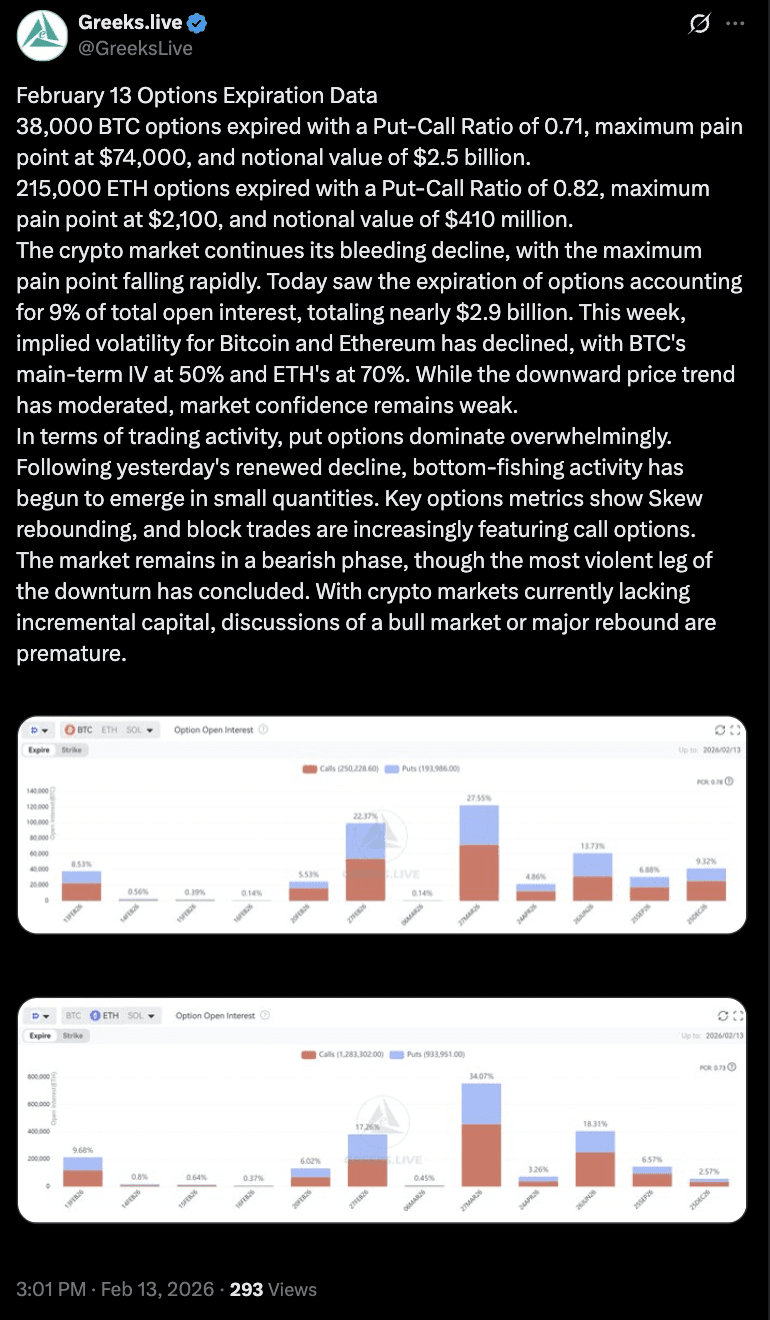

On February 13, a significant number of Bitcoin and Ethereum options are set to expire, according to PANews. Analysis from Greeks.live indicates that 38,000 BTC options and 215,000 ETH options will reach maturity. The BTC options have a Put Call Ratio of 0.71, with a maximum pain point at $74,000 and a nominal value of $2.5 billion. Meanwhile, ETH options show a Put Call Ratio of 0.82, with a maximum pain point at $2,100 and a nominal value of $410 million.

The cryptocurrency market continues to experience a downturn, with the maximum pain point decreasing rapidly. Today, options accounting for 9% of total open interest, amounting to nearly $2.9 billion, are expiring. This week, the implied volatility for Bitcoin and Ethereum has decreased, with BTC's main term IV at 50% and ETH's at 70%. Although the downward price trend has slowed, market confidence remains low. In terms of trading, put options dominate, although some buying interest has emerged following yesterday's further decline. Key options data show a rebound in Skew, and there is an increase in bullish options.