Discipline Turns Screenshots Into Results

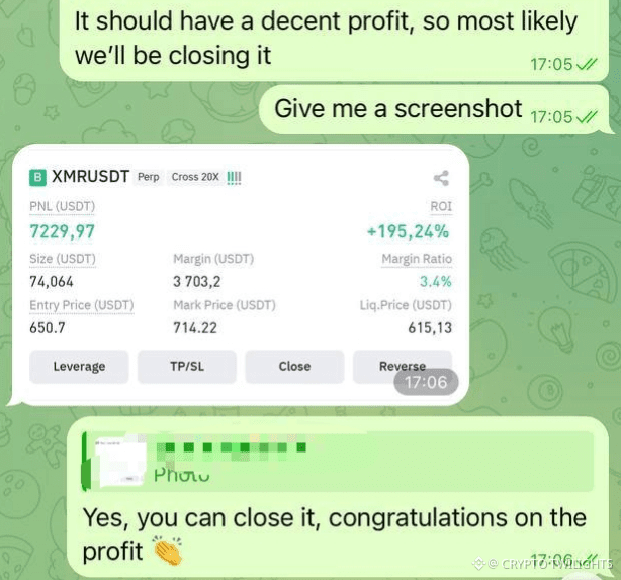

This screenshot is not about showing off numbers. It’s about showing process. Anyone can post a profit image after the trade is done, but very few understand what actually led to that moment. Behind every green PNL, there are dozens of decisions made before the trade ever went live.

Look closely at what matters here.

The position wasn’t closed in panic. It wasn’t closed because of fear. It wasn’t held because of greed. It was closed because the objective was met. That single line — “It should have a decent profit, so most likely we’ll be closing it” — says more about trading maturity than any indicator ever could.

Most traders fail not because their analysis is wrong, but because their execution is weak.

They enter correctly, but exit emotionally.

They plan a trade, but abandon the plan when price moves fast.

They see profit, then imagine more, and turn a winning trade into regret.

Here, the mindset is different.

The trade was monitored.

Profit was acknowledged.

Confirmation was taken.

Decision was executed.

That’s how consistency is built.

Notice another important detail: the leverage is high, but the control is higher. Leverage itself is not the enemy. Lack of discipline is. When traders blame leverage, what they’re really admitting is that they didn’t respect risk. A professional respects position size, liquidation levels, and margin health before clicking buy or sell.

Look at the calmness of the conversation. No excitement. No emotional rush. Just a simple confirmation: Yes, you can close it. That’s the mindset of someone who understands that trading is not gambling — it’s probability management.

Many people chase trades.

Professionals wait for trades to come to them.

Many people look for signals.

Professionals look for clarity.

And clarity comes from experience, losses, patience, and self-control.

Another lesson here: profits don’t need noise. When a trade works, the best thing you can do is protect it. Markets don’t reward ego. They reward discipline. The goal is not to catch every move. The goal is to survive long enough to compound.

This is why consistency beats one-time big wins. A trader who can repeatedly secure “decent profits” will always outperform someone chasing home runs. Closing in profit is never a mistake. What is a mistake is letting greed rewrite your plan.

Remember this:

You don’t need to trade every move.

You don’t need to prove anything to anyone.

You don’t need to post hype to validate your skills.

All you need is a system you trust and the discipline to follow it.

Every screenshot like this represents hours of chart time, emotional control, and lessons learned the hard way. If you’re still struggling, don’t focus on profits yet. Focus on process. Focus on taking the same type of trades, managing risk the same way, and reacting the same way every time.

The market will always be there tomorrow. Your capital won’t — unless you protect it.

Trade smart.

Stay patient.

Respect the plan.

That’s how real growth happens in this market.

#MarketRebound