🧠 Opening Insight: Use Cases Decide Survival

Technology alone does not win.

Use cases decide who survives 🧬

The Dusk Foundation did not build Dusk Network for experiments or hype loops.

It was engineered to operate inside real financial systems, not outside them.

This article explores where Dusk actually fits in the real world — not theory, not marketing.

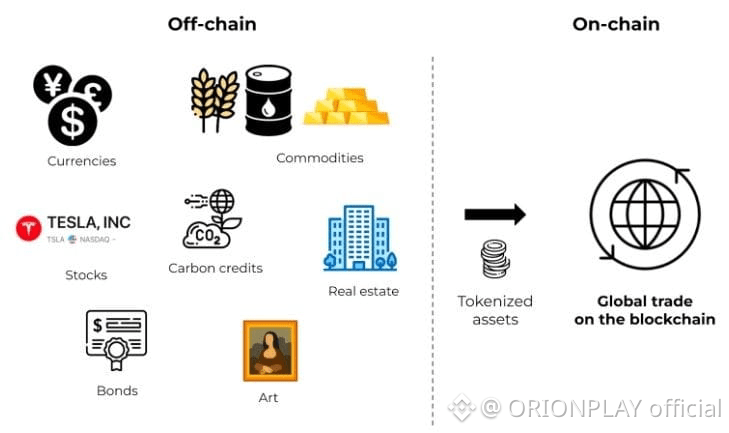

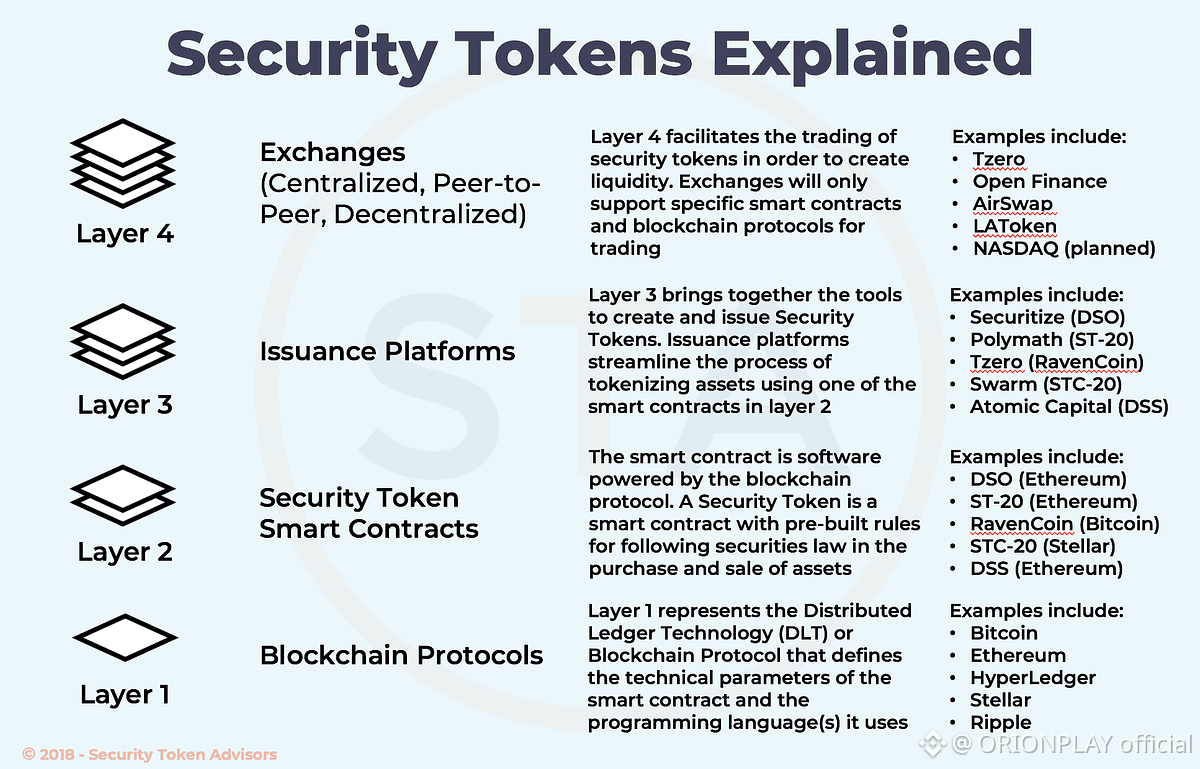

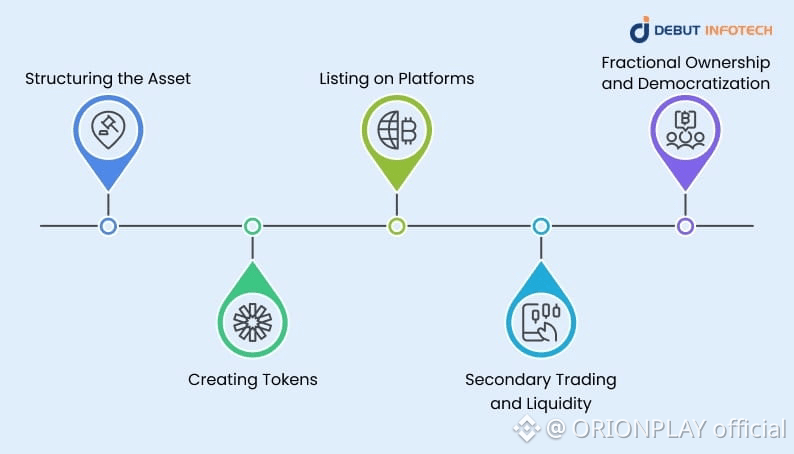

🏛️ 1. Security Tokens & Asset Tokenization

The Problem in Traditional Finance

• Paper-heavy processes

• Slow settlement

• Limited transparency

• Privacy leaks

Why Most Blockchains Fail Here

• Public balances

• Traceable ownership

• No compliance controls

Why Dusk Works

Dusk Network was explicitly designed for security token lifecycle management.

Using Zedger:

• One verified identity = one private account

• Balances stay confidential

• Ownership changes are provable

• Regulators can audit when required

📌 Result:

A blockchain that can issue:

• Equity tokens

• Debt instruments

• Fund shares

• Regulated assets

Without exposing investor data publicly.

🧾 2. Confidential Capital Tables (Cap Tables)

Traditional cap tables:

• Fragmented

• Error-prone

• Difficult to audit

Public blockchains:

• Too transparent

• Too revealing

Dusk’s Advantage

Zedger enables:

• Private balance segmentation

• Snapshot-based disclosure

• Cryptographic proofs of ownership

Cap tables become:

• Accurate

• Private

• Always up to date

Perfect for:

• Startups

• Private equity

• Venture funds

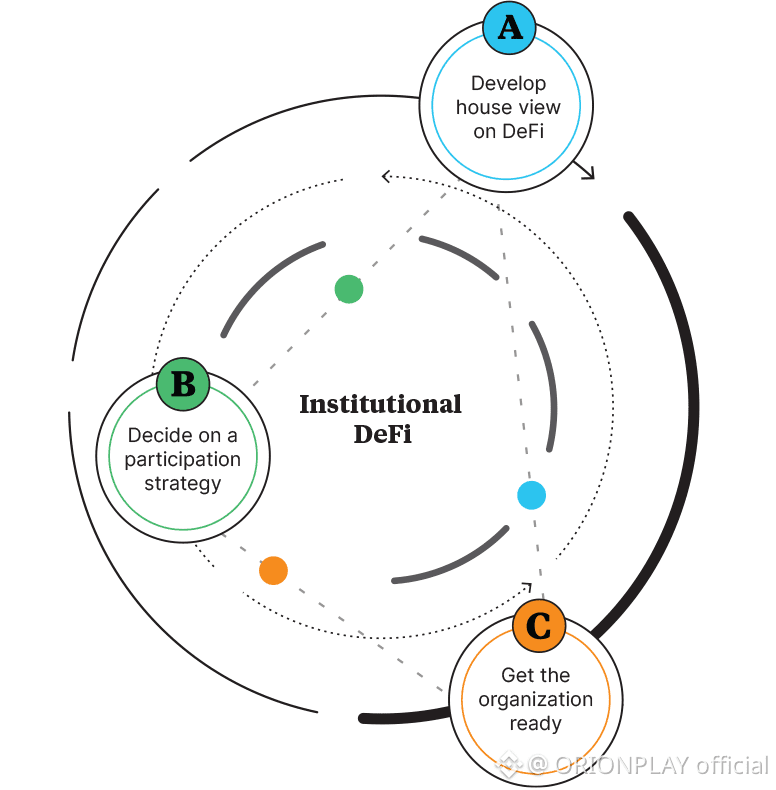

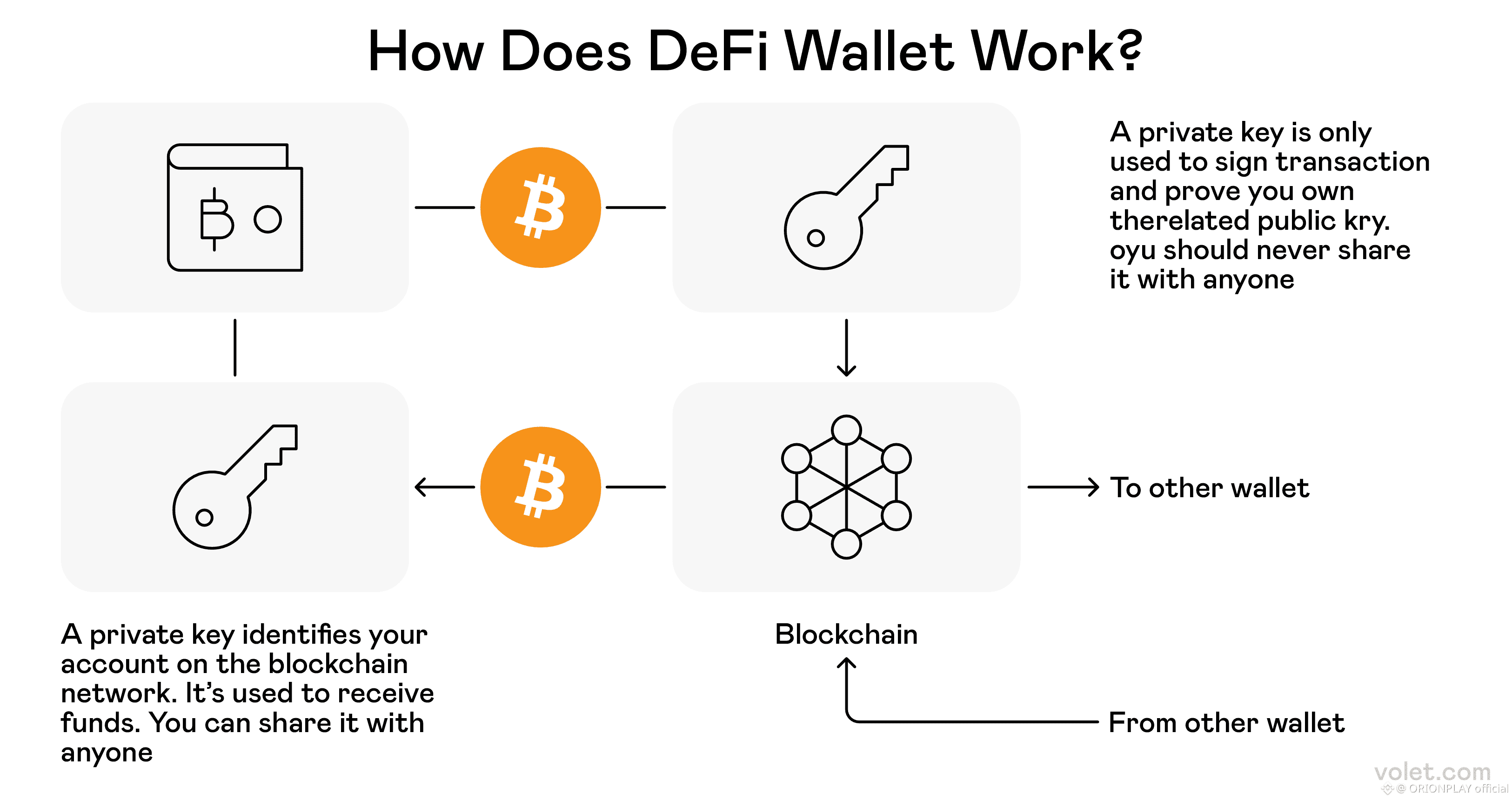

🏦 3. Institutional DeFi (Yes, It Exists)

Retail DeFi thrives on openness.

Institutions need controlled privacy.

Problems Institutions Face

• Trade exposure

• Strategy leakage

• Regulatory constraints

How Dusk Enables Institutional DeFi

Using Phoenix + Rusk VM:

• Positions stay private

• Contract logic remains confidential

• Settlement is final and fast

Possible applications:

• Private lending markets

• Confidential liquidity pools

• Yield products with hidden strategies

This is DeFi without front-running 😎

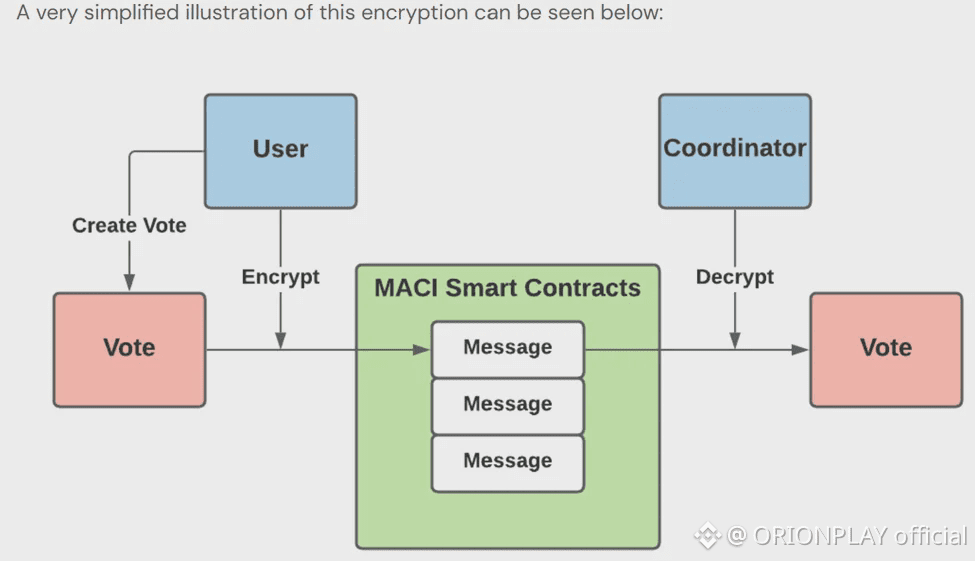

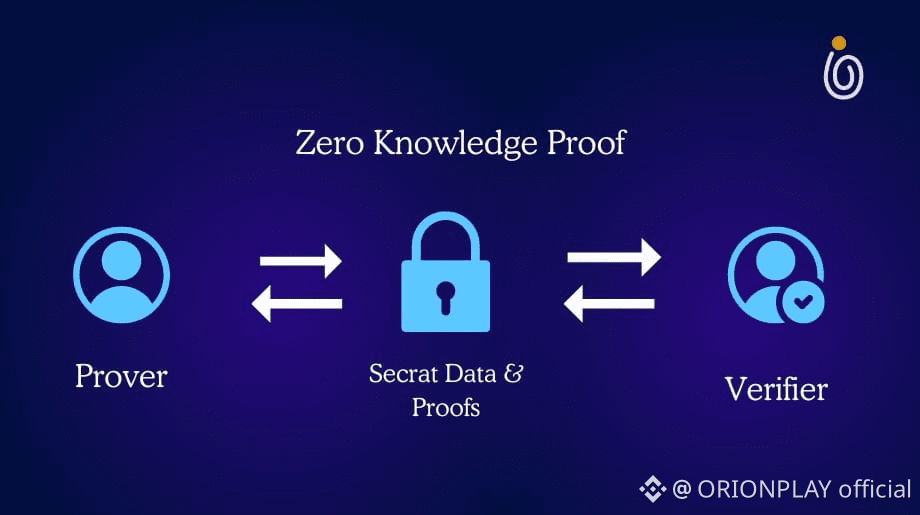

🗳️ 4. Private Governance & Voting Systems

Most governance systems expose:

• Voter identity

• Vote weight

• Voting patterns

Dusk’s Approach

• Vote eligibility verified privately

• Vote content hidden

• Final outcome provable

Ideal for:

• Shareholder voting

• DAO governance

• Corporate resolutions

Privacy protects:

• Minority voters

• Strategic decisions

• Sensitive proposals

💰 5. Dividend Distribution Without Surveillance

Dividends on public chains:

• Reveal who earns what

• Enable financial profiling

Dusk Solution

Zedger allows:

• Dividend eligibility verification

• Private balance adjustments

• Confidential payout logic

Regulators can verify totals.

Participants keep privacy.

That balance is rare — and powerful.

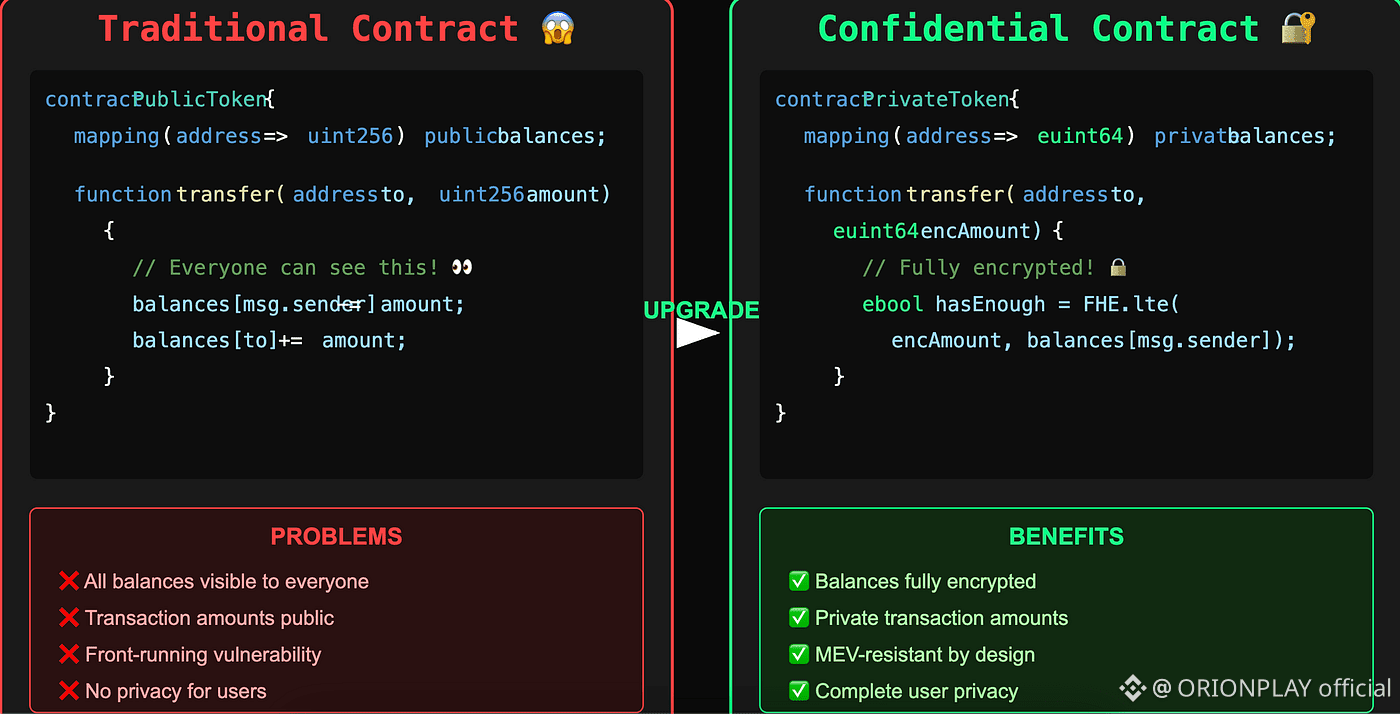

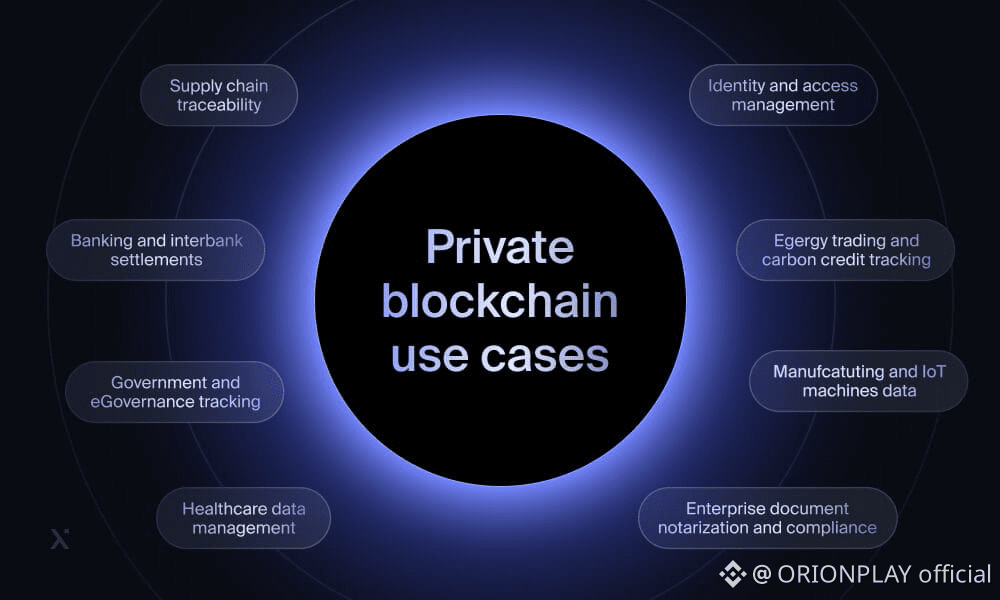

🔐 6. Confidential Smart Contracts for Enterprises

Enterprises avoid public blockchains because:

• Business logic leaks

• Trade secrets exposed

With Rusk VM:

• Contract state is private

• Inputs and outputs are encrypted

• Proofs validate correctness

Possible use cases:

• Supply chain agreements

• Licensing logic

• Revenue-sharing contracts

Blockchain becomes usable inside companies, not just between strangers.

🌉 7. Privacy-Preserving Interoperability

Dusk can function as:

• A confidential execution layer

• A privacy sidechain

• A settlement network

This enables:

• Private settlements for public chains

• Confidential asset bridging

• Cross-chain compliance

Privacy becomes a service, not a barrier.

😄 Simple Analogy Time

If blockchains were buildings:

• Public chains = glass houses 🏠

• Private databases = locked bunkers 🔒

• Dusk = secure office with blinds and auditors 🕶️📋

🧠 Why These Use Cases Matter Long-Term

Short-term trends fade.

Regulated finance does not.

Dusk Foundation focuses on:

• Longevity

• Legal compatibility

• Institutional readiness

That makes adoption slow but sticky — the best kind.

🧾 The Role of $DUSK in These Use Cases

The $DUSK token:

• Secures consensus

• Powers execution

• Aligns validators

• Enables participation

Every real-world use case depends on:

👉 Network security

👉 Finality

👉 Incentives

All tied back to $DUSK .

🧠 Final Reflection

Dusk Foundation is not building a louder blockchain.

It is building a quieter, smarter, legally usable one.

Privacy without chaos.

Compliance without surveillance.

DeFi without exposure.

That combination is rare — and intentional.