When people hear “SVM compatibility,” it usually sounds like something only developers should care about. I used to think the same — until I started noticing how often execution speed, not strategy, was deciding my results.

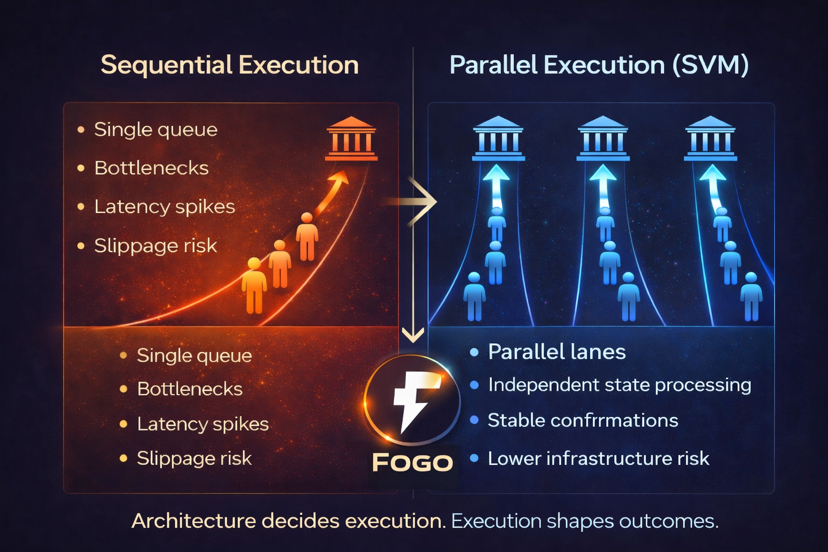

Every blockchain has an engine that executes transactions. That engine determines how orders are processed, how contracts run, and how fast everything moves once you press “confirm.” On many networks, transactions are processed sequentially: one finishes, then the next begins. Most of the time you don’t notice. Until volatility hits.

That’s when confirmations slow down, fees spike, orders fail, and slippage increases. It’s not hype or bad luck — it’s architecture.

SVM (Solana Virtual Machine) approaches this differently. It allows parallel execution. If two transactions don’t interact with the same state, they don’t need to wait in line — they can be processed simultaneously. In simple terms, some blockchains operate like a single checkout counter, while SVM works more like multiple counters open at once. In calm markets both feel fine. In heavy traffic, only one keeps moving smoothly.

Now connect this to trading. Markets move in bursts. They spike, cascade, and react within seconds. When thousands of orders hit the network simultaneously, sequential systems create natural bottlenecks. Even a small delay can shift an entry or exit. Parallel execution doesn’t remove market risk, but it reduces infrastructure risk — the risk of the network becoming the weakest link.

This is where Fogo becomes interesting. It isn’t just “SVM compatible” as a label; it positions itself as infrastructure designed for trading and financial applications. Trading environments are stress tests by default. If a network slows down under pressure, traders notice instantly — not in theory, but in execution.

Parallel execution helps the network keep its rhythm during spikes. Orders don’t pile up in a single queue, confirmations remain more consistent, and the gap between submission and finality stays tighter. For traders, that consistency matters more than headline TPS numbers.

For teams building exchanges or financial tools, it’s the same story. Predictability under load is what keeps a product usable during volatility. And because Fogo aligns with the SVM model, developers coming from the Solana ecosystem don’t have to start from zero. Familiar tooling lowers friction, which often translates into faster iteration and faster ecosystem growth.

In trading, timing is capital. Infrastructure that processes transactions in parallel instead of sequentially doesn’t just feel faster — it behaves differently under pressure. I no longer see execution design as a technical detail. I see it as part of market structure.

When infrastructure becomes the bottleneck, strategy stops mattering. Fogo is attempting to remove that bottleneck before it becomes visible. In fast markets, design decisions aren’t cosmetic — they shape outcomes.