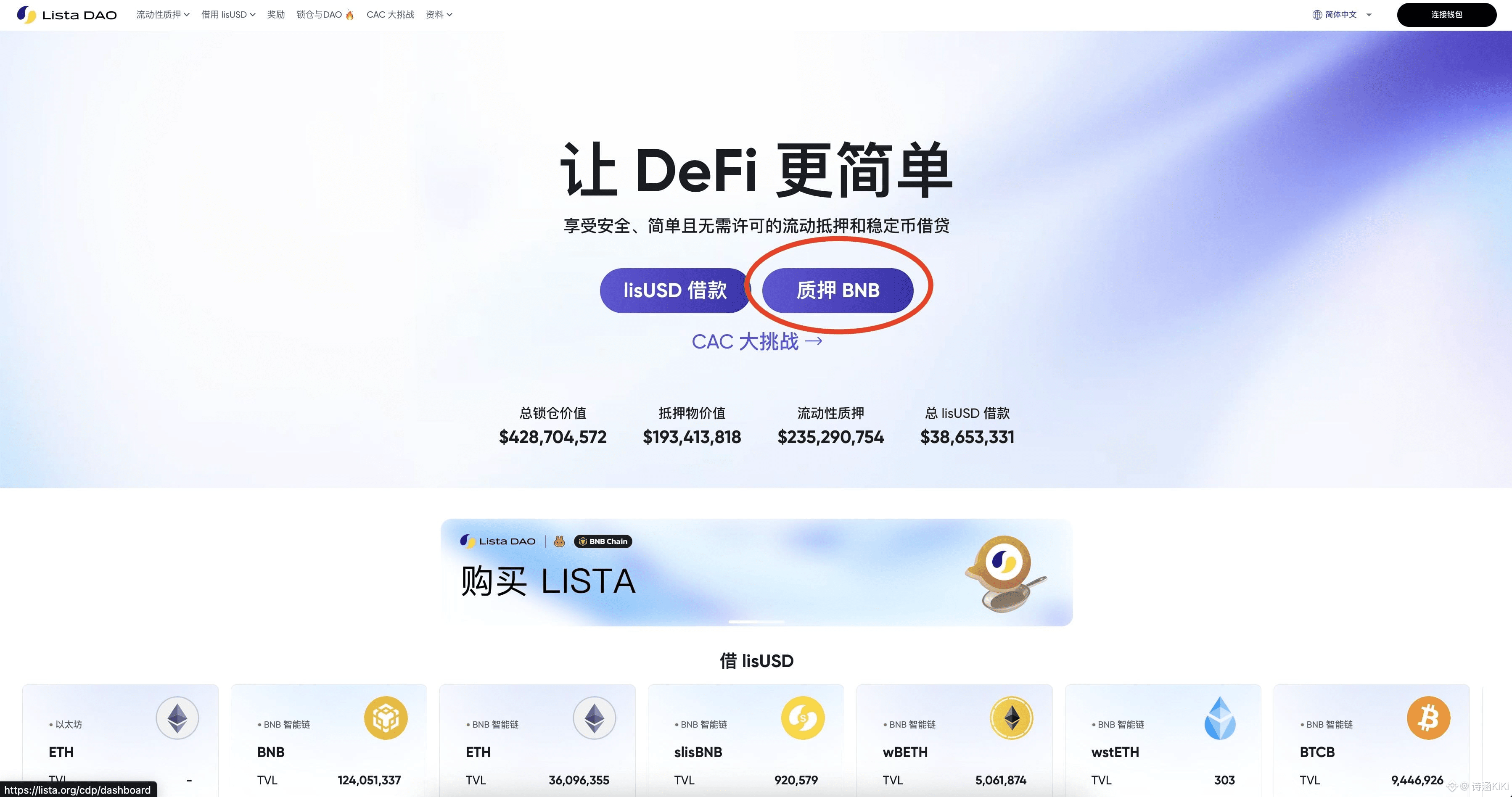

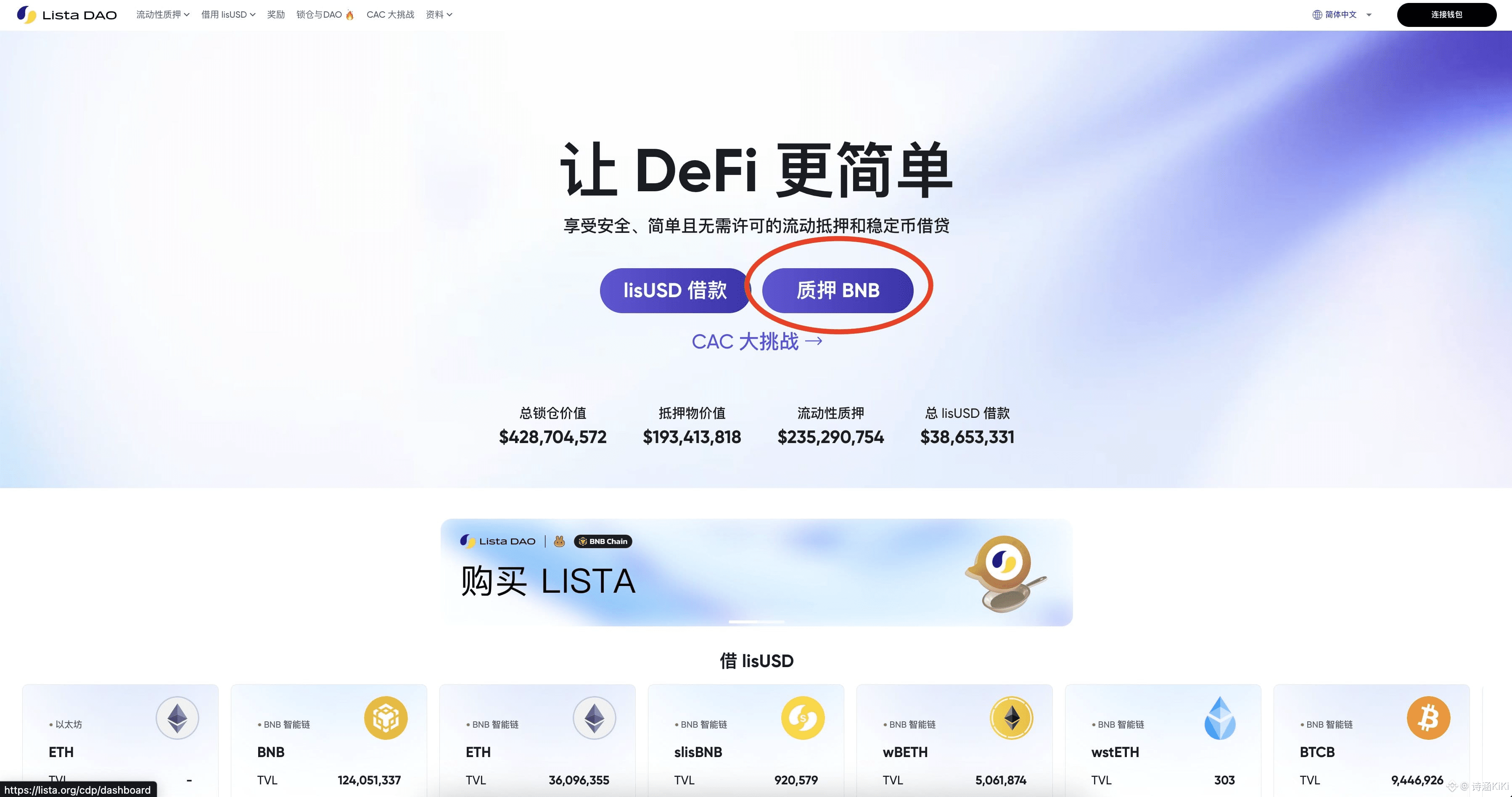

🌟 Deep Dive: What's fueling the massive influx into Lista DAO on BNB Chain? Let's unpack the latest developments that are making this DeFi lending platform a must-watch in 2026.

Recently, as Binance launched its 20% APY on USD1 flexible savings, savvy users have pivoted to Lista DAO for collateralized borrowing, depleting pools and prompting the team to inject more liquidity.

This isn't random—it's a testament to Lista's core mechanics that blend borrowing efficiency with high-yield opportunities, allowing users to mortgage assets like BTCB (Binance's Bitcoin anchor), PT-USDe (Pendle's yield-bearing USDe principal), or slisBNB (Lista's staked BNB token) paired with native BNB to access USD1 loans seamlessly.

The platform's advantages shine in accessibility: No minimums, instant executions, and mobile-friendly dApp make it ideal for global users. In volatile times, its over-collateralization (150%+ ratios) protects against liquidations, far superior to under-collateralized CeFi loans.

As TVL climbs past billions, Lista's fee-sharing model rewards stakers, creating a virtuous cycle. This update isn't just tech—it's economic empowerment, turning passive holders into active earners.

In summary, Lista DAO's recent liquidity boosts and borrowing surge explain its meteoric rise: It's the DeFi hub where efficiency meets opportunity, redefining how we interact with assets on BNB Chain. #ListaDAO @ListaDAO #usd1理财最佳策略listadao $LISTA