#MarketRebound After the recent correction, the market has shown some recovery, prompting mixed reactions. Some view this as an early stabilization phase, while others see it as a short-term relief movement. Understanding both perspectives is important to maintain a balanced view.

Sentiment Reset

Sharp downside moves are often fear-driven. Leverage decreases, speculative positions close, and volatility temporarily rises. This type of reset can help stabilize the market in the short term.

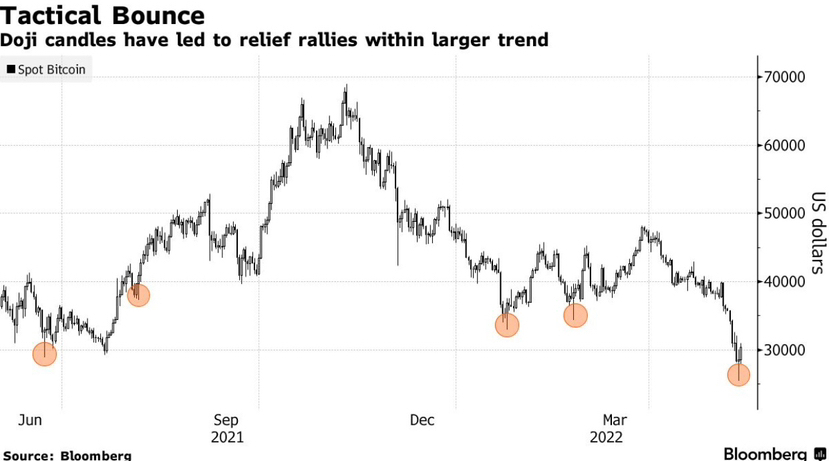

Historically, an initial bounce after a correction does not always indicate a long-term trend change. In some cases, it may simply be a temporary reaction.

Structure & Volume Observation

When evaluating market movement, several neutral factors are observed:

Is the price able to sustain above key resistance levels?

Is volume gradually increasing or declining during the recovery?

Are higher lows forming, or is the structure returning to lower levels?

If stability is maintained and volatility remains controlled, the recovery may be sustainable. However, if resistance levels reject the price and momentum weakens, further downward movement cannot be ruled out.

Macro & Liquidity Context

Global liquidity expectations, interest rate outlooks, and broader economic data all influence market movement. Positive macro conditions may boost confidence.

On the other hand, uncertainty or policy ambiguity can keep the market sideways or volatile. Therefore, it’s important to assess a rebound within a broader context rather than in isolation.

Balanced Perspective

During a market rebound:

Optimism may gradually return

Caution remains equally important

Short-term strength does not automatically confirm a long-term reversal

This phase is usually a transition zone, where market direction takes time to become fully clear.

Conclusion

A market rebound does not necessarily mean sustained upward movement.

It represents an adjustment phase where sentiment, liquidity, and structure gradually realign. Until a clear direction is confirmed, it is best to maintain a balanced perspective—neither overly optimistic nor overly pessimistic—and rely on data-driven observation.