Bitcoin is currently trading around $70,700, with recent moves showing wide daily ranges and ongoing volatility. The market has seen sharp drawdowns as low as the $60,000 area just days ago before a rebound attempt. This kind of price action reflects a market that is still grappling with uncertainty, as participants try to absorb large moves and recalibrate risk exposure.

What Happened in the Market

The recent decline was driven less by panic and more by position unwinding. As BTC failed to hold above key short-term levels, leveraged positions began to exit, accelerating the move lower. This resulted in a strong daily drawdown and wider candles, signaling a shift from controlled price action into a volatility-driven environment. Importantly, this move followed a period where upside continuation attempts repeatedly failed, increasing vulnerability to a downside reset.

Reading the Current Market Structure

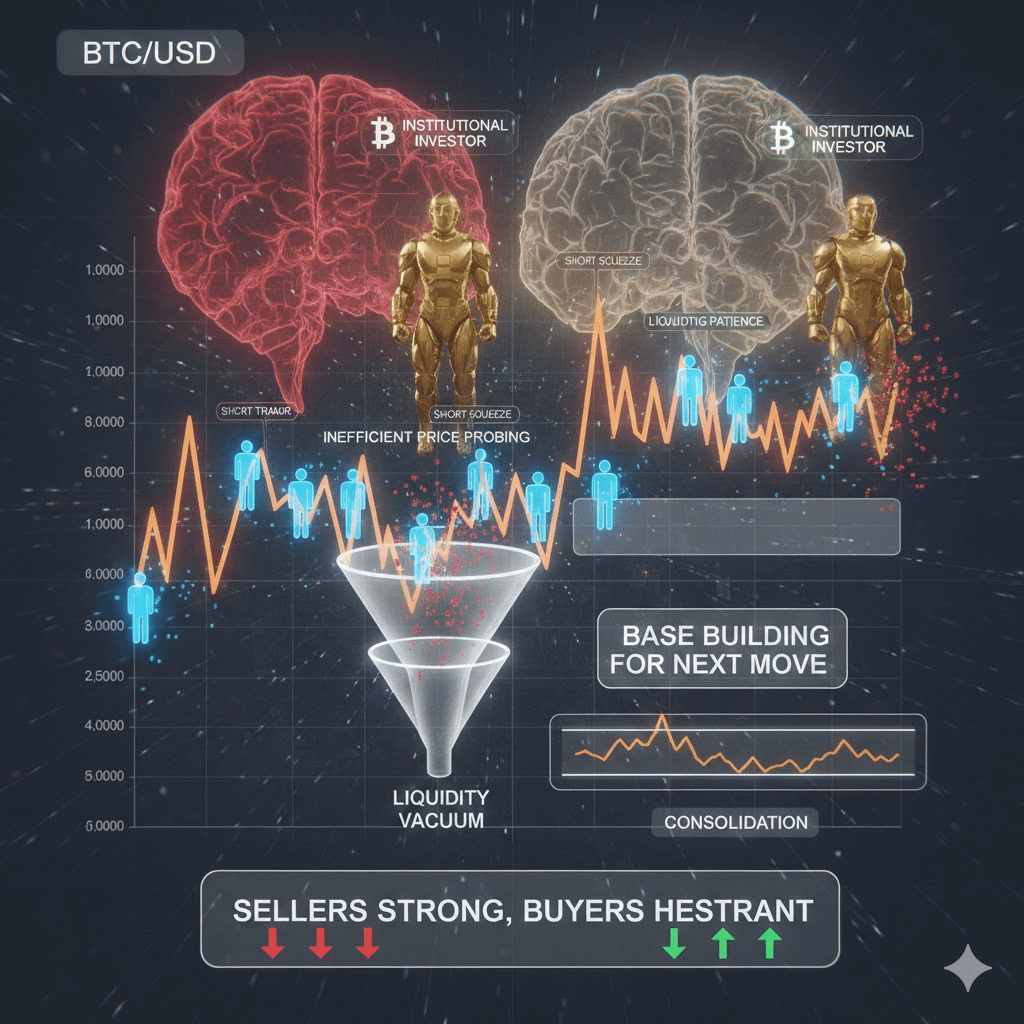

From a structural perspective, Bitcoin has moved away from its prior area of acceptance and is now trading below short-term equilibrium levels. While downside momentum was strong, price has not yet shown sustained acceptance below the broader range. This suggests the move is part of a rebalancing phase, where liquidity is being redistributed rather than a confirmed long-term trend reversal taking place. Markets often behave this way after impulsive moves. Instead of continuing lower immediately, price tends to slow down as participants reassess risk and positioning stabilizes. This is where confusion increases and false signals become more common.

Liquidity, Behavior, and Market Psychology

During volatile phases, weaker hands are usually forced out first. Stronger participants tend to wait for clarity rather than chase price. This creates periods where BTC trades inefficiently, probing liquidity above and below recent levels without committing to a clear direction. The current environment reflects this dynamic. Sellers have shown strength, but buyers are not yet displaying conviction. This balance often leads to consolidation or gradual stabilization before the market reveals its next meaningful move.

Why Patience Is Critical Right Now

One of the most common mistakes during these phases is trying to identify a definitive bottom too early. Markets rarely confirm direction through single candles or isolated bounces. Instead, they reveal intent through acceptance, time, and structure.

Watching how Bitcoin behaves after volatility expansion provides far more information than attempting to predict the next move. Whether price stabilizes, consolidates, or reclaims key structural zones will matter more than short-term reactions.

Final Thoughts

Bitcoin’s recent price action is a reminder that volatility often signals transition, not immediate resolution. In these conditions, discipline and observation tend to outperform urgency. Letting structure develop before forming strong bias is often the difference between reacting emotionally and navigating markets strategically.