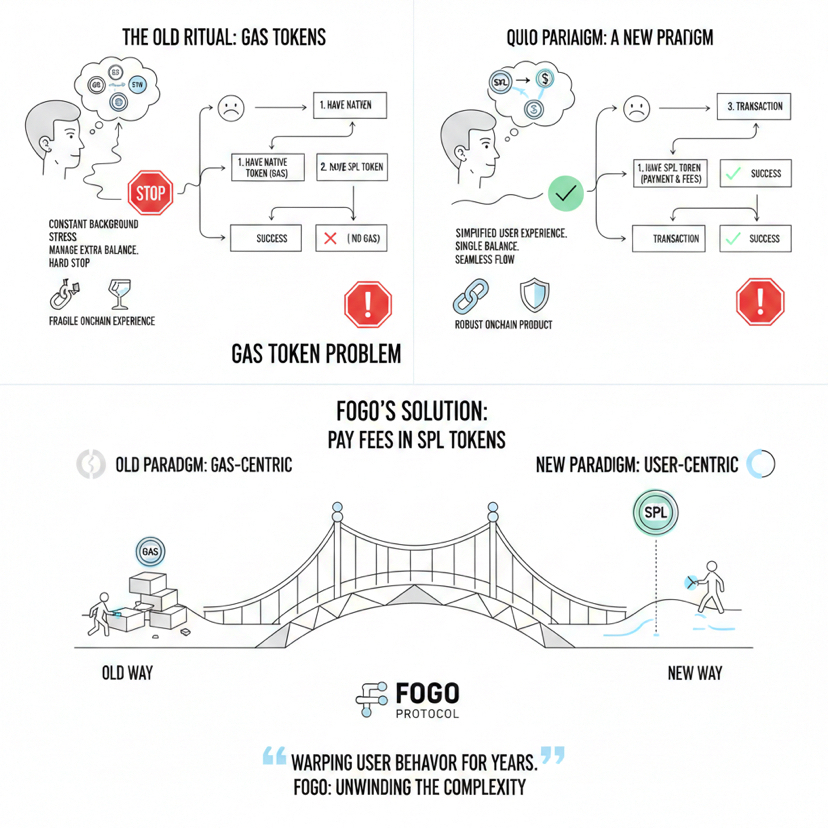

Long-term, the crypto industry has been viewing gas fees as a mere cost of decentralization. You purchase and use the native token, store some of them up to use later and move on. It became routine. Routine is not in itself efficient, and by no means user-friendly. By making it possible to complete gas payments with the use of SPL tokens, what Fogo is doing is unhelpful to the old assumption.

The actual problem of gas had never been how much it costs. It was in the nature of how it interferes with the experience. Herofiliti and Saeed derive genuine pressure when they compel users to have a separate balance just in case a transaction is to fail. There is never a time that you are not thinking of whether you have enough. And forget it all, and all the world comes to a standstill. It is that abrupt stop which people remember. It even renders solid on-chain applications unreliable.

The strategy by Fogo does not eliminate the fees. Rather, it changes their dealers. By allowing its users to pay with the tokens of SPL they already have, they do not need to stop their activity to buy a certain native asset. That minor design consideration eliminates the whole friction layer. The blockchain continues to receive payment but the user does not have to micromanage the workings of the blockchain.

This alters the psychology of relating with a chain. Historically, all transactions are ritualistic. You. Click. Sign. Check balances. Confirm. With time, such repetition is tiresome. As a more session-driven model, permissions can be configured in advance and so it is easier to interact after that. The experience begins to look more like the modern internet applications rather than an endless chain of manual confirmations.

A structural change in value flowing is also occurring. The user in the older models is charged directly by the chain. The intermediaries in Fogo model are applications. They may pay the fees, include them in the price of the products, or charge users using stablecoins. It implies that fees are made a business option and not a compulsory protocol. It brings blockchain even nearer to the functioning of digital services in other industries.

The other aspect that has been ignored is there is an effect on token economics. Many people carry a gas token when there is a general need to have one and not passion about it. Such a demand is skimming and short lived. When the day-to-day activity shifts to SPL tokens, the native FOGO token will have a higher chance of being hoarded by validators, infrastructure providers, and builders, who actually require the system to run. That makes it more purpose driven base of holders as opposed to accidental ones.

Naturally, tradeoffs are brought by this design. There is operational complexity associated with handling more than one fee token. Paymasters should deal with settlement effectively. It is dangerous when the power were concentrated in the hands of a few intermediaries. The key difference however is that the complexity moves up to professional level rather than being vested on the shoulders of each user.

Anything Fogo is signaling goes beyond being a technical aspect, in the end. It proposes vision where users deal with applications and not with infrastructure. Where the blockchain is not spoken about and is in the background doing its calculations rather than alerting you every other minute that it exists. Gas does not evaporate, no it does not free itself. It just ceases to be your day-to-day duty.

In the event that such vision succeeds, the greatest victory will not only be speed or cost efficiency. It will become the case that the use of blockchain will be a normal feeling. Seamless. Almost invisible. And then the real adoption can be achieved.