When I first looked at Plasma, what stood out wasn’t speed, throughput, or some shiny metric people usually lead with. It was how little it seemed to care whether I understood what was happening underneath. And that sounds like criticism until you realize it’s probably the point.

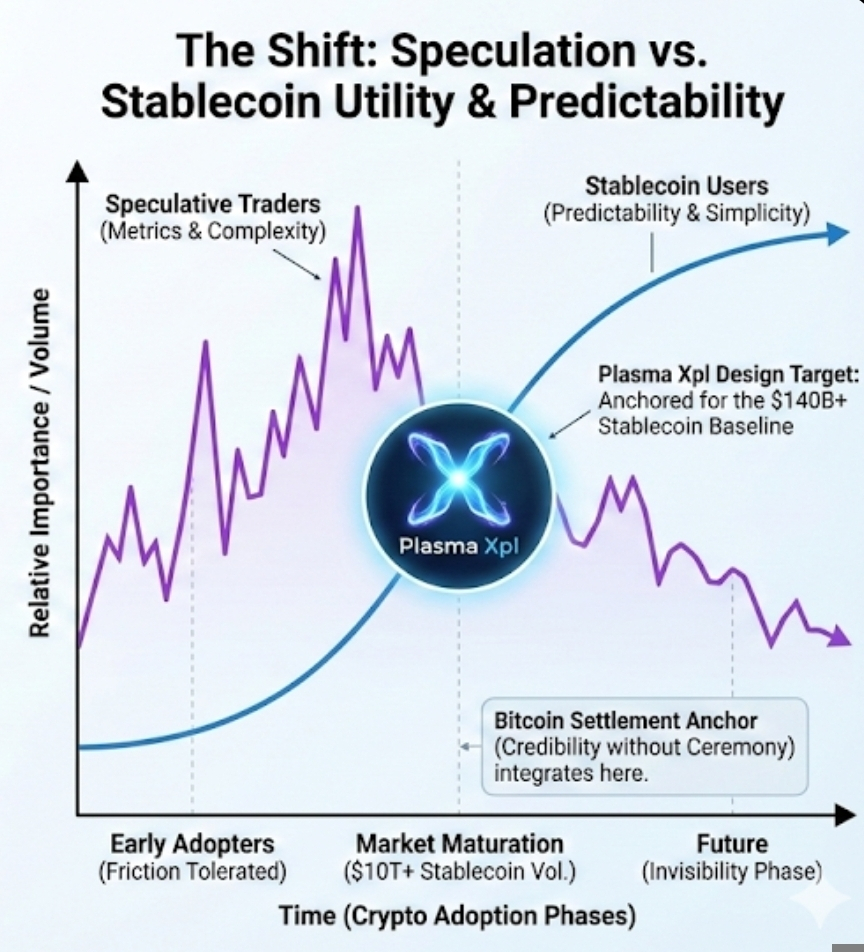

For years, crypto has quietly trained users to become part-time infrastructure managers. You don’t just send money. You choose a network, worry about gas, time your transaction, bridge assets, track confirmations, and hope nothing breaks along the way. We normalized that friction because early adopters were willing to tolerate it. But the market has changed. Stablecoins now move more than $10 trillion annually across blockchains, a figure that matters because it’s already larger than many traditional payment rails. Most of that volume isn’t coming from people who care about block times. It’s coming from people who just want the transfer to work.

That shift helps explain why Plasma feels different in texture. Plasma is not trying to educate users into becoming better crypto participants. It’s designing around the assumption that users are done learning. The surface experience reflects that. Zero-fee USD transfers, gas sponsorship, stablecoin-native contracts. On the outside, it looks boring. Underneath, it’s a deliberate rejection of how most chains frame their relationship with users.

Take the zero-fee model. On the surface, it reads like a marketing hook. Underneath, it changes who bears complexity. Instead of pushing cost management onto users, Plasma pushes it into the system itself. Fees still exist. Infrastructure still needs to be paid for. But those costs are abstracted away and handled through paymaster-style mechanics and application-level sponsorship. What that enables is not cheaper transactions, but predictable ones. If this holds, predictability becomes the real product.

That predictability matters because stablecoin users behave differently from speculative traders. A trader might tolerate a $7 fee if the upside is there. Someone sending $120 to family or paying a supplier won’t. Right now, stablecoins account for roughly 70 percent of on-chain transaction volume during low-volatility periods, according to multiple market trackers. That number is revealing because it shows where actual usage settles when speculation cools. Plasma is designing directly for that baseline.

Meanwhile, the choice to anchor trust back to Bitcoin settlement is another signal. On the surface, a Bitcoin bridge sounds like a technical feature. Underneath, it’s about borrowing credibility. Bitcoin settles around $30 billion per day on average, depending on market conditions. That scale matters not because Plasma needs that volume, but because it ties its security assumptions to something users already trust without needing to understand why. It’s an earned foundation rather than a promised one.

Understanding that helps explain Plasma’s EVM strategy too. Developers get familiar tools. Users never have to know what EVM means. The chain behaves in a way people expect money to behave. Transactions clear. Balances update. Nothing dramatic happens. In crypto terms, that’s unusual. Most chains want you to feel the machinery. Plasma seems to want the opposite.

There’s an obvious counterargument here. Abstracting complexity can hide risk. If users don’t see fees, do they understand tradeoffs? If gas is sponsored, who controls access? Those questions are valid. Abstraction always shifts power somewhere else. Early signs suggest Plasma is betting that centralized-feeling UX can coexist with decentralized settlement, but that balance remains to be tested under stress.

Market timing adds another layer. As of early 2026, stablecoin market cap sits just above $140 billion. That number matters because it has grown even during periods when altcoin volumes collapsed. While attention cycles rotate, stablecoin usage compounds quietly. Plasma’s design seems aligned with that slow growth rather than the fast narrative spikes that dominate social feeds.

What struck me is how little Plasma asks from the user emotionally. No loyalty. No ideology. Just use it if it works. That restraint is rare in crypto, where projects often demand belief before they earn trust. Plasma flips that order. Trust is built through repetition, not persuasion.

If this approach spreads, it hints at a broader pattern. Crypto infrastructure may be entering a phase where invisibility becomes the competitive edge. Not hiding risks, but hiding ceremony. The chains that matter might be the ones people forget they’re using.

The sharpest realization is this. Plasma isn’t designing for the next crypto user. It’s designing for the moment crypto stops being a thing people notice at all.