Fundamental Indicators: Crypto Regulations and Spot ETFs

Near-term price drivers include:

XRP-spot ETF flow trends.

US economic data and the Fed’s rate path.

US crypto-related legislative developments.

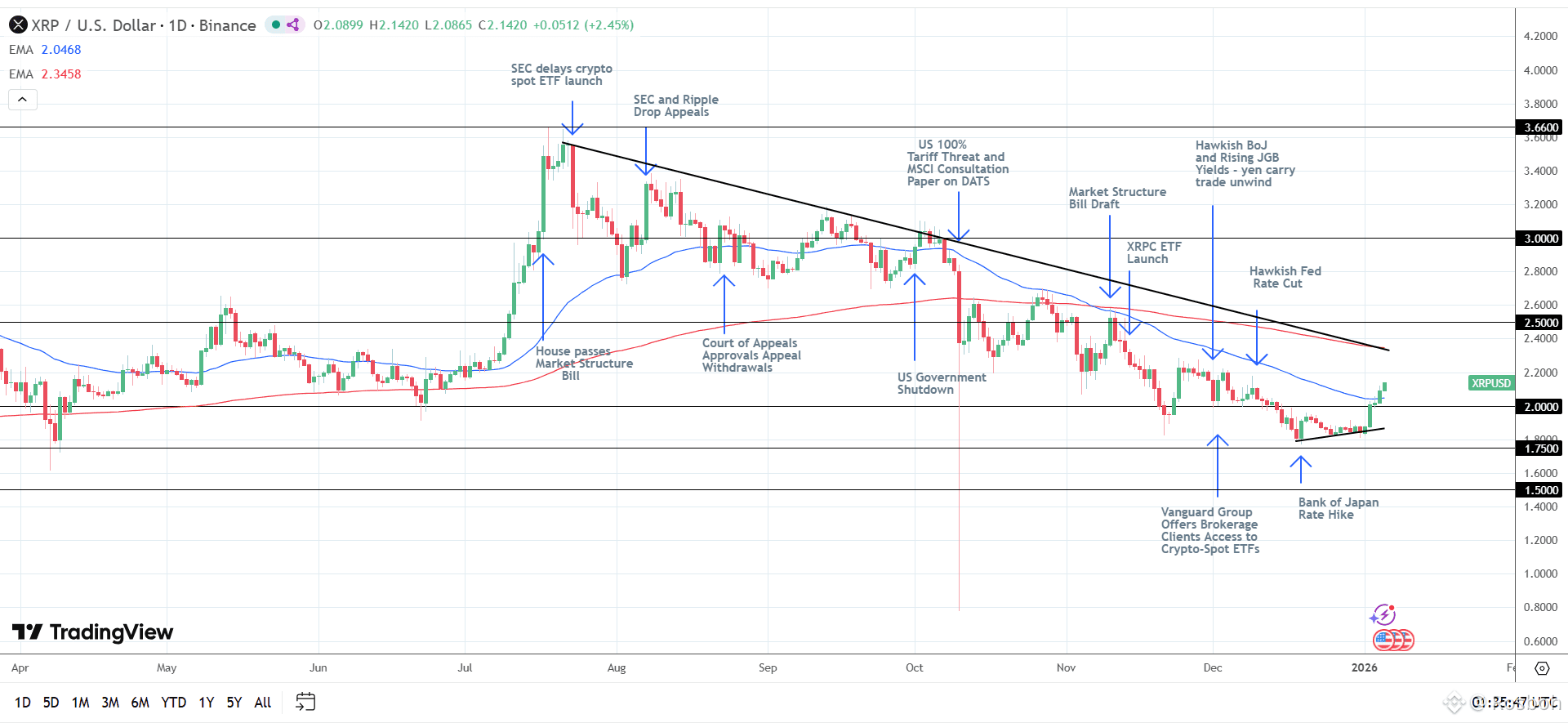

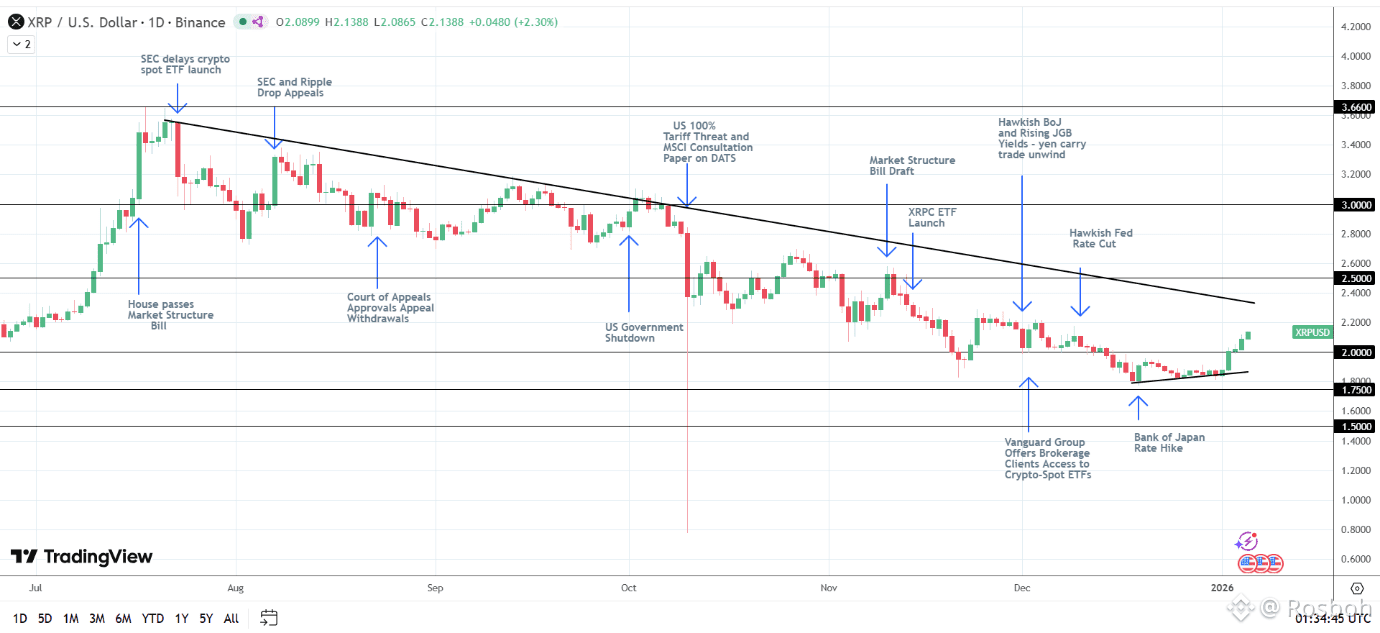

Avoiding $2.0 Remains Key for the Bullish Structure

Reclaiming $2.0 and a move toward the $2.2 level underpinned a marked improvement in market sentiment. Avoiding a break below the $2.0 psychological support level would reinforce the bullish structure and the constructive price bias.

A breakout above $2.2 would bring the upper trendline into play. A sustained move through the upper trendline would validate the bullish structure and indicate a bullish trend reversal, supporting the price targets:

Medium-Term (4-8 weeks): $3.0.

Longer-term (8–12 weeks): target of $3.66.

However, rejection at the upper trendline and a drop below the lower trendline would invalidate the bullish structure, signaling a bearish trend reversal.

Outlook:

Looking ahead, the BoJ, the Fed, US economic data, crypto-related legislative developments, and XRP-spot ETF flows will influence near-term price trends.

Increased expectation of a March Fed rate cut and dovish BoJ rhetoric would likely drive demand for XRP. Extended inflows into XRP-spot ETFs and bipartisan support for the Market Structure Bill would reinforce the bullish outlook.

In summary, increased institutional demand for XRP-spot ETFs and crypto regulatory headlines support a medium-term (4–8 weeks) move to $3.0. A March Fed rate cut and the Senate passing the Market Structure Bill would reaffirm the longer-term (8–12 weeks) price target of $3.66.

Looking beyond the medium term, these positive price events are likely to send XRP past its all-time high $3.66, targeting $5 over a 6-12 month time horizon.