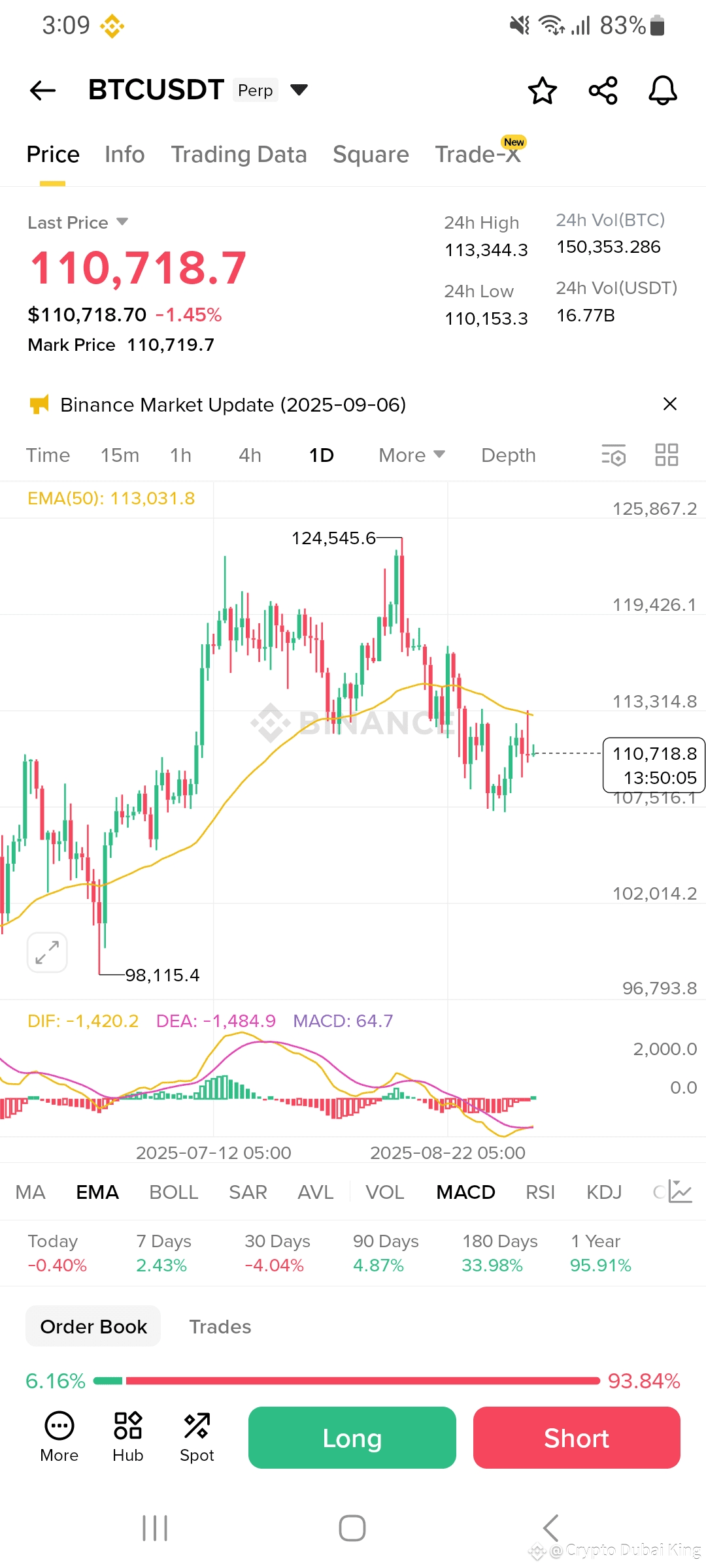

$BTC Bitcoin is trading near $110,718 (-1.45%), showing weakness after failing to hold above the 50-day EMA ($113,031). The recent rejection near $113,314–113,500 zone indicates strong resistance, while the local support lies at $107,500 and key psychological level at $110,000.

Key Observations:

1. Trend: Price is below the 50 EMA, suggesting a short-term bearish bias.

2. MACD: Histogram is narrowing, showing weakening bearish momentum — a potential sign of consolidation.

3. Volume: 24h volume is moderate, indicating indecision among buyers and sellers.

4. Market Sentiment: Order book shows 93.84% shorts vs 6.16% longs, meaning retail traders are heavily positioned for further downside — a potential setup for a short squeeze if price rebounds.

Outlook:

Bearish scenario: Break below $110,000 may push BTC toward $107,500–105,000 zone.

Bullish scenario: Recovery above $113,500 could open room for $116,000–118,000.

Conclusion:

BTC is in a consolidation phase with a bearish tilt. Watch $110,000 as a critical pivot — a daily close below may trigger further selling, while a bounce from this level could trap shorts.#MarketPullback #Binance #ETH