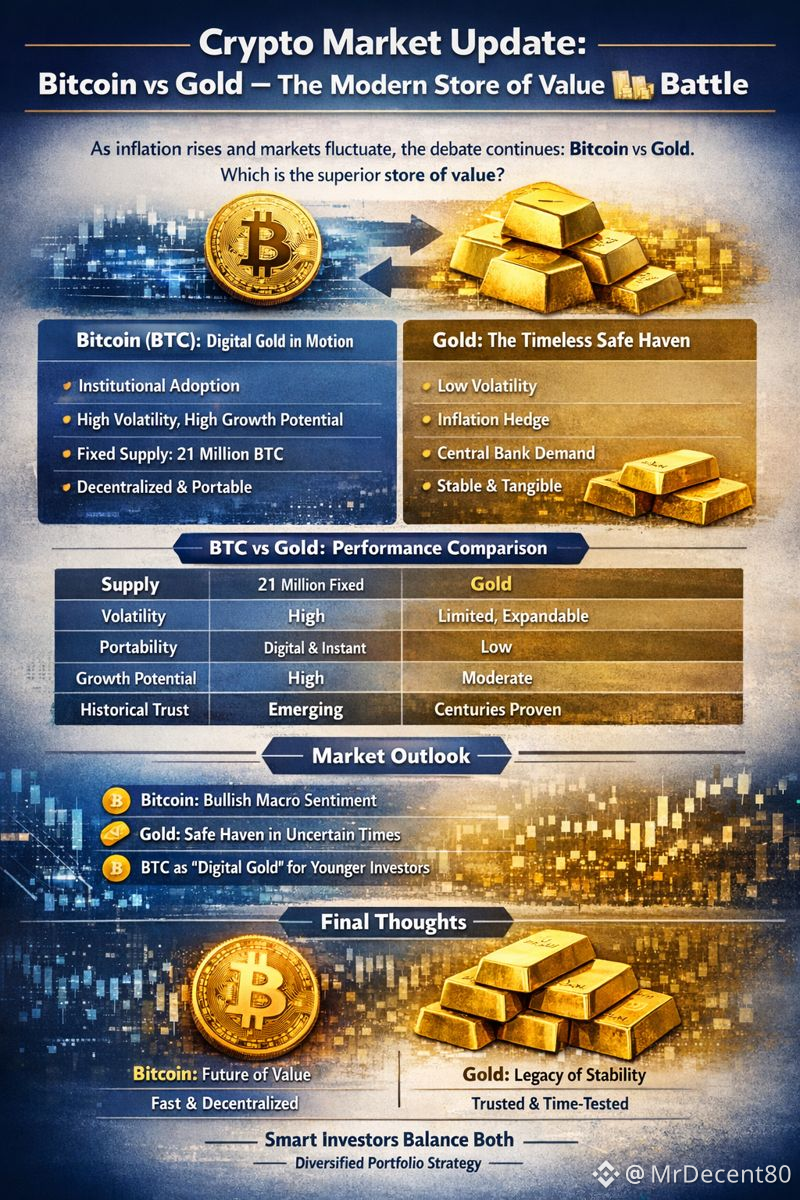

#BTCVSGOLD The global financial landscape is evolving rapidly, and one debate continues to dominate investor conversations: **Bitcoin vs Gold**. As markets react to inflation, interest rates, and geopolitical uncertainty, both assets are being tested as stores of value—but in very different ways.

Bitcoin (BTC): Digital Gold in Motion

Bitcoin remains the leading cryptocurrency and a benchmark for the entire crypto market. Unlike traditional assets, BTC operates on a decentralized network with a **fixed supply of 21 million coins**, making it inherently scarce.

Key BTC Market Highlights

* Increased institutional adoption through ETFs and custodial products

* High volatility but strong long-term growth potential

* Correlation with risk assets during macro uncertainty

* On-chain data shows long-term holders continuing accumulation

Bitcoin thrives in environments where investors seek **innovation, portability, and independence from central banks

Gold: The Timeless Safe Haven

Gold has served as a store of value for thousands of years. In times of economic stress, capital traditionally flows into gold due to its **stability and universal acceptance.

Key Gold Market Highlights**

* Lower volatility compared to BTC

* Strong hedge against inflation and currency devaluation

* Central bank accumulation supports long-term demand

* Limited upside but reliable capital preservation

Gold performs best during **risk-off market phases**, offering safety rather than aggressive growth.

BTC vs Gold: Performance Comparison**

| Factor | Bitcoin (BTC) | Gold |

| ---------------- | ----------------- | ---------------------- |

| Supply | Fixed (21M) | Limited but expandable |

| Volatility | High | Low |

| Portability | Digital & instant | Physical |

| Growth Potential | High | Moderate |

| Historical Trust | Emerging | Proven over centuries |

Market Outlook

* Bullish macro sentiment** favors Bitcoin as liquidity returns to risk assets

* **Geopolitical uncertainty** strengthens gold’s role as a defensive hedge

* Investors increasingly treat BTC as **“digital gold”**, especially among younger market participants

Rather than competitors, Bitcoin and Gold are becoming **complementary assets** in diversified portfolios.

Final Thoughts

Bitcoin represents the future of value—fast, decentralized, and borderless.

Gold represents the past and present—stable, trusted, and time-tested.

Smart investors are no longer choosing one over the other; they are **balancing both** to navigate an unpredictable global economy.

If you want:

* 🔹 A **shorter version** for Twitter/X

* 🔹 A **technical analysis angle**

* 🔹 An **Urdu or bil

ingual version**

* 🔹 Or a **custom post for BTC traders**

Just tell me 👍