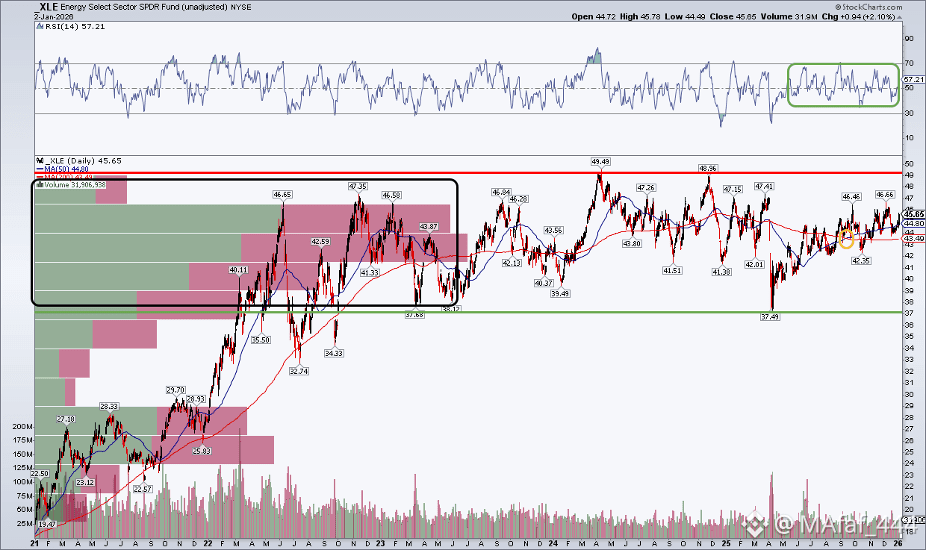

$ETH Here’s a short analysis of the recent strong gains in the energy sector, along with a market snapshot image and key points you need to know:

Latest Energy Sector Headlines: What’s Driving the Rally

TechStock²Woodside Energy shares hold near one-month peak as oil jitters keep traders on edgeYesterday

TechStock²Woodside Energy shares hold near one-month peak as oil jitters keep traders on edgeYesterday

Seeking AlphaEnergy Is, By Far, My Favorite Sector For 202621 days ago

Seeking AlphaEnergy Is, By Far, My Favorite Sector For 202621 days ago

TrefisTerrestrial Energy Stock Pre-Market (+6.1%): DOE Pilot Reactor Agreement MomentumToday

TrefisTerrestrial Energy Stock Pre-Market (+6.1%): DOE Pilot Reactor Agreement MomentumToday

📈 What’s Happening

Energy stocks have surged sharply, with major players like oil & gas producers and even related equipment companies hitting recent peaks as markets shift focus from tech into value and commodity plays. Integrated leaders and independents have benefited from higher commodity prices, strong demand, and strategic investments.

📊 Key Drivers Behind the Gains

1. Commodity Price Support

Oil and natural gas prices have lifted energy stocks as inventories tighten and demand strengthens. This boosts revenue expectations for producers and refiners.

2. Sector Rotation & Investor Sentiment

Investors are reallocating capital from high-growth tech into value-oriented sectors like energy, which offer strong cash flows, dividends, and exposure to real assets.

3. Rising Power & AI-Driven Demand

Demand for electricity to support AI data centers and broader industrial needs has lifted energy equities beyond traditional oil & gas — including natural gas and power generation segments.

4. Company-Specific Catalysts

Deals, new contracts, and government/industry momentum (e.g., DOE agreements) have lifted individual stocks, further energizing sector performance.

🧠 What It Means for Investors

Positive sign: Strong energy performance can signal rotation into cyclicals and value stocks.

Dividend appeal: Many energy players return capital via dividends, attractive in volatile markets.

Watch volatility: Commodities and energy stocks can swing with geopolitical events and macroeconomic data.