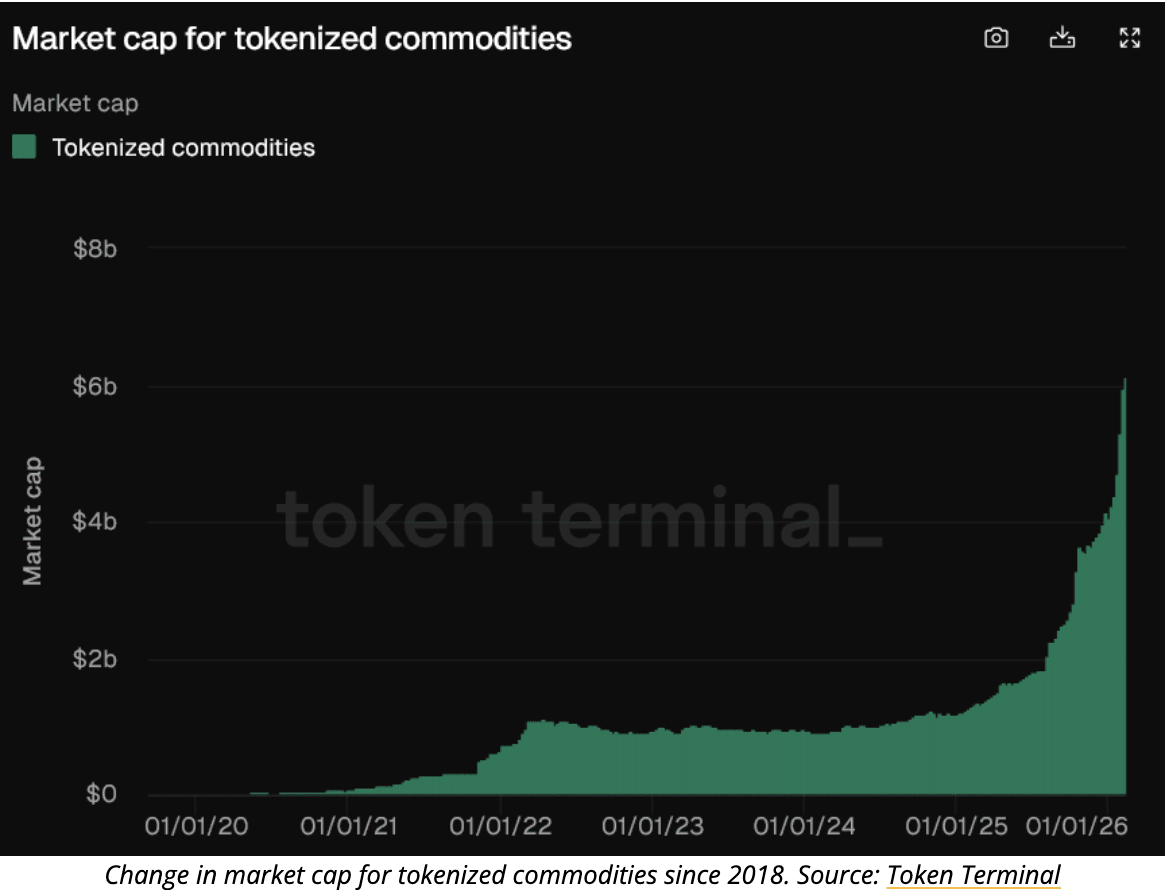

The tokenized commodities market has surpassed $6.1 billion in value, rising 53% in less than six weeks, as gold-backed tokens attract growing demand amid a historic rally in bullion prices.

The market stood at just over $4 billion at the start of the year, meaning roughly $2 billion has been added since Jan. 1, according to data from Token Terminal. The surge makes tokenized commodities the fastest-growing segment within the real-world asset (RWA) tokenization space.

Gold tokens dominate the market

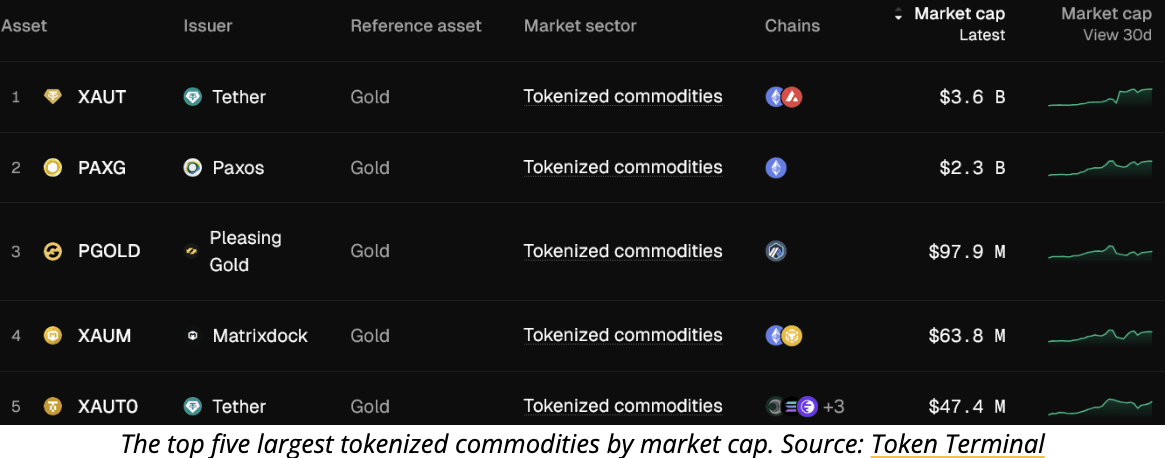

Growth has been overwhelmingly driven by tokenized gold products, which now account for more than 95% of the tokenized commodities market.

Tether’s gold-backed token, Tether Gold (XAUt), has been the largest contributor. Its market capitalization rose 51.6% over the past month to $3.6 billion. Meanwhile, Paxos-issued PAX Gold (PAXG) increased 33.2% to $2.3 billion over the same period.

Overall, tokenized commodities are now up 360% year-on-year, with growth since the start of 2026 far outpacing tokenized stocks (42%) and tokenized funds (3.6%).

The sector is now valued at just over one-third of the $17.2 billion tokenized funds market and is substantially larger than tokenized equities, which stand at about $538 million.

Tether expands tokenized gold strategy

Tether recently deepened its push into tokenized commodities by acquiring a $150 million stake in precious metals platform Gold.com. The company said XAUt will be integrated into Gold.com’s platform, and it is exploring options that would allow customers to purchase physical gold using its USDt stablecoin.

Gold outperforms as crypto lags

The rise in tokenized gold mirrors gold’s strong performance in traditional markets. Spot gold has gained more than 80% over the past year, reaching a new all-time high near $5,600 on Jan. 29. After a brief pullback toward $4,700, prices have rebounded to around $5,050.

By contrast, Bitcoin and the broader crypto market have struggled since an October sell-off that triggered roughly $19 billion in liquidations. Bitcoin fell more than 50% from its early October peak of $126,080 to around $60,000, before rebounding to roughly $69,000, according to CoinGecko.

The divergence has reignited debate over Bitcoin’s role as a safe-haven asset. Jack Mallers, CEO of Strike, has argued that markets still treat Bitcoin more like a high-growth software stock. Crypto asset manager Grayscale echoed that view, saying Bitcoin’s “digital gold” narrative has been tested as its price action increasingly resembles that of a risk asset.

The contrast underscores why tokenized gold has emerged as the leading beneficiary of RWA adoption during the current market cycle, as investors seek onchain exposure to traditional safe-haven assets.