Every blockchain loves throwing around massive throughput numbers. "We can process 100,000 transactions per second!" "Our chain does 500,000 TPS!" It's become this meaningless numbers game where projects compete on theoretical maximums that nobody ever actually achieves in production.

So when Fogo claims 136,866 transactions per second, my first instinct was skepticism. Because I've seen this movie before, and it usually ends with disappointed users and crashed networks.

But then I actually looked at how they're achieving it. And here's the thing — Fogo's throughput claims are backed by architecture decisions that make those numbers plausible, not just theoretical lab conditions that fall apart under real usage.

The Hardware Reality Nobody Talks About

Most blockchains are designed to run on consumer-grade hardware. The thinking goes: if you require expensive servers, you'll end up centralized because only wealthy operators can afford to validate. Makes sense philosophically, right? Democratic access to validation equals decentralization.

Except that philosophy creates a performance ceiling. You can't squeeze high-end server performance out of someone's gaming PC running a node in their basement. Physics doesn't care about your ideology.

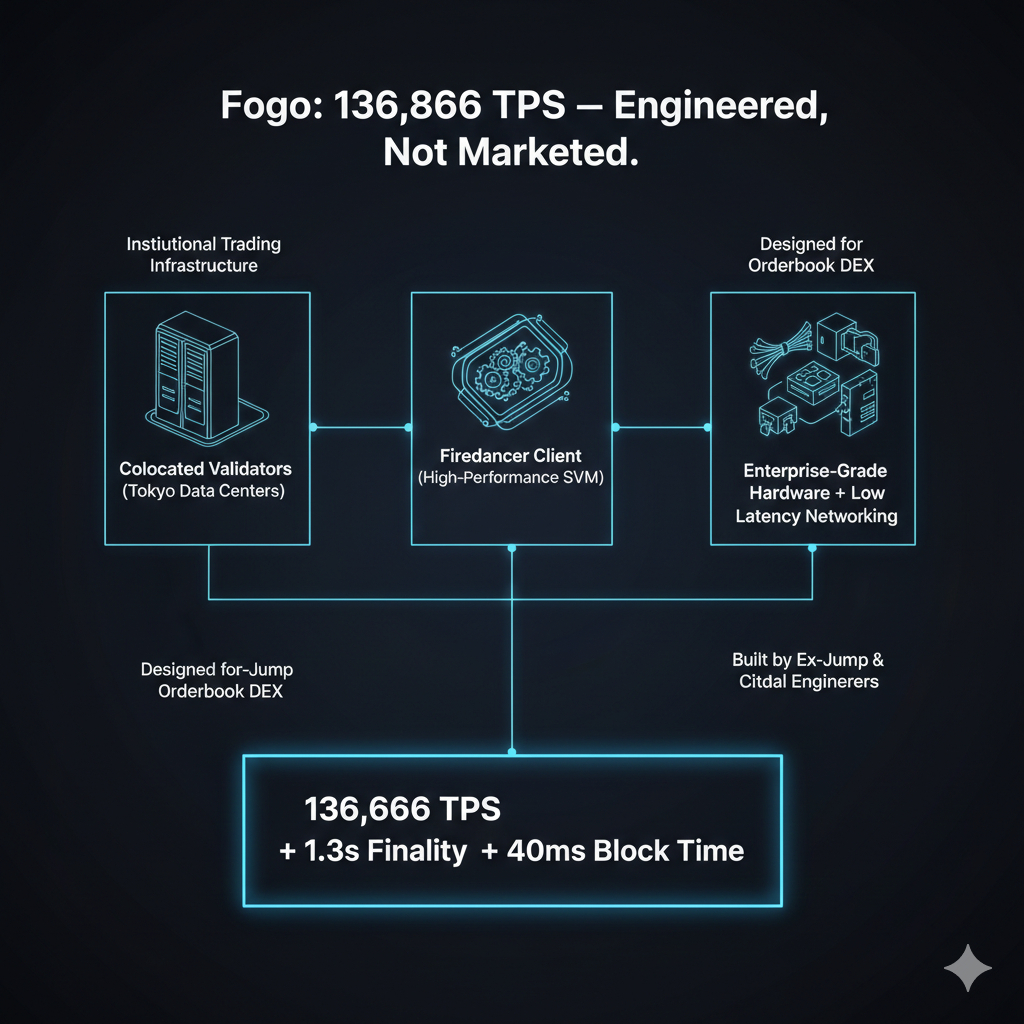

Fogo took a different approach. Their validators are colocated in Tokyo running on serious hardware. We're talking enterprise-grade servers with fast SSDs, high-bandwidth connections, and optimized networking equipment. The kind of infrastructure that actual financial systems run on.

Is that more centralized? Yes. Does it enable performance that's actually competitive with centralized exchanges? Also yes.

The Fogo team made a deliberate choice: they're building infrastructure for institutional trading, not trying to be a maximally decentralized settlement layer. Different use case, different trade-offs. And for their specific goals, prioritizing performance over geographic distribution makes complete sense.

When your validators are physically close together with low-latency connections and powerful hardware, achieving 136K+ TPS stops being theoretical and starts being engineered reality.

Firedancer Makes the Difference

The other crucial piece is that Fogo uses the Firedancer client, which is basically a from-scratch, high-performance implementation of the Solana Virtual Machine. This isn't some quick fork of existing code — Firedancer was built by Jump Crypto (before they spun it out) with the explicit goal of maxing out SVM performance.

Traditional Solana validators can get overwhelmed during high usage periods. We've all seen the network congestion issues. Firedancer was designed to handle that problem through better engineering — more efficient memory usage, faster transaction processing, optimized networking code.

When Fogo says they're achieving 136,866 TPS, they're running on Firedancer architecture with colocated validators on high-end hardware. That's not three separate advantages — it's a multiplicative effect where each optimization compounds with the others.

The 40-millisecond block times work in concert with this. Faster blocks mean you can process more transactions in the same period without increasing individual block size to dangerous levels. It's elegant engineering rather than just throwing hardware at the problem.

But Does It Actually Matter?

Here's the question that matters: do traders actually need 136K TPS? For most blockchain use cases, honestly no. If you're just sending tokens around or minting NFTs, even 1,000 TPS is plenty.

But think about what Fogo is designed for. An on-chain order book DEX handling serious trading volume. Liquidation cascades in lending protocols. Perpetual futures with high-frequency updates. These aren't casual use cases — they're scenarios where thousands of transactions need processing every second during peak activity.

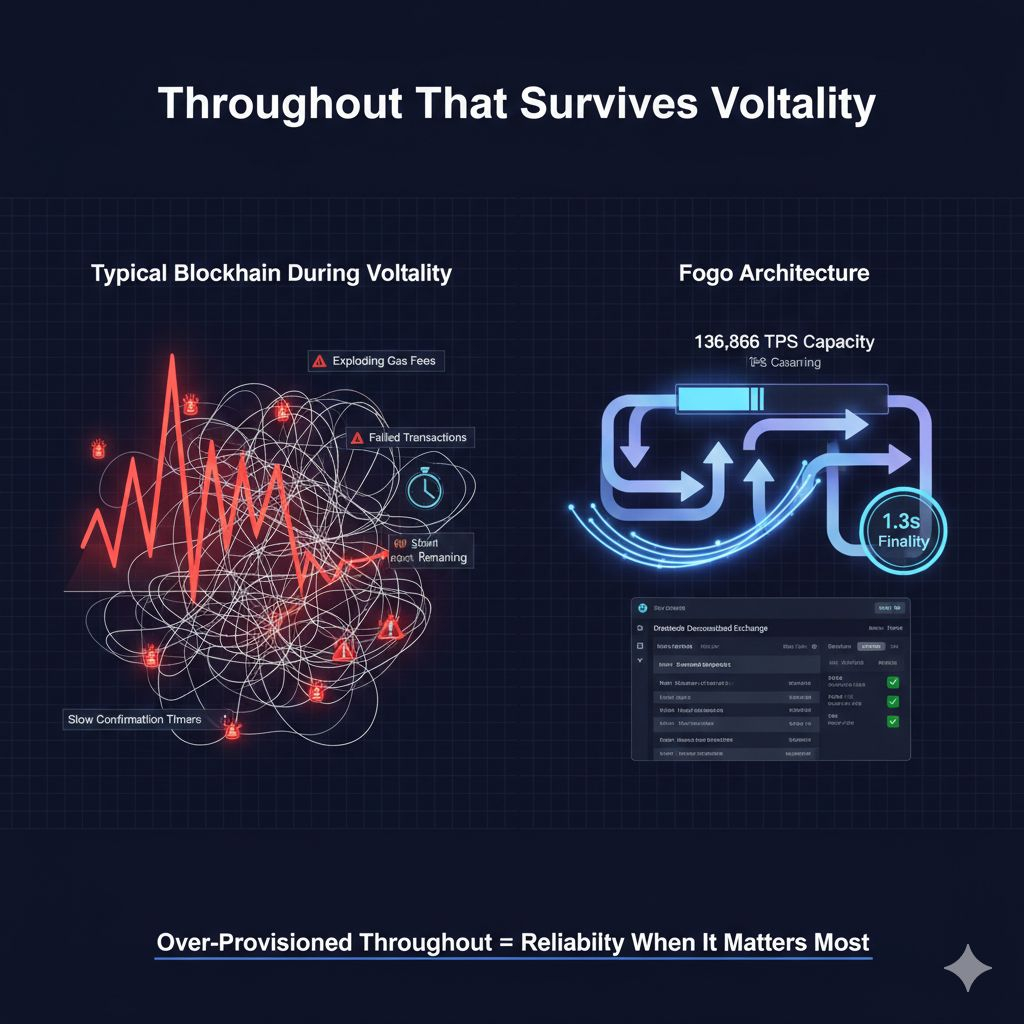

Traditional DEXs on Ethereum or even Solana struggle when volume spikes. Orders fail. Gas fees explode. Users get liquidated because their transactions didn't confirm fast enough. It's not just annoying — it's capital-destructively bad.

Fogo's throughput capacity means that even during extreme volatility, the chain doesn't become a bottleneck. Traders can execute at the speeds they need. Liquidations happen when they're supposed to. The infrastructure doesn't fail exactly when it's most critical.

That's the difference between theoretical TPS numbers and real-world utility. Fogo's throughput isn't there to win benchmark competitions — it's there to ensure the chain doesn't crap out when institutional volume hits.

The Stress Test Results

What I find compelling is that Fogo has actually run stress tests demonstrating their throughput claims. These aren't just whitepaper projections — they've loaded the network and measured actual performance.

Now, stress tests are always somewhat artificial. Real-world usage patterns differ from simulated load. But the fact that Fogo can demonstrably process 136K+ transactions per second under test conditions at least proves the architecture can handle it technically.

Compare that to projects that quote TPS numbers without ever demonstrating them. Or chains that hit their theoretical maximum for five seconds before crashing. Fogo's engineering team comes from Jump and Citadel — places where you don't get to ship code that doesn't work under pressure. That pedigree matters.

The mainnet launch in January 2026 has been relatively smooth. No major outages. No catastrophic bugs. The network has been processing transactions consistently with the performance characteristics they advertised. For a brand new Layer 1, that's actually remarkable.

Where Throughput Meets Finality

Speed without finality is useless. If your chain can process 100K TPS but takes ten minutes to finalize those transactions, you haven't actually solved the problem. That's why Fogo's 1.3-second finality is just as important as their throughput number.

Think about it: 136,866 transactions per second with 1.3-second finality means you can process massive volume AND confirm it almost instantly. That combination is what enables professional trading applications.

When you execute a trade on Valiant DEX built on Fogo, you're not sitting there wondering if it'll actually settle. Within 1.3 seconds, it's finalized. That certainty lets you immediately execute your next trade, manage your positions, adjust your risk. The infrastructure doesn't force you to wait.

Centralized exchanges have conditioned traders to expect instant execution and settlement. For DeFi to compete for institutional volume, it needs to match that experience. Fogo's throughput plus finality gets remarkably close.

The Ecosystem Load Test

Here's what's interesting: Fogo launched with over ten dApps already functional. Valiant DEX, Brasa, Moonit, Pyron, Fogolend — these are real applications with actual users, not just testnets.

That means the network is getting organic load tested from day one. Multiple protocols processing transactions simultaneously. Various smart contracts executing. Real economic activity creating unpredictable usage patterns.

And the network is handling it. That's the real validation of Fogo's throughput claims — not theoretical benchmarks, but production performance with actual applications running.

As the ecosystem grows, as trading volume increases, we'll see if Fogo can maintain performance under heavier sustained load. But the early signs are promising. The FOGO token is being used for gas across multiple protocols. Transactions are confirming quickly. Users aren't reporting issues.

What Happens When Volume Spikes?

The real test will come during market volatility when everyone rushes to trade simultaneously. That's when throughput capacity actually matters. During the next crypto market crash or pump, when traders are panic-selling or FOMO-buying, can Fogo handle the load?

Based on the architecture, they should be able to. The 136K TPS capacity provides significant headroom above current usage. Even if trading volume spikes 10x during extreme volatility, the network should absorb it without degrading performance.

Compare that to chains that run close to capacity during normal conditions. When volume spikes even 2-3x, they immediately hit limits. Gas fees explode. Transactions get stuck. The network becomes unusable exactly when people need it most.

Fogo's over-provisioned throughput is insurance against those scenarios. It's engineering margin that ensures reliability during the moments that define whether infrastructure is actually production-ready.

The Skeptic's Take

Look, I'm not saying Fogo has zero performance risks. Collocating validators in Tokyo creates a single point of failure geographically. If something happens to those data centers, the network has problems. That's a real concern.

There's also the question of long-term sustainability. High-performance infrastructure isn't free. Validator operators need serious hardware and bandwidth. That requires either high token rewards to compensate them, or transaction fee revenue that supports the costs. Fogo needs to prove the economic model works long-term.

And of course, throughput capacity means nothing if nobody uses the chain. Fogo could process 136K TPS all day, but if there are only 100 transactions per second actually happening, who cares?

Why I'm Betting They'll Succeed

Despite those concerns, Fogo's approach seems fundamentally sound. They identified a specific market need — institutional-grade trading infrastructure — and engineered specifically for that use case. The 136,866 TPS isn't a vanity metric. It's a requirement for the applications they're targeting.

The team has proven execution ability through Pyth Network. The technology is delivering on its promises so far. The ecosystem is functional and growing. Major exchanges are supporting the FOGO token.

Most importantly, the throughput claims are backed by real engineering decisions rather than marketing hype. When you understand how they're achieving 136K TPS, it stops sounding impossible and starts sounding like competent systems design.

That's rare enough in crypto to be worth paying attention to.