So, there’s this new blockchain called Plasma, and it’s pretty interesting, especially when you start to dive into what it’s really built for. Essentially, it's a Layer 1 blockchain, meaning it's right at the base level, the foundation where transactions actually happen. Now, what makes Plasma stand out is that it’s specifically built for stablecoin transactions. If you’re not super familiar with stablecoins, think of them as cryptocurrencies that are usually pegged to something stable like the US dollar, so their value doesn’t swing around like crazy. They’re pretty important in the crypto world, especially for people looking to get in and out of crypto without worrying about market volatility.

Plasma’s got a few things going for it that make it a bit of a game changer. For one, it’s fully compatible with the Ethereum Virtual Machine or EVM, which is kind of like a universal language for smart contracts in the Ethereum ecosystem. But here’s the twist Plasma uses a newer version called Reth. It’s kind of like upgrading your phone to the latest model, which makes everything work a bit smoother and faster. But it doesn’t stop there. Plasma has something called sub-second finality, which is a fancy way of saying that transactions are locked down almost immediately. Think about how long it usually takes for most blockchains to confirm a transaction Plasma does it in less than a second. That’s seriously quick when you think about how transactions usually drag on in the blockchain world.

Plasma’s got a few things going for it that make it a bit of a game changer. For one, it’s fully compatible with the Ethereum Virtual Machine or EVM, which is kind of like a universal language for smart contracts in the Ethereum ecosystem. But here’s the twist Plasma uses a newer version called Reth. It’s kind of like upgrading your phone to the latest model, which makes everything work a bit smoother and faster. But it doesn’t stop there. Plasma has something called sub-second finality, which is a fancy way of saying that transactions are locked down almost immediately. Think about how long it usually takes for most blockchains to confirm a transaction Plasma does it in less than a second. That’s seriously quick when you think about how transactions usually drag on in the blockchain world.

Now, the big hook for Plasma is how it’s optimized for stablecoins, particularly USDT, one of the most widely used stablecoins. This means you can send USDT without having to pay the usual gas fees that come with every transaction on other blockchains. No more paying for each little action you do on the blockchain Plasma’s got gasless USDT transfers. That’s huge, especially for everyday users who are just trying to get by without racking up costs on every single transaction. But they didn’t stop there. They’ve got something called “stablecoin-first gas,” which means they’re prioritizing stablecoins for paying for the actual processing of the transactions. It’s a smart move, considering how important stablecoins have become for a lot of people.

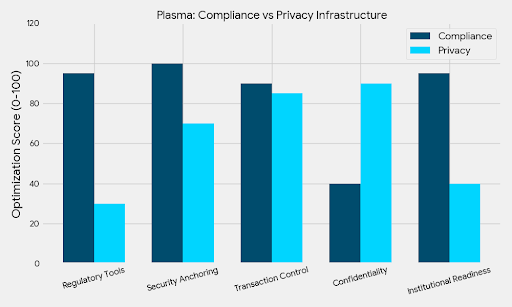

Another thing that makes Plasma different is its security model. It’s not just relying on the usual blockchain security; Plasma is anchored to Bitcoin. Yep, you read that right. Bitcoin, the OG cryptocurrency, is used as a reference point to secure Plasma’s network. This adds an extra layer of neutrality and resistance to censorship, which is something a lot of newer blockchains lack. With Bitcoin in the mix, Plasma gains some serious credibility and trust. It's like having a security guard from a top-tier company vouching for you when you enter a building there’s an extra sense of safety there.

When you look at who this blockchain is really targeting, it's clear that Plasma isn’t just for the average crypto enthusiast. While it’s definitely built for retail users in markets where adoption is already high, Plasma is also targeting institutions in the payments and finance sectors. The traditional financial world is slowly warming up to crypto, and a blockchain like Plasma could be just the kind of tool that makes crypto more attractive to institutions that need reliable and efficient stablecoin transactions. You know, the kind of people who don’t want to deal with the instability of crypto prices but still want to make use of the underlying technology.

If you zoom out and think about it from a broader perspective, Plasma is trying to solve a problem that many blockchains face today. Speed, cost, and usability are still major hurdles for widespread adoption. Yes, blockchain tech is cool and all, but if it’s too slow or expensive for everyday transactions, people won’t use it. Plasma’s approach of focusing on stablecoins and making sure that everything works fast and cheap could be a key factor in making crypto more mainstream. It’s like taking the best parts of Ethereum, making them faster, and tailoring them specifically for stablecoins, which is where the demand is going.

In the grand scheme of things, this could be the next step toward integrating crypto into everyday financial life. There’s so much noise in the blockchain space right now projects popping up left and right, some promising the moon and others crashing before they can take off. But Plasma feels like it’s built with a clear understanding of where things are headed. Stablecoins are here to stay, and with systems like Plasma pushing the boundaries of what’s possible in transaction speed and cost, it’s not hard to see how this could play a major role in the next phase of blockchain’s evolution.

In a world where every new project seems to come with a million promises, Plasma stands out because it’s focused on a real, tangible need making stablecoin transactions faster, cheaper, and more secure. It's a tool that could help connect the traditional financial world with the world of crypto in a way that feels seamless, which, honestly, is something we’ve all been waiting for.