Executive Summary

Aave stands as a leading decentralized lending protocol with $45B in TVL, serving as a cornerstone of DeFi infrastructure. The protocol demonstrates strong fundamentals with consistent revenue generation ($200K-$1M daily), healthy user adoption (7K-34K DAU), and sustainable tokenomics (96% circulating supply). Recent expansion to Mantle Network positions Aave for continued multi-chain growth.

Token Metrics & Valuation

Current State (2026-02-16 11:27 UTC):

Price: $125.31

Market Cap: $1.91B

24h Volume: $424.1M (22.2% of market cap)

24h Change: -2.85%

Token Supply Dynamics:

Total Supply: 16,000,000 $AAVE (fixed)

Circulating Supply: 15,299,469 AAVE (95.6% circulated)

Ecosystem Reserve: 3,000,000 AAVE (18.75% of total)

Fully Diluted Valuation: $2.00B

The high circulation ratio (96%) significantly reduces token inflation risk compared to newer protocols with substantial locked allocations.

Protocol Performance Analysis

TVL & Capital Efficiency

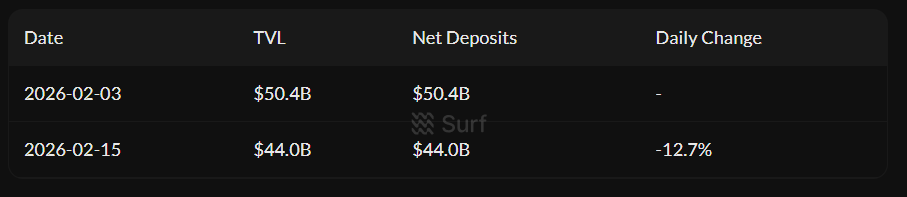

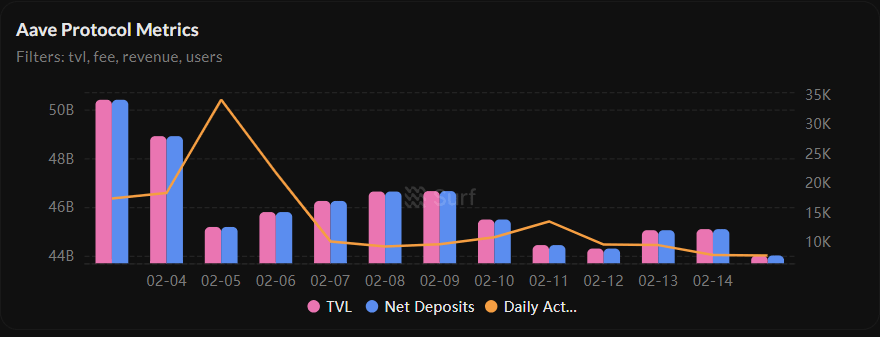

Aave maintains dominant TVL figures despite recent market volatility:

The TVL decline from $50.4B to $44.0B over 12 days reflects broader market conditions rather than protocol-specific issues. $AAVE continues to command significant market share in decentralized lending.

Revenue & Fee Generation

Aave demonstrates consistent revenue generation with attractive fee splits:

Recent Performance (7-day average):

Daily Fees: $2.97M

Supply-Side Fees: $2.56M (86% to depositors)

Protocol Revenue: $413K (14% to treasury)

Earnings: $389K (net after expenses)

The protocol maintains a sustainable 86/14 fee split, rewarding liquidity providers while generating meaningful treasury revenue. Daily revenue fluctuates between $200K-$1M based on market activity.

User Adoption & Engagement

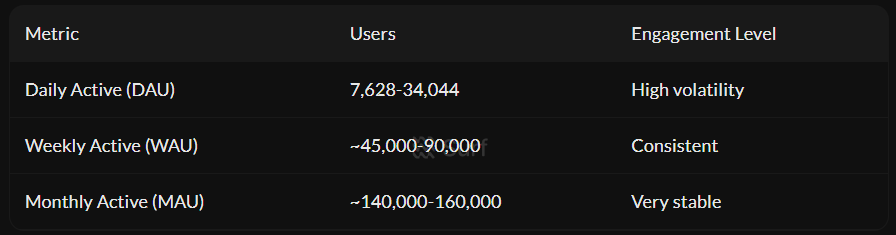

Aave shows strong user retention across time horizons:

The MAU/DAU ratio of approximately 5:1 indicates strong user retention with monthly users returning weekly on average.

Team & Funding Background

Leadership Team:

Stani Kulechov (Founder/CEO) - Industry veteran with strong track record

Peter Kerr (CFO) - Financial expertise

Claudia Ceniceros (CCO) - Communications leadership

Emilio Frangella (VP Engineering) - Technical execution

Nicole Butler (CCO) - Compliance focus

Funding History ($49.3M total raised):

ICO (2017-10-25): $16.2M

Undisclosed Rounds (2020): $32.5M from top-tier investors including:

Blockchain Capital

Standard Crypto

Framework Ventures

Three Arrows Capital

ParaFi Capital

The well-capitalized position and reputable investor backing provide significant operational runway and credibility.

Recent Developments & Catalysts

Mantle Network Deployment (Key Growth Catalyst):

Aave V3 launched on Mantle Network in partnership with Bybit

Supported assets: WETH, WMNT, USDT, USDC, GHO

Incentive program: 8M MNT + 1.5M GHO tokens

Strategic importance: Expands to Ethereum L2 ecosystem with major exchange partnership

This deployment represents Aave's continued multi-chain expansion strategy, leveraging Bybit's user base for distribution.

Investment Perspective

Strengths

Market Position: Dominant lending protocol with $45B TVL

Revenue Generation: Consistent $200K-$1M daily protocol revenue

Tokenomics: 96% circulating supply reduces inflation pressure

Team & Backing: Experienced team with top-tier investor support

Multi-Chain Strategy: Expanding to L2s (Mantle) and beyond

Risks

Market Correlation: TVL closely tied to crypto market cycles

Competition: Emerging lending protocols and traditional finance entry

Regulatory Uncertainty: Evolving global DeFi regulations

Smart Contract Risk: Though extensively audited, protocol complexity remains

Valuation Assessment

At current $1.91B market cap, Aave trades at:

Price/Sales (annualized): ~15x (based on $130M annual revenue)

TVL/Market Cap: 0.04x (compared to sector average 0.10-0.15x)

The valuation appears reasonable given Aave's market leadership, revenue generation, and established track record. The Mantle expansion and continued multi-chain deployment provide growth optionality.

Conclusion

Aave represents a high-quality blue-chip DeFi protocol with strong fundamentals, consistent revenue, and reasonable valuation. The protocol's dominance in decentralized lending, experienced team, and strategic expansion to L2 ecosystems position it well for continued growth.

Investment Rating: ACCUMULATE - Current levels offer attractive entry for long-term exposure to DeFi infrastructure. Monitor TVL trends, revenue generation, and successful Mantle deployment execution.

#OpenClawFounderJoinsOpenAI $USDC #MarketRebound #USRetailSalesMissForecast