Markets are entering a danger zone

And almost nobody is positioned for it.

Two U.S. events are about to collide.

Both can flip sentiment violently.

Neither is priced correctly.

This is how traders get trapped.

EVENT #1: THE TARIFF TIME BOMB

The U.S. Supreme Court is about to rule on tariffs.

Here’s the problem:

Markets are already pricing in a favorable outcome.

Most traders assume tariffs will be ruled illegal or rolled back.

That assumption is now consensus.

And consensus is where markets punish the hardest.

If the ruling disappoints even slightly, expectations reset instantly.

Risk assets don’t drift lower — they gap.

Crypto doesn’t hedge this.

Crypto amplifies it.

Sentiment shocks hit crypto first and hardest.

EVENT #2: UNEMPLOYMENT DATA — NO GOOD OUTCOME

Then comes U.S. unemployment data.

And here’s the trap nobody wants to admit:

• Weak data

→ Recession narratives explode

→ Risk gets dumped

→ Liquidity hides

• Strong data

→ Rates stay higher for longer

→ Rate cut hopes die

→ Risk assets choke slowly

There is no bullish outcome here in the short term.

Only different flavors of pressure.

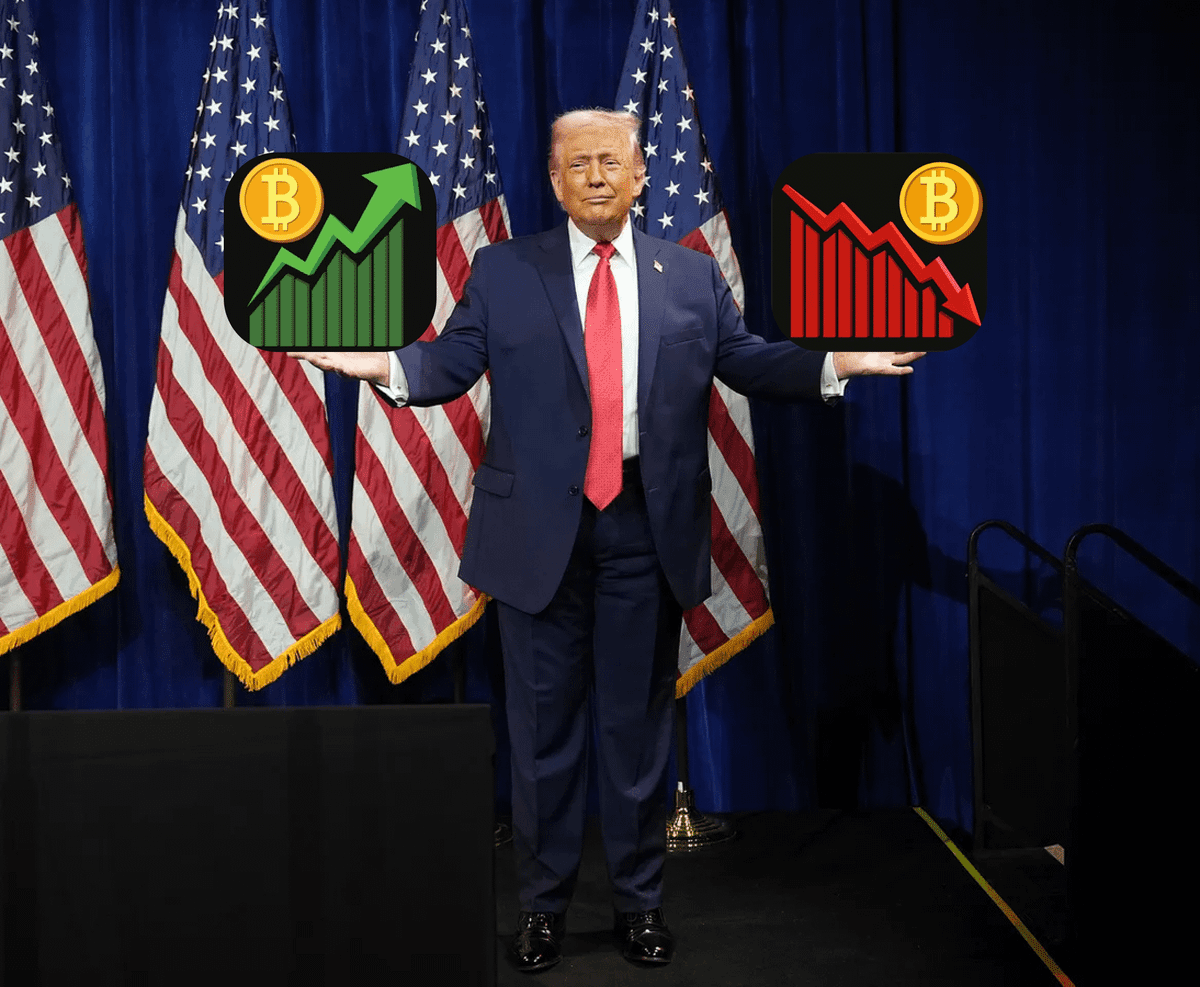

WHY THIS IS DANGEROUS FOR CRYPTO

Crypto thrives on: • Predictability

• Liquidity expansion

• Narrative momentum

Right now, we have none of those.

Instead we have: • Binary legal risk

• Macro uncertainty

• Crowded positioning

• Recent leverage wipeouts still fresh

This is where fake breakouts happen.

This is where confidence gets punished.

This is where traders confuse volatility for opportunity.

THE BIGGEST MISTAKE YOU CAN MAKE NOW

Trying to predict direction.

This is not a directional setup.

This is a volatility window.

Markets aren’t choosing up or down yet.

They’re shaking out weak positioning.

The goal here isn’t hero trades.

It’s survival positioning.

MY TAKE (READ THIS TWICE)

• Reduce emotional exposure

• Respect liquidity gaps

• Avoid oversized bets

• Let the data hit first

• Trade reactions, not predictions

The traders who win this phase don’t call the move.

They’re still standing when the move is clear.