You said:

Give me analysis on Venezuela situation with pics

ChatGPT said:

Here’s a current, up-to-date analysis of the Venezuela situation — covering political, economic, humanitarian, and global impacts — plus visual context with images from recent events.

Latest Venezuela Situation — Jan 2026

CSIS

Are U.S. Operations in Venezuela a Blueprint for China for Taiwan?

2 days ago

Al Jazeera

Updates: ‘Don’t need international law,’ Trump says after Maduro abduction

4 days ago

TIME

Venezuelans Can’t Afford Another Catastrophe

Yesterday

The Guardian

US attack on Venezuela will decide direction of South America’s vast mineral wealth | Oil

4 days ago

Reuters

Number of prisoners released in Venezuela rises to 41, says rights group

Today

🇻🇪 1) What’s Happening Now — Political & Military Context

U.S. Intervention and Capture of Maduro

In early January 2026, U.S. forces carried out a military operation in Venezuela, capturing President Nicolás Maduro and his wife on criminal charges; this is unprecedented in Latin America.

The U.S. administration — led by President Donald Trump — is pushing for control over Venezuelan oil assets and restructuring the country’s political future.

Trump’s rhetoric includes asserting that international law isn’t needed to dictate Venezuela’s direction and oil sales.

Political Tensions & Public Response

Venezuelans inside and outside the country express mixed emotions — relief for Maduro’s ouster but deep anxiety about violence, uncertainty, and migration policies.

Meanwhile, international bodies and many nations question the legality and regional implications of the U.S. military action.

Human Rights Update

A human rights group reports a recent release of 41 prisoners — including some political detainees — possibly reflecting pressure to address past abuses.

📉 2) Economic Collapse & Oil Politics

Oil: Curse and Global Chess Piece

Venezuela has the world’s largest proven oil reserves (~303 billion barrels) — but years of mismanagement and sanctions left infrastructure degraded and production low.

Sanctions and blockades since late 2025 have reduced exports further.

Market Reactions

Global debt markets saw Venezuelan bonds rally as regime change boosted perceived recovery prospects, but underlying fundamentals remain weak.

Oil markets show limited short-term reaction, with longer-term bearish pressure expected if production is restored, due to global oversupply.

Foreign Investment Friction

U.S. efforts to attract companies face pushback; ExxonMobil, for example, has been reportedly excluded from some plans after hesitating to invest.

🍞 3) Humanitarian Crisis & Daily Life

Economic Hardship

Inflation remains high and purchasing power extremely low; many families struggle to buy basic food.

IMF forecasts show ongoing currency depreciation and inflation surging again after a brief decline.

Food Insecurity

Poor households especially face food consumption deficits as staple prices skyrocket.

Humanitarian Needs

UNICEF estimates millions require critical aid, especially children, due to rising needs across health, food, and protection sectors.

Migration

Nearly 8 million Venezuelans have fled the country since the start of the crisis, creating a significant regional refugee and remittance challenge.

🌍 4) Regional & Global Implications

Climate & Energy

Plans to exploit Venezuela’s oil could consume ~13 % of the global carbon budget needed to limit warming to 1.5 °C, raising environmental industry concerns.

Security & Tension

U.S. government warnings now urge Americans to leave Venezuela due to reports of armed paramilitary activity targeting citizens.

Market & Policy Impact

The crisis influences commodity prices, sovereign debt, and Latin American geopolitical risks — with some markets tightening risk premiums and others watching debt restructuring developments.

Neighbors like Cuba feel spillover from sanctions and tanker seizures tied to Venezuela.

🧠 Summary: What It Means

Current Phase:

🇻🇪 A very unstable transitional moment — military intervention, regime change, and volatile diplomacy.

Short-Term Impact:

📉 Humanitarian conditions deteriorate as economics worsen; political uncertainty spikes regionally.

Long-Term Outlook:

⚖️ Possible regime transition toward Western engagement, but infrastructure decay, deep poverty, and legal/financial entanglements make recovery difficult.

If you want, I can also share a short timeline graphic of the crisis’s key events or a map of refugee flows from Venezuela.

You said:

Give short analysis on Washington DC reports with pics regarding trade

ChatGPT said:

Here’s a short, current Washington, DC-based analysis on U.S. trade reports and developments, with context and visuals:

Latest Washington DC / Trade News Summary

Asharq News

بعد تهديدات جرينلاند.. البرلمان الأوروبي يبحث تجميد اتفاق التجارة مع واشنطن

2 days ago

الجزيرة نت

الصين: اتصال بناء مع واشنطن لتعزيز التعاون التجاري

Dec 12, 2025

AS/COA

Tracking Trump and Latin America: Trade—Tariffs Threatened on Mexico over Water Sharing

Dec 12, 2025

CNN الاقتصادية

واشنطن وبكين تبحثان في ماليزيا تجنب تصعيد الحرب التجارية

Nov 12, 2025

Council on Foreign Relations

The U.S.-China Trade Relationship

Nov 12, 2025

Yahoo Finance

Trump tariffs live updates: US holds off on Chinese chip tariffs until mid-2027; Hassett says $2K rebate checks 'likely'

21 days ago

CSIS

USMCA Review 2026

Sep 12, 2025

📊 Key Themes from Washington Trade Reports

1) Ongoing U.S.–China and Global Trade Tensions

• Washington and Beijing are engaging in “detailed and constructive” trade discussions aimed at reducing escalations after years of tariffs and counter-measures — a reflection of U.S. efforts to manage competitive pressures without full decoupling.

• The broader U.S.–China trade relationship remains crucial and complex, as China is one of the largest export markets for U.S. products, even amid policy friction.

2) Trump Administration’s Tariff Strategy & Market Impact

• President Trump’s “America First” approach continues to influence U.S. trade policy, with possible tariffs threatened on key partners (e.g., Mexico over non-trade issues).

• Live market coverage shows ongoing tariff considerations, including delays on targeted Chinese tech tariffs, contributing to uncertainty for businesses and investors.

3) USMCA & Regional Trade Dynamics

• The U.S.–Mexico–Canada Agreement (USMCA) — Washington DC’s cornerstone North American pact — is under formal review for 2026, with implications for labor, digital trade, and supply chains.

4) Calls for Public Input on Barriers

• The U.S. Trade Representative (USTR) has opened comments for the 2026 Foreign Trade Barriers Report, inviting public and business input on obstacles to U.S. exports — a routine but important transparency measure in Washington’s trade reporting cycle.

📌 Policy Environment & Debate

Tariff Uncertainty & Rule Systems

• Trade policy uncertainty is a major theme in Washington discussions, as U.S. courts and policymakers contest aspects of tariff authority and enforcement.

Global Reaction and Partner Responses

• European lawmakers have debated halting an EU-U.S. trade deal in response to Washington’s trade stances, reflecting diplomatic pushback on tariff and bargaining tactics.

📉 Broader Trade Trends Seen from DC Reports

Negotiations with Global Partners:

• Washington’s trade agenda isn’t limited to China — U.S. officials are also in talks with countries like Turkey to deepen commercial ties.

Shifting Global Supply Chains:

• Washington DC analyses often highlight how tariff hikes and policy uncertainty are reshaping global supply chains — with companies adjusting sourcing and logistics in response to changing U.S. trade policies. (based on broader trend context)

🧠 What It Means (In Brief)

✔ Policy Direction: U.S. trade policy remains assertive and protectionist under the present administration, with an emphasis on tariffs and strategic leverage.

✔ Market Impact: Continued tariff uncertainty is shaping trade flows, investment decisions, and negotiations with multiple regions.

✔ Global Diplomacy: Traditional partners (EU, Mexico/Canada) and rivals (China) are recalibrating their responses to Washington’s trade strategy.

If you want, I can add a brief timeline of key U.S. trade actions over the past year or summarize the forecast from recent trade reports like DHL Trade Atlas.

You said:

Give short analysis on XRP with pics

ChatGPT said:

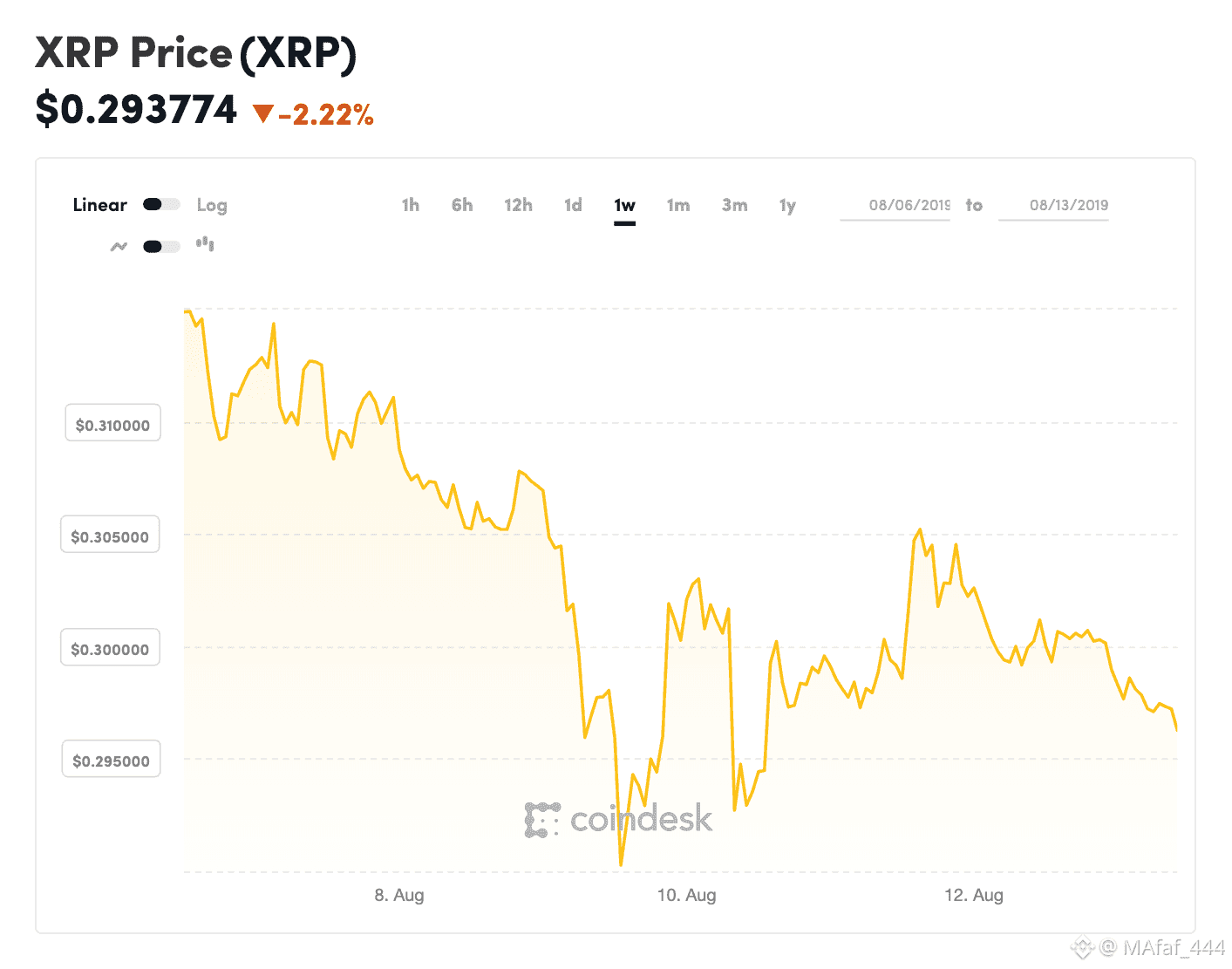

🔹 XRP Short Analysis

Trend: XRP is moving in a consolidation phase after recent volatility, indicating market indecision.

Support: Strong buying interest is seen near key support zones, where price has repeatedly bounced.

Resistance: Overhead resistance remains intact; a clean breakout above it could trigger momentum buying.

Indicators: RSI is near neutral, suggesting room for movement in either direction. Volume is moderate, waiting for a catalyst.

Outlook:

📈 Bullish scenario: Break and hold above resistance → short-term rally.

📉 Bearish scenario: Loss of support → retest of lower demand zones.

Key Catalyst: Ongoing regulatory and legal news around Ripple continues to be the main driver for sharp moves.

If you want, I can make this Binance-post style, or add exact price levels for quick trading reference.