Stop and pay attention. Something big is unfolding inside the U.S. economy, and if you’re trading $BTC , $ETH , or $SOL , this moment cannot be ignored. Markets are approaching a decision zone where one data print could flip sentiment fast and violently.

🔥 INFLATION IS COLLAPSING — AND THAT MATTERS

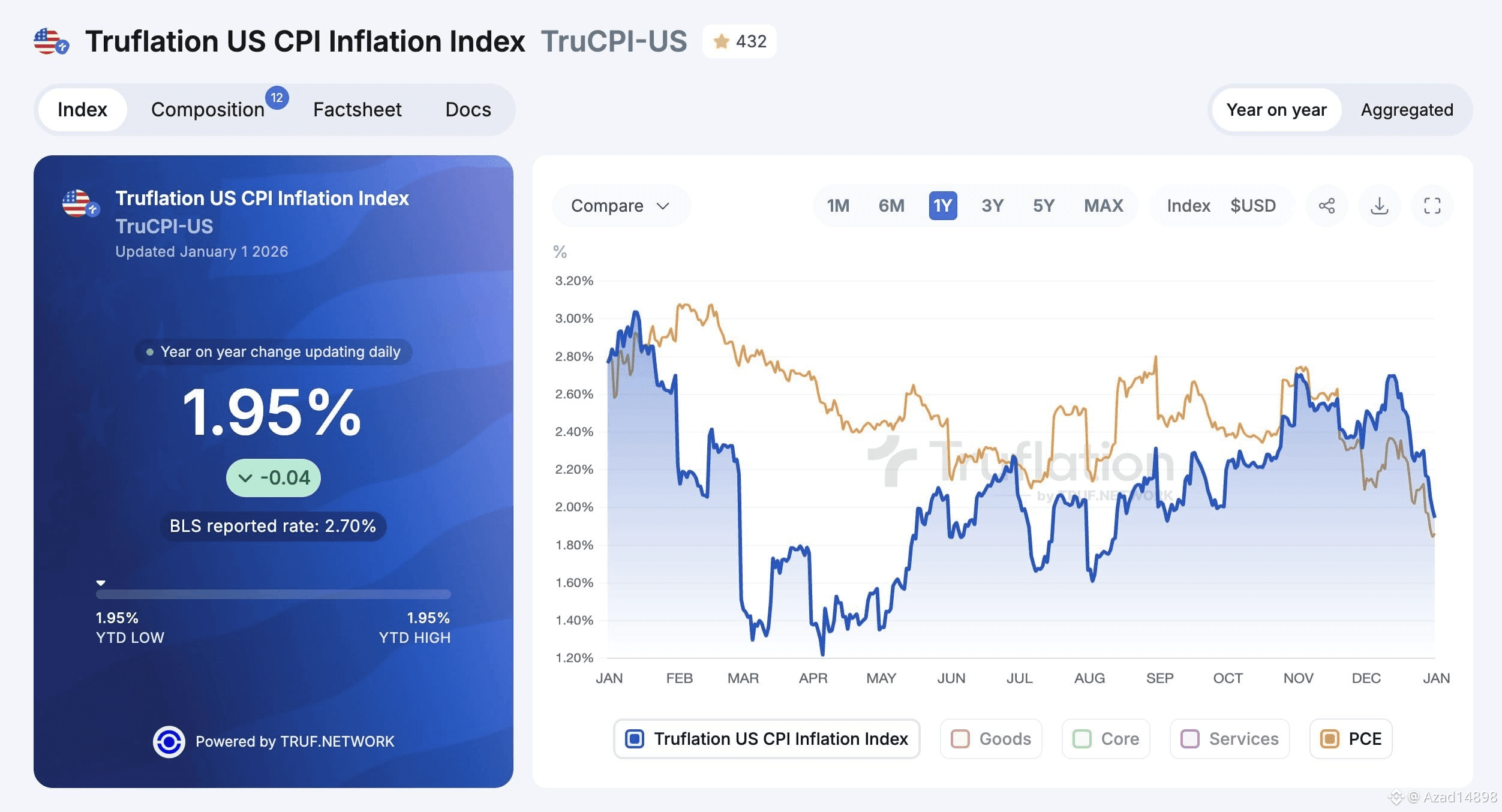

According to the latest Truflation data, U.S. CPI has dropped below 1.95%. That’s a major shift. Falling inflation eases pressure on financial conditions and historically creates the kind of environment where crypto thrives. Liquidity breathes, risk appetite returns, and capital starts hunting upside.

⏰ THE MAKE-OR-BREAK DATA FOR 2026

All eyes are now on today’s S&P PMI release at 9:45 AM. This report isn’t just routine data — it’s a forward-looking signal for growth and liquidity heading into 2026. A strong reading above 52.5 would support a bullish, green-market reaction. A weak print below 51.5 could spark a short-term pullback and risk-off move.

🧠 THE FED IS BACKED INTO A CORNER

With inflation cooling rapidly, the Federal Reserve’s flexibility is shrinking. Rate cuts move from “if” to “when,” and that shift has historically been rocket fuel for Bitcoin and broader crypto markets.

🚀 STRATEGY & POSITIONING

The setup is clear. Strong PMI could ignite a legendary PUMP $BTC, . Weak data delays it. I’m watching closely and letting the data lead.

Now the question is yours: buying the dip, or waiting for confirmation?

#BinanceSquare #CryptoMarketAlert #BitcoinBullRun #FedUpdate #StrategyBTCPurchase #InflationDrop