In April 2013, Bitcoin experienced one of the most violent crashes in its history. Within hours, the price collapsed by more than 80 percent. For many, this was not just another market correction. It looked like the end of an experiment that had gone too far, too fast.

What followed, however, reshaped the crypto industry forever.

Before the Collapse

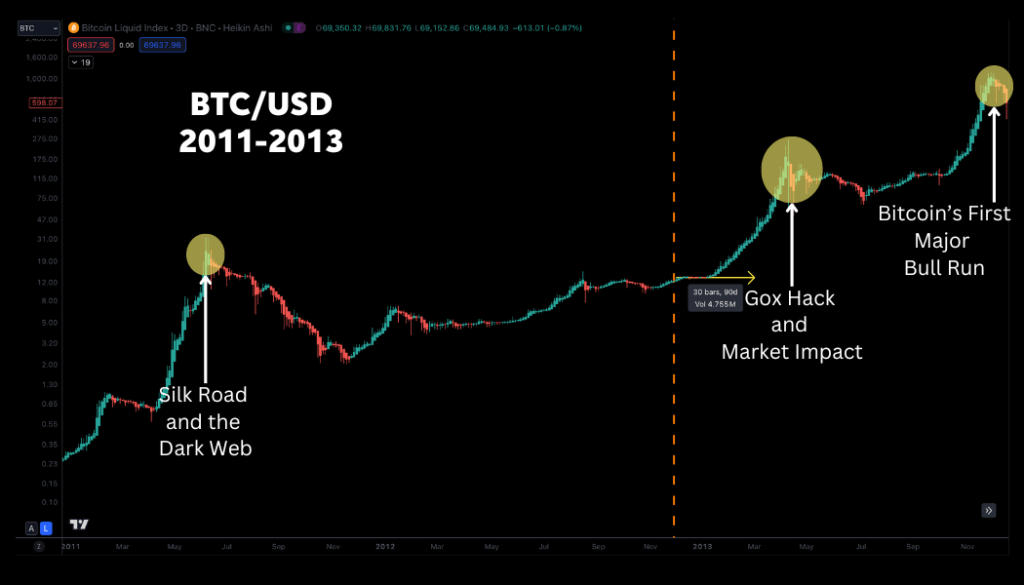

At the start of 2013, Bitcoin was transitioning from a niche curiosity into a mainstream topic. Price surged from around thirteen dollars to over two hundred and sixty dollars in a matter of months. Media coverage intensified, forums exploded with activity, and a wave of new participants entered the market with little understanding of the risks involved.

The Hidden Fragility

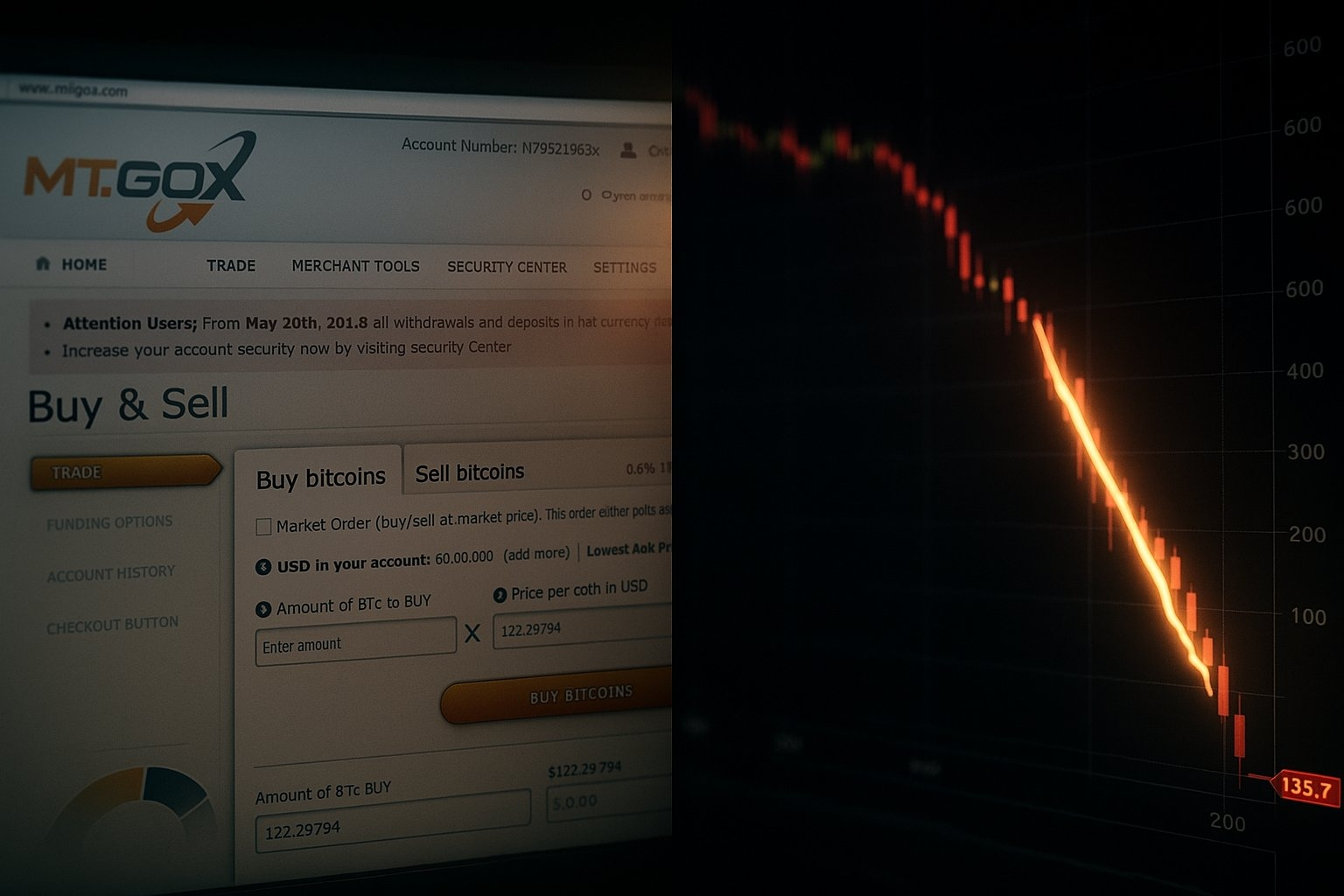

At the center of Bitcoin’s early infrastructure stood Mt. Gox, the dominant exchange of the era. It processed the majority of global Bitcoin trading volume. Yet beneath its influence lay severe weaknesses. The platform relied on outdated systems, lacked proper safeguards, and was never designed to handle the scale of activity it suddenly faced.

The Moment Panic Took Over

On April 10, 2013, trading volume spiked sharply. Mt. Gox failed under the load. Users were locked out of their accounts and unable to sell or withdraw funds. With no clear communication, uncertainty turned into fear. Rumors spread rapidly, questioning whether the exchange had been hacked or whether Bitcoin itself was fundamentally broken. While Mt. Gox stalled, other exchanges remained open, triggering widespread panic selling.

The Crash

In less than two hours, Bitcoin’s price collapsed from two hundred and sixty-six dollars to nearly fifty dollars. Billions in market value vanished almost instantly. Screens were filled with red, and many participants were convinced they were witnessing Bitcoin’s final moments.

Why It Really Happened

The crash was not caused by a single factor. It was the result of multiple failures converging at once. Infrastructure buckled under pressure. Speculation had replaced long-term conviction. Liquidity was thin, and fear spread faster than accurate information. The event exposed how immature and fragile the ecosystem still was.

What People Forgot

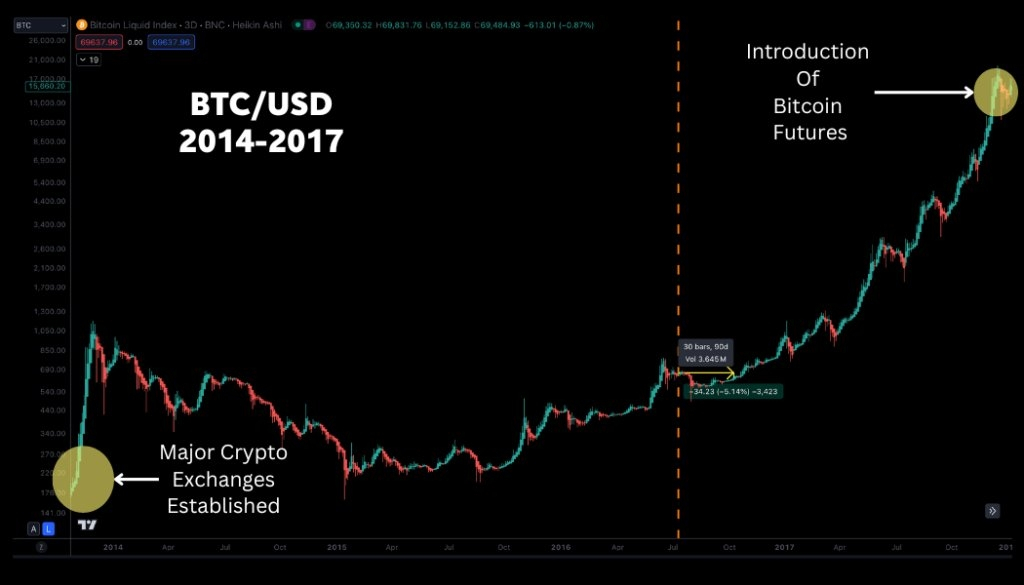

Despite the scale of the collapse, Bitcoin did not disappear. It recovered. Within eight months, the same asset many had written off reached new highs above eleven hundred dollars. What was supposed to be a fatal blow became a stress test that Bitcoin survived.

Lessons That Shaped the Industry

That day permanently changed how participants approached crypto. Reliance on a single exchange was recognized as a critical risk. Volatility was no longer seen as an anomaly but as a defining feature of the asset class. Most importantly, belief in Bitcoin was no longer theoretical. It had been tested under extreme conditions.

Could It Happen Again

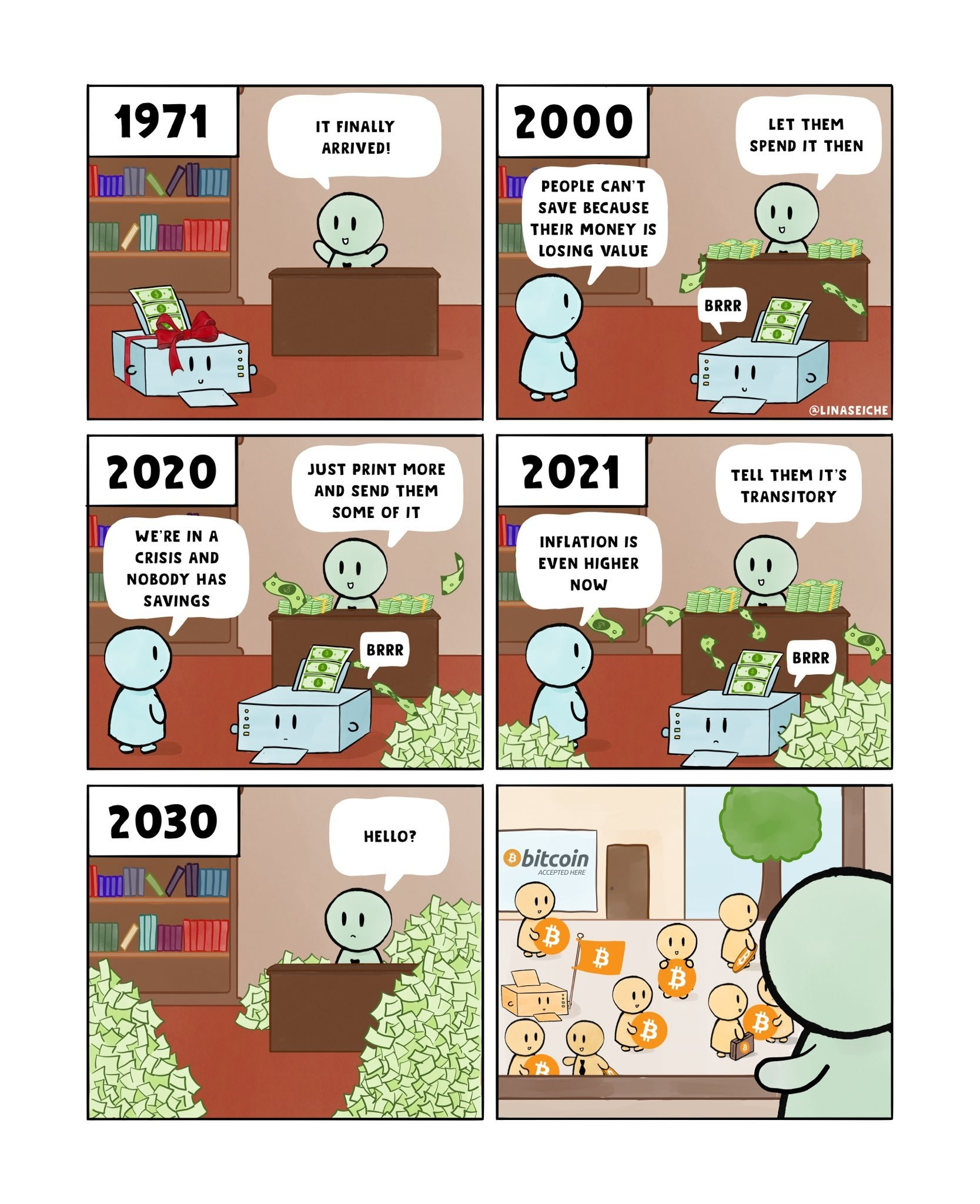

Yes, and it has. Events like Terra and FTX echo similar patterns of structural failure and misplaced trust. The difference today is that the ecosystem has evolved. Security practices are stronger, custody options are better, and awareness of counterparty risk is far higher than in 2013.

A Test of Conviction

Imagine holding Bitcoin during that crash. An eighty percent drop in a single afternoon. No access to your funds. No clarity. Every market cycle contains moments like this. They separate speculation from conviction.

The Day That Changed Everything

Black Monday was meant to end Bitcoin. Instead, it revealed something more important. The most brutal crashes often forge the strongest believers. Many projects fail and disappear, but the idea of open, unstoppable money endured. That idea survived its darkest day, and it continues to shape crypto today.