📈 Short-Term (Next 24 hrs) Scenarios

🟢 Bullish Case

If price breaks and closes above $2.13–$2.22 on good volume: Targets (TP):

TP1: ~$2.22

TP2: ~$2.30–$2.36

TP3: Above ~$2.40 if volume expands

Bullish Confirmation Signals: ✔ Higher highs on 1H/4H

✔ RSI climbing above 55

✔ Break of local swing high with volume

🔴 Bearish Case

If sellers dominate and price breaks below $2.08–$2.05: Targets:

TP1 (down): ~$2.00

TP2: $1.95

TP3: $1.85

Bearish Confirmation Signals: ✔ Close below pivot support

✔ RSI dipping below 45 on short timeframe

✔ Increased sell volume

🎯 Take Profit & Stop-Loss Guidelines

(Assuming entry near current price ~2.10)

🟢 Bullish Trade

Entry Zone: 2.10–2.13

Stop-Loss: 2.03 (just below key support)

TP1: 2.22 (range breakout)

TP2: 2.30

TP3: 2.36

Risk-Reward:

TP1 ~ +~5.5%

TP2 ~ +~9.5%

TP3 ~ +~12.6%

🔴 Bearish Trade

Entry Zone: 2.08 or break below 2.08

Stop-Loss: 2.15

TP1: 2.00

TP2: 1.95

TP3: 1.85

Risk-Reward:

TP1 ~ +~4%

TP2 ~ +~6%

TP3 ~ +~10%

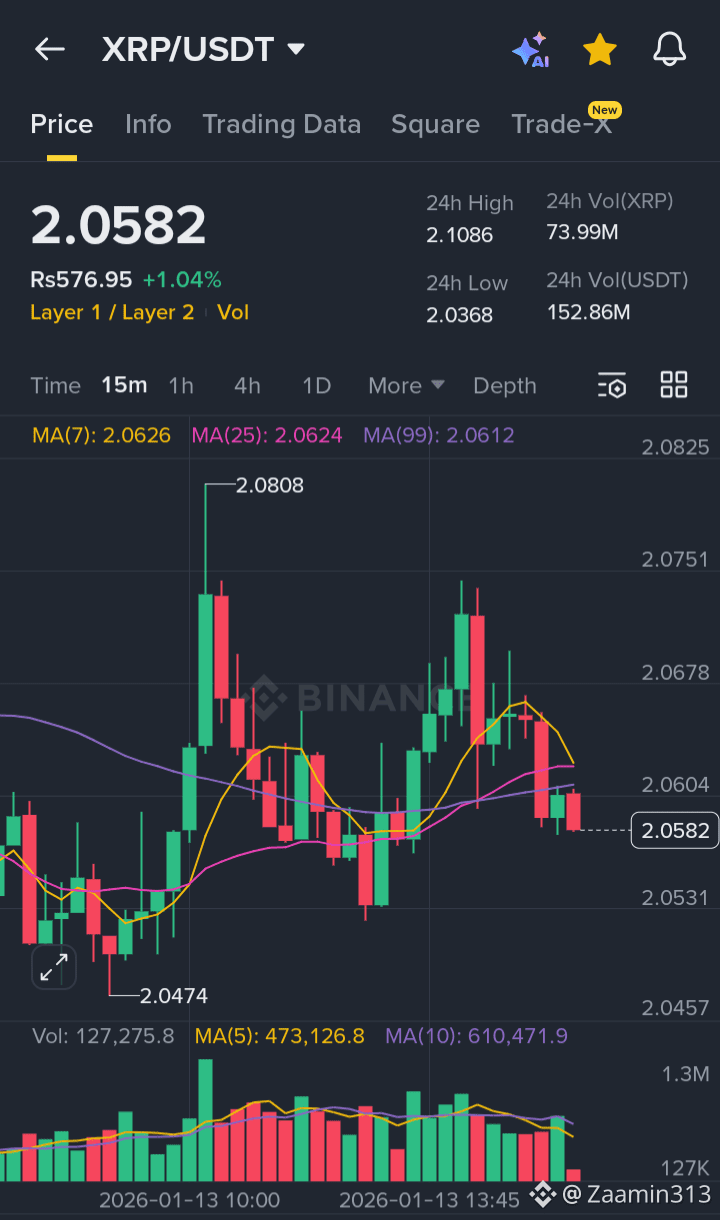

📉 Indicators to Watch (24 hrs)

RSI — momentum bias; a move above 55 suggests bullish continuation, below 45 suggests breakdown.

CoinCheckup

Volume — larger than average volume on breakouts validates moves; low volume suggests false break.

Moving Averages (short TF) — price trading above short EMAs favors upside; below them favors downside.