When people hear SVM L1, they instinctively group Fogo with every other high-TPS chain chasing speed metrics.

That’s a mistake.

Fogo isn’t selling throughput.

It’s selling a market architecture.

The core question Fogo asks is simple but uncomfortable:

If on-chain finance wants to compete with professional markets, why do blockchains ignore the very things real trading depends on—latency, geography, clock synchronization, and client performance?

In real markets, these aren’t optimizations.

They are constraints.

The new narrative isn’t “faster blocks.”

It’s coordination: aligning time, place, validator behavior, and execution paths so on-chain markets behave like actual markets—not noisy experiments.

Latency isn’t a feature request.

It’s a system-level problem.

fogo treats it the way exchanges do.

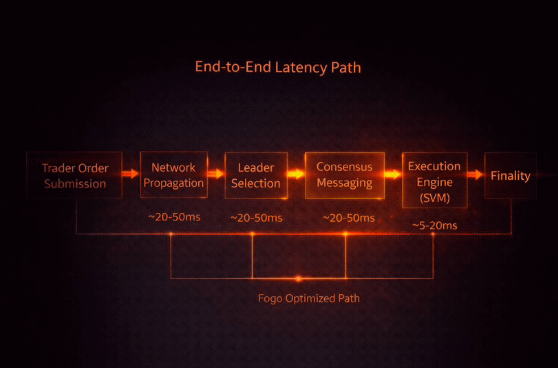

If you want real-time order books, precise liquidations, fair auctions, and reduced MEV extraction, optimizing the execution engine alone isn’t enough. You have to optimize the entire pipeline: clocks, propagation, consensus messaging, and who gets to produce blocks.

That’s Fogo’s positioning: build the chain so markets behave correctly by design.

Rather than reinventing everything, Fogo builds on the proven architecture of Solana—Proof of History for synchronized time, Tower BFT for fast finality, Turbine for propagation, and SVM for deterministic execution.

The difference isn’t imitation.

It’s reinterpretation—performance-first, market-first.

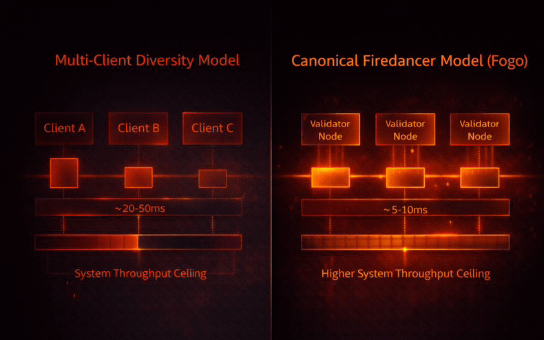

One of Fogo’s most controversial choices is also its most honest:

a single canonical validator client, based on Firedancer.

Client diversity sounds good in theory. In practice, performance collapses to the slowest implementation. Exchanges don’t run five matching engines for diversity—they run the fastest one because milliseconds matter.

Fogo makes the same call.

Even better, it outlines a realistic migration path—starting with a hybrid client and moving to full Firedancer—showing execution discipline, not ideology.

Then there’s multi-local consensus.

Validators are intentionally co-located to push latency to hardware limits, shrinking the window for market manipulation. Zones rotate via on-chain governance, preserving jurisdictional diversity while avoiding capture.

Co-locate to win milliseconds.

Rotate to stay decentralized.

Validator participation is curated—not permissionless chaos, but performance-based membership. Stake secures the network; approval secures the user experience. That’s not anti-decentralization—it’s market realism.

For traders, this all collapses into three things that matter more than buzzwords:

• Consistency under load

• Predictability in execution

• Fairness against toxic flow

Fogo’s architecture directly targets the friction tax, bot tax, and speed tax that quietly drain on-chain profitability.

the technical story and the trading story align. That coherence is rare.

Strip away the branding and Fogo is proposing a worldview:

A blockchain for real-time markets shouldn’t behave like a public bulletin board.

It should behave like coordinated market infrastructure.

You can disagree with the philosophy—but you can’t call it generic.

If Fogo succeeds, it won’t be because of TPS charts.

It will be because builders stop designing around chain weaknesses—and users feel the difference in the only way markets care about:

clean execution.

@Fogo Official

$FOGO

#FogoChain #OnChainMarkets #CryptoInfrastructure