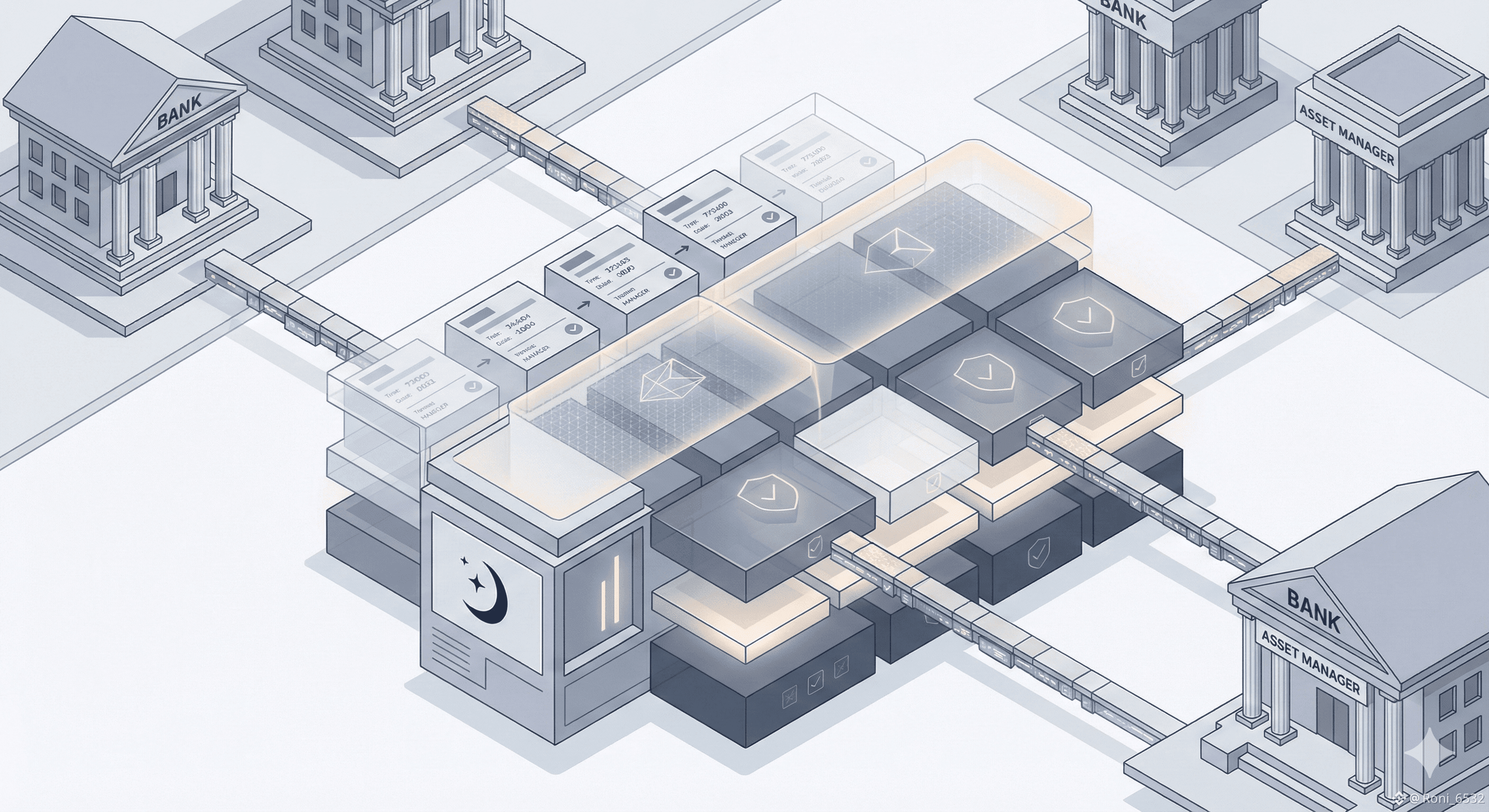

Most crypto users talk about privacy as a personal right. Institutions experience it as a regulatory liability. That gap has shaped nearly every failed attempt to bring serious financial activity on chain. Public blockchains exposed too much. Private blockchains removed too much. Somewhere in between, capital waited. Dusk exists because that waiting could not last forever.

When people ask why another layer 1 was necessary, they usually assume the goal was speed, composability, or developer mindshare. Dusk was never chasing those metrics. It was built around a quieter but more persistent problem that surfaced repeatedly over the last decade. Regulated finance does not move where transparency is absolute, nor where opacity is total. It moves where privacy and accountability coexist without contradiction.

This is the tension Dusk was designed to resolve, and it is why the project feels more relevant now than it did even a few years ago.

The uncomfortable truth about public blockchains in finance

Public blockchains solved coordination but created exposure. Every transaction, position, and interaction became observable not just by regulators but by competitors, adversaries, and automated strategies. For retail users, this was an inconvenience. For institutions, it was a deal breaker.

Banks and asset managers do not operate in environments where trade flows are globally visible. Market structure relies on discretion. Risk models assume confidentiality. Compliance teams require selective disclosure, not radical transparency.

The industry tried to patch this with privacy layers, mixers, and application level obfuscation. None of those approaches aged well. They were either too opaque for regulators or too fragile under scrutiny. The result was predictable. Institutions stayed out, and on chain finance evolved largely without them.

Dusk starts from the assumption that this outcome was not accidental. It was structural.

Privacy that regulators can reason about

The phrase compliant privacy sounds like a contradiction until you examine how traditional finance already works. Financial institutions do not disclose everything publicly. They disclose what is required, to whom it is required, and when it is required. Audits are controlled. Access is permissioned. Oversight exists without broadcasting sensitive data to the world.

Dusk mirrors this logic at the protocol level.

Rather than treating privacy as an add on or a defensive feature, Dusk integrates zero knowledge cryptography in a way that allows proofs of correctness without revealing underlying data. This is not about hiding activity. It is about proving legitimacy selectively.

That distinction matters. It changes how regulators engage. It changes how institutions assess risk. It changes which use cases are even possible on chain.

Tokenized securities, compliant DeFi instruments, and regulated marketplaces do not need maximum anonymity. They need verifiable privacy.

Why modularity matters more than maximalism

Many layer 1s pursue completeness. Every feature, every execution environment, every assumption is baked into a single stack. That works well for generalized ecosystems. It works poorly for regulated ones.

Regulation evolves. Jurisdictions diverge. Requirements change faster than protocols upgrade.

Dusk’s modular architecture reflects a belief that financial infrastructure must adapt without breaking. By separating concerns like execution, privacy, and compliance logic, the network allows applications to evolve alongside regulation rather than against it.

This is not a developer convenience. It is an institutional necessity.

A bank does not rebuild its core systems every time a rule changes. It configures. Dusk brings that same configurability on chain.

Auditability is not the enemy of privacy

One of the most persistent misunderstandings in crypto is the idea that audits require transparency. In reality, audits require verifiability.

Traditional audits are private processes. Sensitive data is reviewed by authorized parties under legal constraints. The public rarely sees more than summary disclosures.

Dusk aligns with this reality. Zero knowledge proofs allow financial actors to demonstrate compliance without exposing positions, counterparties, or internal strategies. Regulators gain assurance. Institutions retain confidentiality.

This is why Dusk resonates more with compliance teams than with crypto maximalists. It speaks their language.

Timing is the quiet advantage

If Dusk had launched during the height of retail driven DeFi speculation, it would have been misunderstood. The market was not asking the questions Dusk was answering.

Today, those questions are unavoidable.

Tokenized real world assets are no longer theoretical. Institutions are experimenting, cautiously but publicly. Regulatory clarity is improving in some regions and hardening in others. The tolerance for regulatory arbitrage is shrinking.

In this environment, protocols that treat compliance as optional feel increasingly fragile. Protocols that embed it by design feel inevitable.

Dusk sits firmly in the second category.

Builders are no longer optimizing for attention

Early crypto builders optimized for users. Then they optimized for liquidity. Now a different group is optimizing for longevity.

Applications built on Dusk are not chasing daily active users. They are designing systems meant to survive audits, regulatory reviews, and institutional procurement cycles. That is a slower game, but it is a more durable one.

This shift explains why Dusk feels understated compared to more visible ecosystems. Its success is measured less by headlines and more by conversations that never happen publicly.

Markets eventually reward infrastructure that reduces friction

Financial markets move where friction is lowest. In crypto, friction is no longer technical. It is legal, operational, and reputational.

Protocols that ignore this reality may grow faster in the short term. They also face sharper ceilings.

Dusk reduces friction where it matters for serious capital. It allows institutions to participate without rewriting their risk frameworks. It allows regulators to engage without dismantling their oversight models.

This does not guarantee dominance. It does, however, create relevance that is difficult to replicate.

The long game is not about replacing finance

Dusk does not position itself as an alternative to the financial system. It positions itself as infrastructure that the system can actually use.

That difference shapes everything from protocol design to community expectations. It attracts fewer speculators and more practitioners. Fewer promises and more constraints.

In crypto, constraints are often seen as weakness. In finance, they are prerequisites.

Why this matters now

The crypto ecosystem is entering a phase where integration matters more than disruption. The narrative of replacing banks has given way to the reality of working with them.

Dusk exists because someone had to build infrastructure for that reality rather than for the narrative.

As a long term observer, it is hard not to see this as one of the more honest design philosophies in the space. It accepts trade offs openly. It prioritizes compatibility over maximalism. It builds for users who do not tweet.

That may never make Dusk loud. It does make it necessary.

For those watching the slow convergence of traditional finance and blockchain, @dusk_foundation represents a thesis that feels increasingly difficult to ignore. The question is not whether compliant privacy is needed. The question is which infrastructure will be trusted when it finally becomes unavoidable.