The Screenshot Trap: Why Profits Mean Nothing Until You Close the Trade

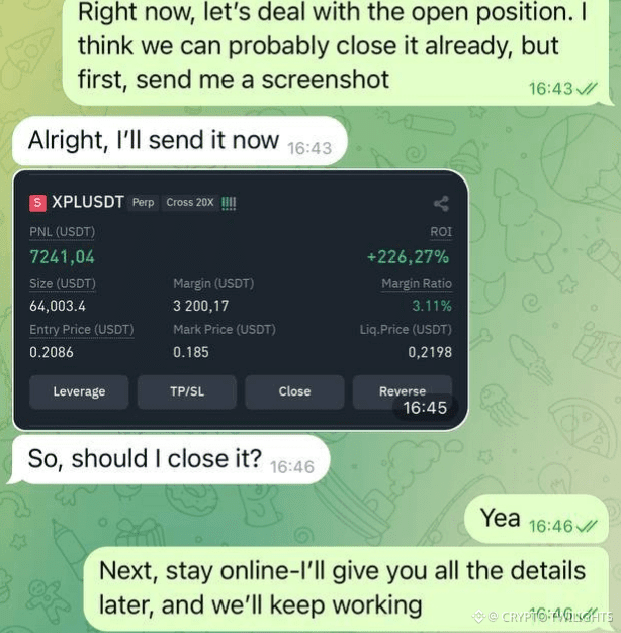

Look at the screenshot carefully.

Big numbers. High ROI. Green PnL. Confidence in the air.

And then one simple question appears:

“So, should I close it?”

That one question separates gamblers from traders.

In trading, screenshots are dangerous. Not because profits are bad, but because screenshots lie. They show a moment, not a result. They show potential, not reality. Until a position is closed, everything you see is temporary. The market hasn’t paid you yet.

Most traders fall in love with open profit. They start calculating what they will buy, how smart they were, how easy trading is. The ego starts celebrating before the work is done. And that’s exactly when the market punishes.

The market doesn’t care about your ROI percentage.

It doesn’t care about your margin size.

It doesn’t care that you “almost” made money.

It only cares about one thing: Did you close the trade properly or not?

Open Profit Is Not Your Money

An open position is a promise, not a payment.

You can be up 200% right now, and still end the day at zero—or worse.

Why?

Because leverage magnifies everything:

Profits feel exciting

Losses arrive fast

Emotions go out of control

When you see a big green number, the brain switches off risk management. You start thinking, “What if it goes higher?” instead of “What if it reverses?”

Professional traders don’t ask, “How much more can I make?”

They ask, “How much can I protect right now?”

That mindset alone saves accounts.

The Power of Closing at the Right Time

Closing a trade is a skill.

Not early. Not late. On purpose.

Closing doesn’t mean fear.

Closing means discipline.

Many traders think holding longer makes them brave. In reality, knowing when to exit makes you professional.

Markets move in waves. No move is infinite. When momentum slows, when structure breaks, when volume fades—profits must be respected.

A trader who closes in profit can trade again tomorrow.

A trader who waits for “just a little more” often becomes a lesson.

Control Over Chaos

Notice something important in the conversation:

Before closing, a screenshot was requested.

That’s not about the image.

That’s about control.

Good traders don’t act blindly. They verify:

Position size

Leverage

Liquidation level

Margin safety

Only then do they decide.

Impulse kills accounts.

Structure saves them.

If you cannot explain why you’re still in a trade, you shouldn’t be in it.

Big ROI Doesn’t Mean Smart Trading

A high ROI looks impressive, but it can hide bad habits:

Over-leverage

No stop-loss

Emotional holding

Luck mistaken for skill

Real trading success is boring:

Small mistakes

Consistent exits

Capital protection

Long-term survival

Anyone can have one big screenshot.

Very few can repeat it without blowing up.

The Silent Skill: Walking Away

One of the hardest things in trading is closing a profitable position and doing nothing afterward.

No revenge trade.

No overconfidence trade.

No “one more setup.”

Just silence.

That silence is where discipline lives.

The market will open again. Opportunities never end. But capital does.

Final Thought

If you remember only one thing, remember this:

The market rewards those who respect risk, not those who chase screenshots.

Profit is not what you see.

Profit is what you secure.

Close wisely.

Trade calmly.

And let your account grow quietly while others chase noise.

Because in trading, survival is the real victory.