Good morning traders! Let's dive into what's happening with BTC right now.

Market Snapshot (data at time of writing - 9:30 AM UTC):

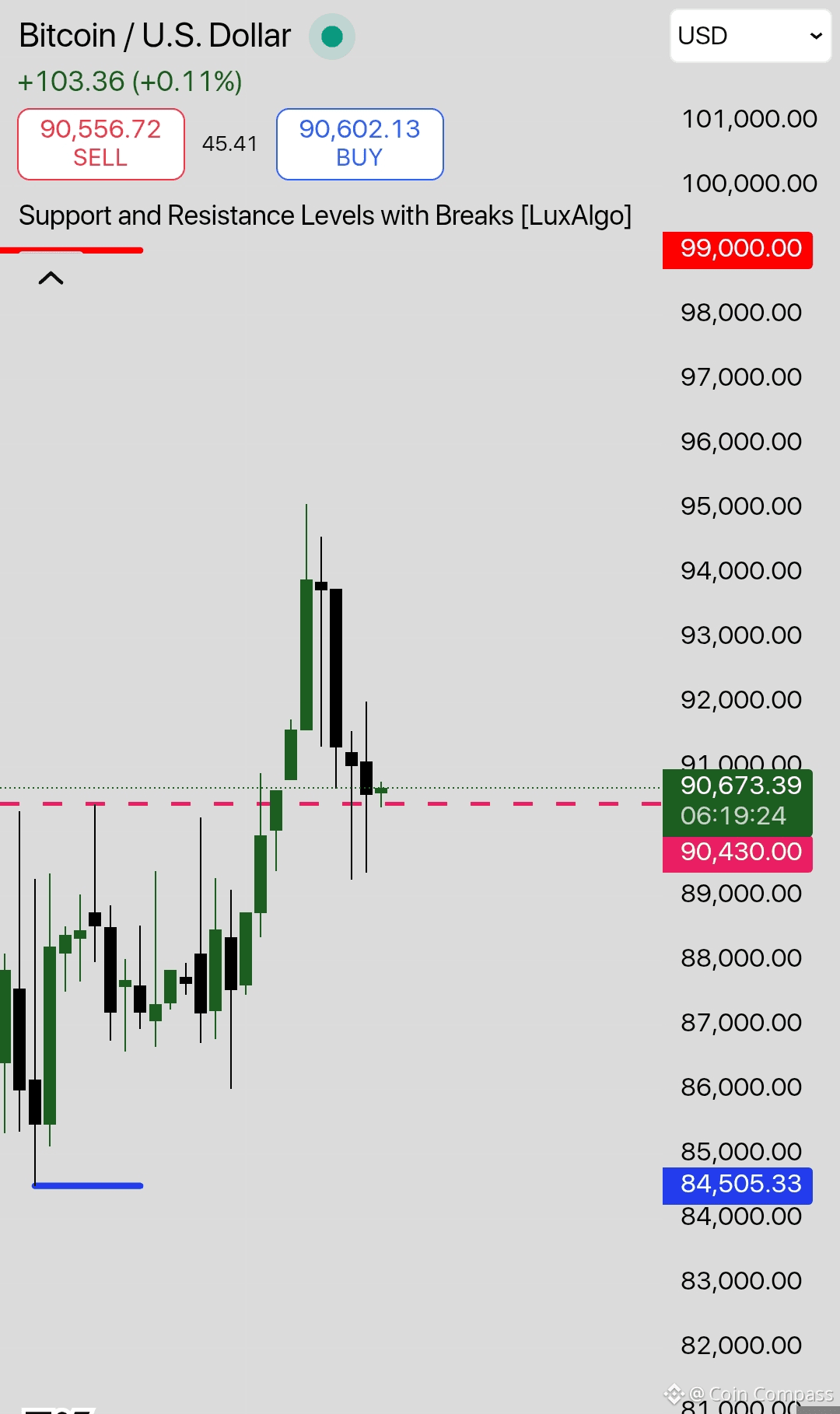

BTC is currently trading around $90,430-$90,490 (CoinMarketCap) (Fear & Greed Meter) , holding the critical $90K psychological support zone. The market has been consolidating in this range for the past few sessions, with 24-hour trading volume at $18.71B (CoinMarketCap) , which is relatively subdued compared to recent weeks.

Sentiment Reading (at time of writing):

The Crypto Fear & Greed Index currently stands at 27, reflecting "Fear" in investor sentiment (CoinMarketCap) (YCharts) . This is a significant drop and shows the market psychology has shifted from neutral to fearful territory. We're approaching "Extreme Fear" (below 20), but we're not there yet.

What This Means:

When the Fear & Greed Index drops to these levels (27), historically it signals potential buying opportunities. The market is oversold and panic is setting in - exactly when Warren Buffett's wisdom applies: "Be fearful when others are greedy and greedy when others are fearful." We're clearly in the fearful zone.

Key Technical Levels to Watch:

📉 Critical Support:

$90,000 - Major psychological level (currently holding)

$88,000-$89,000 - Next strong support if $90K breaks

📈 Resistance Zones:

$92,000-$93,000 - First resistance, needs volume to break

$95,000+ - Major resistance if we reclaim momentum

What I'm Watching Today:

Can BTC defend the $90K zone with conviction?

Volume patterns - we need to see buying volume increase for a bounce

Any macro news or catalysts that could shift sentiment

How altcoins react - are they showing relative strength or weakness?

Chart Setup for TradingView:

📊 For those wanting to analyze themselves:

Timeframe: 4-hour or Daily chart

Indicators to add:

50 & 200 MA (moving averages)

RSI (Relative Strength Index)

Volume bars

Levels to mark:

Support: $90,000, $88,000

Resistance: $92,000, $95,000

My Take:

Bitcoin is at an inflection point. The Fear Index at 27 tells us weak hands are being shaken out. Volume is low, which often precedes bigger moves. We're consolidating in a tight range - this compression typically leads to expansion (breakout or breakdown).

Two Scenarios:

🟢 Bullish Case: If BTC holds $90K and bounces with volume, we could see a relief rally toward $92K-$95K as fear subsides and shorts get squeezed.

🔴 Bearish Case: If we lose $90K on volume, watch for a test of $88K-$89K support. That's where the next buyer interest likely sits.

The Bottom Line:

Patience wins in consolidation. Don't chase moves in low-volume chop. Wait for clear breakout/breakdown confirmation with volume. The fearful are selling; the strategic are planning their next move.

This is where disciplined traders separate themselves from emotional ones. 💪

What's your bias on BTC? Holding through the fear or waiting on the sidelines? Drop your thoughts below! 👇

All prices and sentiment data as of 9:30 AM UTC, January 11, 2026 - always verify current levels before trading.

Not financial advice - always DYOR and manage your risk.

#CryptoTrends2024

#BTC

#Bitcoin

# #crypto

#trading