasts longer. Strategies become cleaner. Risk conversations shift from “Will this position liquidate?” to “What happens to my portfolio if volatility doubles?”

That’s a fundamentally different way to trade.

As crypto markets grow more complex with perpetuals, options, structured products, and cross-asset strategies risk systems have to evolve too. Portfolio Margin isn’t about chasing the next feature. It’s about aligning crypto trading infrastructure with how serious traders already think.

Most people won’t notice the change at first. But the ones who do often don’t want to go back. And that’s usually how the most important upgrades work quietly, until they become the standard.