The Screenshot Is Not the Win — The Decision Is

Every trader loves screenshots. Green numbers, unrealized PnL flashing, percentages that make the heart race. Screenshots look powerful. They look convincing. They look like proof. But here’s the uncomfortable truth most people don’t want to hear: screenshots don’t make you profitable — decisions do.

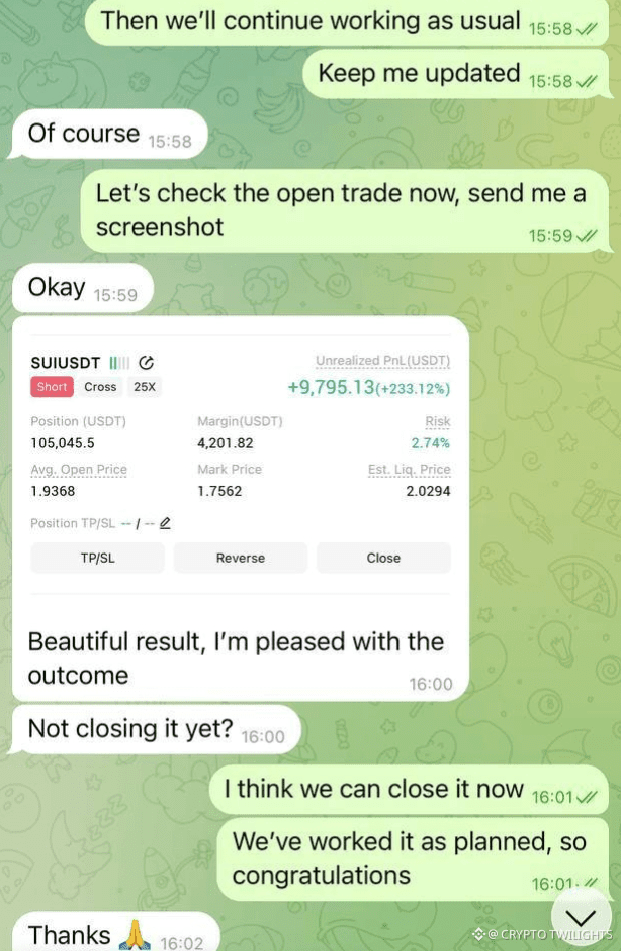

Look at the trade in front of you. A short position, high leverage, unrealized profit sitting comfortably in green. To an outsider, it looks like perfection. To an emotional trader, it looks like a reason to celebrate early. But to a disciplined trader, it’s just one thing: an open position that still needs to be managed.

Unrealized profit is not money.

It’s potential.

And potential can disappear in seconds.

The real skill in trading is not entering the trade. Anyone can click buy or sell. The real skill is knowing when to hold, when to reduce risk, and when to close — without greed or fear controlling the decision.

Notice what matters in the conversation:

The trade was monitored.

The risk was visible.

The discussion wasn’t emotional.

The exit was intentional.

That’s professional behavior.

Too many traders treat green PnL like a trophy. They stare at it, share it, and start imagining what they’ll do with the money. That’s where mistakes begin. The market doesn’t care about your imagination. It doesn’t care about your confidence. It doesn’t care how good your screenshot looks. The market only responds to execution and timing.

Another critical point people ignore: leverage magnifies everything — not just profit, but mistakes. High leverage with no exit plan is not bravery. It’s gambling with extra steps. When you see a clean trade working in your favor, the smartest move is not to feel invincible. The smartest move is to ask one question:

> “If the market turns against me right now, am I still okay?”

If the answer is no, then the trade is already too emotional.

Closing a trade is not admitting defeat.

Closing a trade is completing the plan.

In fact, one of the hardest psychological skills to learn is closing a profitable trade without regret. Many traders wait for “a little more,” and end up with a lot less. Others close too early because they’re afraid to lose what they see. Both are driven by emotion, not structure.

The best traders operate differently:

They define risk before entry.

They let the trade work.

They close when conditions are met — not when emotions spike.

That’s why the final message matters more than the screenshot itself: “We’ve worked it as planned.”

Not “We got lucky.”

Not “Look how much we made.”

But worked as planned.

That sentence separates professionals from gamblers.

If you want consistency, stop chasing screenshots. Start building habits:

Respect unrealized profits, but don’t worship them.

Treat exits as seriously as entries.

Measure success by discipline, not dopamine.

A single screenshot can impress people for a moment.

A repeatable process builds results for years.

The market rewards patience, clarity, and control — not excitement. So next time you see a big green number, don’t rush to celebrate. Ask yourself whether the trade is still aligned with your plan. If it is, manage it. If it’s not, close it — proudly.

Because in trading, the real flex is not how much you made — it’s how calmly and cleanly you made it.