February 17, 2026 - The global cryptocurrency market is navigating a complex landscape of institutional outflows, regulatory uncertainty, and contrasting regional sentiment as major digital assets consolidate below key resistance levels.

Market Performance Snapshot

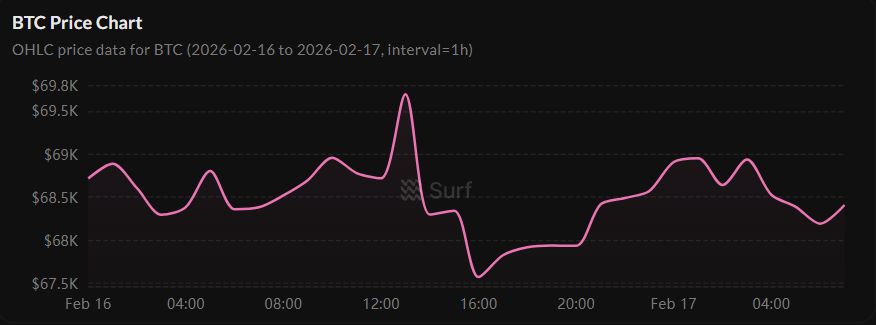

The crypto market shows mixed signals with moderate declines across major assets as of February 17, 2026. Bitcoin is trading at $68,672, down approximately 0.67% over the past 24 hours, while Ethereum has declined 1.45% to $1,981. Solana shows more pronounced weakness, trading at $84.17 with a 3.33% decline.

The total cryptocurrency market capitalization stands at $2.34 trillion, representing a 0.88% decline from previous levels. Trading volume remains substantial at $95.24 billion, indicating active market participation despite the downward pressure.

Institutional Outflows Reach $3.74 Billion

The most concerning trend emerges from institutional investment patterns. Digital asset investment products have experienced outflows for four consecutive weeks, totaling $3.74 billion over the past month. Last week alone saw $173 million in outflows, reflecting growing institutional caution. CoinShares

Regional Divergence: The outflows are predominantly driven by U.S. investors, who withdrew $403 million in a single week. In contrast, European markets showed resilience with Germany adding $115 million, Canada $46.3 million, and Switzerland $36.8 million - totaling $230 million in inflows outside the United States.

Solana Defies Trend: Despite the broader outflow pattern, Solana-focused funds attracted $31 million in inflows, suggesting selective institutional confidence in the ecosystem's prospects. Coinpaper

Regulatory Landscape: Global Divergence

The regulatory environment shows significant regional variation, contributing to market uncertainty:

United States: The Senate faces delays on the CLARITY Act, a key crypto regulatory bill, due to partisan disputes and industry concerns. This uncertainty has triggered nearly $1 billion in market outflows and increased investor hesitation. Phemex

Russia: Authorities are advancing crypto regulation to license exchanges, aiming to capture $650 million in daily turnover and bring significant trading volume onshore. The Finance Ministry reports daily crypto turnover of $650 million and is pushing for new regulations to license exchanges and brokers.

Japan: The Finance Minister has endorsed blockchain-based securities settlement and stablecoin use, signaling growing regulatory support for blockchain finance.

Major Token Unlocks Add Selling Pressure

Today's market faces additional pressure from significant token unlocks totaling over $321 million. The major unlocks include:

Arbitrum $ARB : $92.65 million

RAIN Coin: $93.46 million

LayerZero $ZRO : $44.99 million

YZY: $20.33 million

These unlocks represent substantial potential selling pressure that could increase market volatility throughout the trading day.Phemex

Ecosystem Developments: Silver Linings

Despite the challenging market conditions, several positive developments emerged:

PayPal-Solana Partnership: PayPal has made Solana the default blockchain for its stablecoin, PayPal USD (PYUSD). This means most transfers and payments using PYUSD will now run on Solana, unless users manually choose another network like Ethereum or Arbitrum. AMBCrypto

Cardano's Stablecoin Solution: Cardano is preparing to launch USDCx, a version of USD Coin designed to work within its ecosystem. This addresses Cardano's significant stablecoin liquidity problem, where the network currently has less than $40 million in stablecoins compared to rival networks. The launch is expected by the end of February.

XRP's Relative Strength: XRP has significantly outperformed major counterparts, surging 38% after the February 6 crypto crash compared to Bitcoin's 14% and Ethereum's 12% recovery. XRP spot ETFs have seen cumulative inflows cross $1.37 billion since their November 2025 launch. Coinpedia

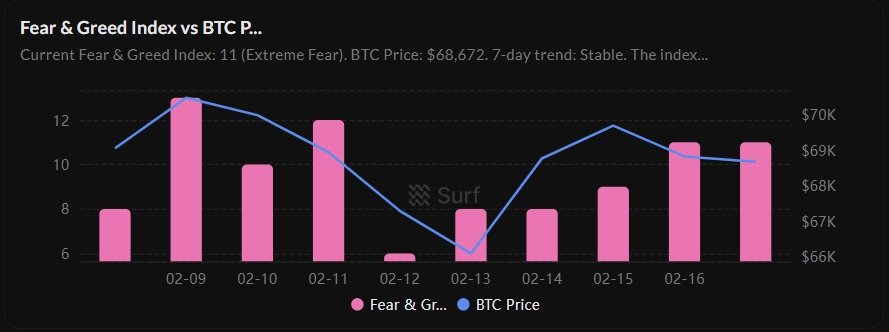

Market Sentiment: Extreme Fear Prevails

The Crypto Fear and Greed Index has dropped to 11, placing the market firmly in "Extreme Fear" territory. This represents a sharp reversal from last month's neutral levels and reflects heightened investor caution driven by macro pressures and ETF flow volatility. AMBCrypto

Technical Analysis Perspective: Bitcoin is currently trading below the 200-day exponential moving average (EMA), which typically signals bearish momentum. The Relative Strength Index (RSI) sits at 34.7, indicating negative momentum dominance without reaching extreme oversold levels. The Average Directional Index (ADX) stands at 56.4, well above the 25 threshold that confirms trend strength, indicating the bearish trend has very strong momentum. Decrypt

Visionary Perspective: Buterin's Prediction Market Thesis

Ethereum co-founder Vitalik Buterin offered a forward-looking perspective, suggesting that prediction markets could evolve beyond gambling to become core financial tools and potential alternatives to traditional fiat systems. Buterin argues that instead of pure speculation, prediction markets could be used for financial safety and coordination, potentially reshaping how stable value is created and trusted online. 99Bitcoins

Market Outlook: Cautious Optimism Among Experts

Despite the current downturn, several analysts maintain a constructive long-term view:

Bitwise CIO Matt Hougan contrasted the current environment with previous bear markets, noting: "In 2018, we had $3,000 Bitcoin and a 'global computer' [Ethereum] with no applications and limited throughput. In 2022, we had a total market collapse and a regulator that wanted to put us out of business." He highlights current positives including "stablecoins going to $3 trillion, tokenization going to $200 trillion, a positive regulatory climate, and better tokenomics." CryptoPotato

WisdomTree Analysis suggests the notorious days of extreme Bitcoin boom-and-bust cycles are largely behind us, with institutional participation fundamentally stabilizing the market. The entry of major institutions has turned Bitcoin trading from a "Wild West" environment into a more disciplined asset class. 99Bitcoins

Conclusion: A Market in Transition

The current crypto market landscape reflects a complex interplay of technical pressures, regulatory uncertainty, and shifting institutional sentiment. While short-term challenges persist with continued outflows and extreme fear sentiment, underlying developments such as the PayPal-Solana integration, Cardano's stablecoin solution, and visionary perspectives on prediction markets suggest continued ecosystem evolution.

The divergence between U.S. outflows and European inflows, coupled with Solana's defiance of the broader outflow trend, indicates selective confidence remains. As the market navigates today's significant token unlocks and regulatory developments, participants appear to be positioning for what could emerge as a more mature, institutionally-integrated digital asset landscape beyond the current volatility.

Market data as of February 17, 2026 07:42 UTC. This analysis synthesizes information from multiple sources including CoinGecko, Phemex, AMBCrypto, Coinpedia, and 99Bitcoins.

source: asksurf

Disclaimer: The information above does not constitute financial advice. This article is for educational purposes only. Always conduct thorough research before investing in the crypto market.

#MarketRebound #HarvardAddsETHExposure #MarketSentimentToday