The crypto landscape in early 2026 is no longer just about "mooning." As we navigate a complex macroeconomic environment, the winners are those building real-world utility. If you’re looking to position your portfolio, understanding the distinct roles of the "Big Three" and the Binance ecosystem is essential.

1. Bitcoin ($BTC): The Digital Growth Engine

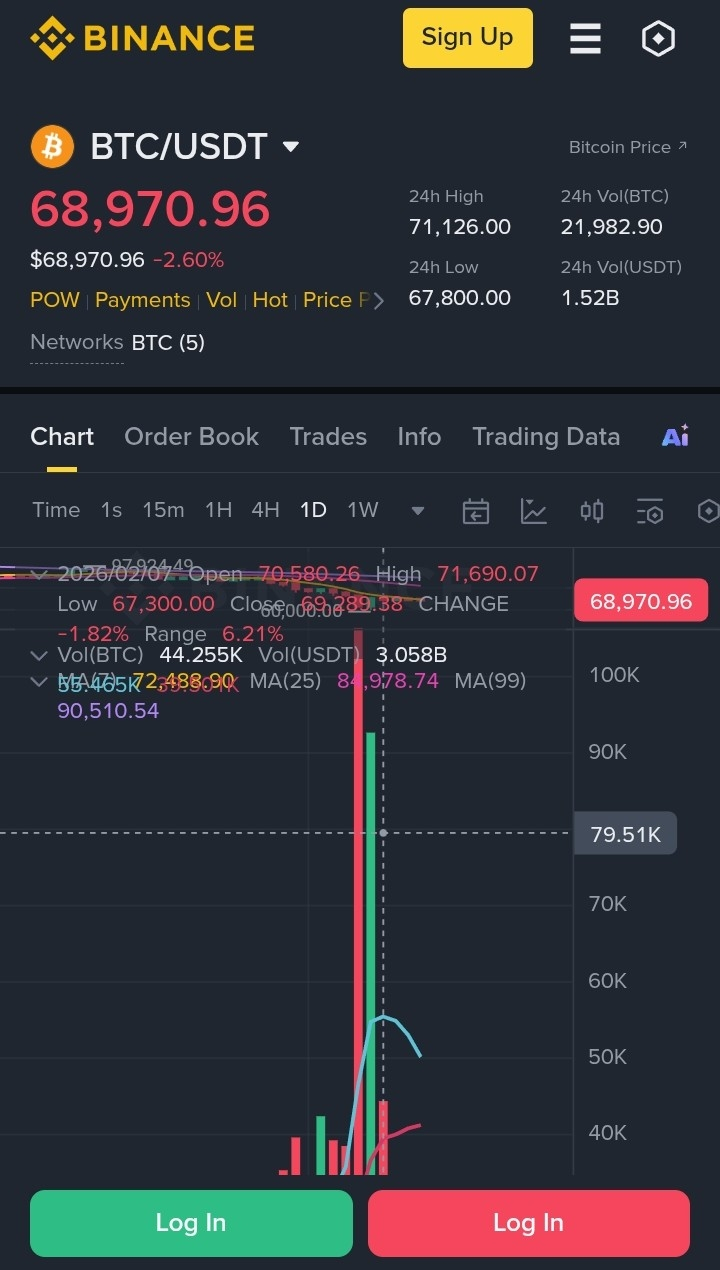

While historically viewed as "Digital Gold," 2026 data shows Bitcoin behaving more like a high-growth tech asset.

The Trend: Institutional treasuries are currently weathering unrealized losses, but conviction remains.

The Catalyst: With the GENIUS Act providing federal frameworks for digital assets, BTC is transitioning from a speculative play to a foundational layer of the global financial "plumbing."

Strategy: Watch the $60,000–$65,000 range. This is the "accumulation zone" for long-term believers.

2. Ethereum ($ETH): The Great Roadmap Shift

Ethereum is undergoing its most significant evolution since the Merge. Vitalik Buterin’s pivot away from "rollup-centric" scaling toward Native ZK-EVM integration is the story of the year.

Why it matters: This simplifies the user experience by bringing high-speed scaling directly to Layer 1.

Institutional Entry: With major banks like Fidelity launching stablecoins directly on Ethereum, the network's role as the "Settlement Layer of the World" is being cemented.

3. Solana ($SOL): The Revenue King

Solana has defied the 2026 "risk-off" mood by leading all blockchains in 7-day revenue and DEX volume.

The Edge: Its ability to handle massive retail volume with near-zero fees makes it the go-to for decentralized AI and prediction markets.

The Outlook: As long as Solana maintains its uptime and developer incentive programs, it remains the primary challenger to Ethereum’s DeFi dominance.

4. The Binance Ecosystem: Your SAFU Haven

In a volatile market, the platform you use is as important as the assets you hold.

Security First: The Binance SAFU Fund recently increased its BTC holdings by $300M, providing a massive psychological safety net for users.

Utility & BNB: $BNB continues to thrive not just as a fee-discounter, but as the gas for a maturing BNB Chain ecosystem that is focusing on "Real World Assets" (RWA).

💡 Pro-Tips for the 2026 Market

Stop Chasing Hype: Look for "plumbing" projects—infrastructure, ZK-tech, and Oracle services.

Manage Your Risk: In a market of high-growth assets, never trade more than you can afford to lose.

Stay Informed: Use Binance Square to follow verified creators who prioritize data over "shilling."

What is your 2026 strategy? Are you accumulating the dip or waiting for more clarity? Let’s discuss below!

#Bitcoin #Ethereum #Solana #Binance #WriteToEarn #Crypto2026