is isn’t hype.

This isn’t narrative trading.

This is math playing out in slow motion — and it’s accelerating.

For months, I’ve been tracking one variable that actually matters long term: net ICP supply. Not price. Not sentiment. Supply.

What’s happening now is something the market historically prices late.

🔥 The Burn Curve No One Is Modeling Correctly

$ICP token burn is not discretionary.

It’s not a governance vote.

It’s not a marketing event.

It is usage-driven.

Every dApp deployed on Internet Computer converts ICP into Cycles.

Those Cycles power computation.

That ICP is destroyed permanently.

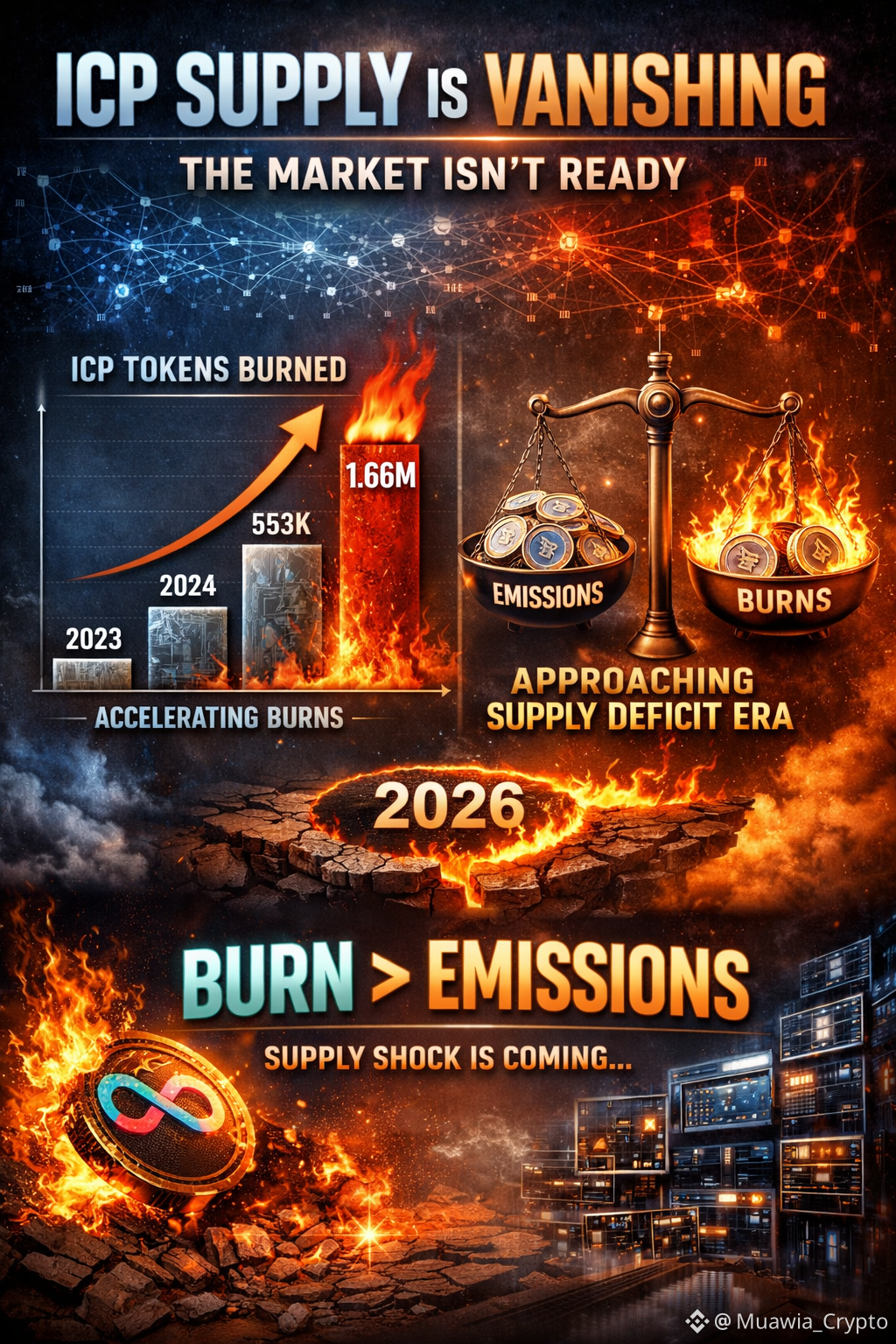

Here’s the hard data:

2023: ~58,000 ICP burned

2024: ~553,000 ICP burned

2025: ~1.66 million ICP burned

This isn’t linear growth.

This is compound acceleration.

The burn rate isn’t rising because of hype — it’s rising because real workloads are increasing.

📉 Why “Price” Is the Last Thing to React

Markets are good at pricing stories.

They’re terrible at pricing structural transitions.

Right now, ICP is still being valued as:

A high-float token

With perpetual emissions

And optional demand

That framework breaks the moment burns begin to rival emissions.

We are approaching that zone.

⚠️ The Inflection Point Most Will Miss

There’s a specific moment every asset with real burn mechanics goes through:

When demand-driven destruction overtakes issuance.

Once that threshold is crossed:

Supply tightens automatically

Valuation models reset

Price stops waiting for narratives

You don’t get announcements for this.

You only get data — and hindsight.

🧠 Why 2026 Matters

If current trajectories hold, 2026 marks the beginning of a supply-deficit era for ICP.

Not because of optimism.

Not because of influencers.

Because usage mathematically outpaces creation.

At that point:

Each new user is a net supply drain

Each new dApp increases scarcity

Each unit of demand competes for fewer tokens

That’s not bullish language.

That’s economic inevitability.

💎 Positioning vs. Chasing

Smart money never waits for confirmation. By the time “burn > emissions” is obvious on price charts, positioning is already done.

The market doesn’t reward those who react. It rewards those who understand sequence.

And supply shocks always announce themselves after they’ve already started.

Final Thought

This isn’t a call for tomorrow. It’s a recognition of where the system is heading.

ICP isn’t reducing supply by promise. It’s reducing supply by being used.

History shows:

Assets with demand-driven burns don’t stay mispriced forever.

They just stay misunderstood… until they don’t.

#ICP #InternetComputer #TokenBurn #SupplyShock