The US Senate Banking Committee has stepped in to address 7 major misconceptions surrounding the CLARITY Act—and the message is loud and clear: this bill is about investor protection, regulatory clarity, and responsible crypto innovation 🏛️🔐

Here’s what you need to know 👇

Here’s what you need to know 👇

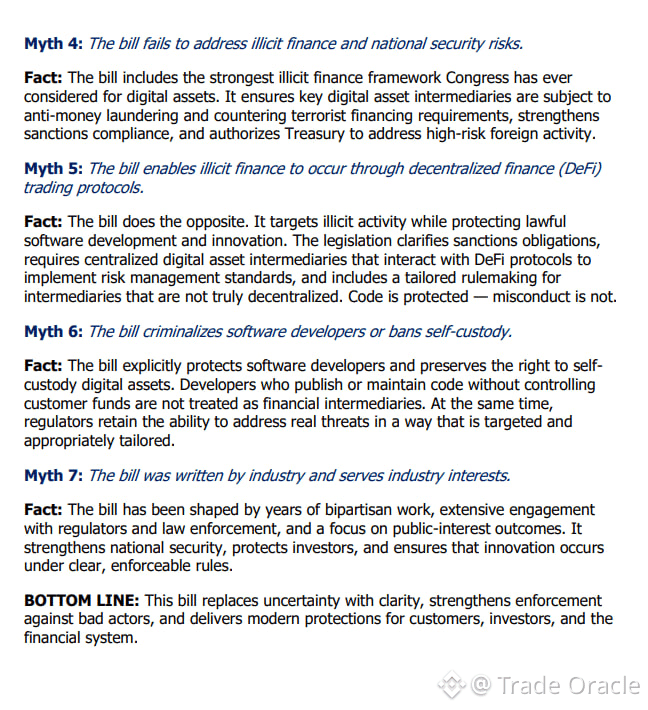

🔍 Myth #1: It weakens investor protections

❌ False. The CLARITY Act strengthens protections by eliminating regulatory confusion that bad actors exploit. Clear rules = safer markets 🛡️

⚖️ Myth #2: It removes SEC authority

❌ Not true. The Act clearly defines SEC and CFTC roles, ensuring each agency regulates what it’s best equipped to oversee—no turf wars, no gaps 🧭

📜 Myth #3: Crypto gets a “free pass”

❌ Nope. Compliance is central. Legit crypto projects must register, disclose, and follow rules, just like other financial products ✅

🚀 Myth #4: It stifles innovation

❌ Actually, it does the opposite. By providing clear regulatory pathways, builders can innovate confidently in the US instead of moving offshore 🌍

🏦 Myth #5: It favors big players only

❌ Wrong again. Regulatory clarity benefits startups, developers, and investors alike, leveling the playing field 🤝

📉 Myth #6: It increases market risk

❌ The Act reduces risk by defining asset classifications and oversight, cutting down on enforcement-by-surprise ⚠️➡️📘

🧑💼 Myth #7: It’s anti-consumer

❌ In reality, consumers win the most—through transparency, accountability, and safer participation in digital asset markets 💙

✨ Bottom line:

The CLARITY Act is a pro-investor, pro-innovation, pro-compliance framework that brings much-needed structure to the crypto space while keeping US markets competitive 🇺🇸📈

Clear rules. Strong protections. Smarter innovation.

That’s the goal.

#BTC100kNext? #USDemocraticPartyBlueVault #MarketRebound #USNonFarmPayrollReport #CPIWatch