RWAs explode and regulators tighten the screws, one standard is quietly stealing the show: XSC (Confidential Security Contract) on Dusk Network. This isn't just another token standard - it's the blueprint for bringing real stocks, bonds, and securities on-chain with institutional-grade privacy, full compliance, and zero drama. No more leaking your portfolio to the world or trusting shady custodians. Let's dive in.

What the Heck is XSC? (The Quick Lowdown)

XSC stands for Confidential Security Contract - Dusk's flagship standard built specifically for privacy-enabled tokenized securities. Think of it as the "ERC-1400 on steroids" but native to a privacy-first Layer-1.

While Ethereum tokens scream everything publicly (balances, transfers, holders), XSC uses Dusk's zero-knowledge proofs (ZKPs) to hide the juicy details:

Who owns what?

How much was transferred?

Shareholder identities?

Yet everything stays verifiable and compliant. Issuers get programmable control (capped transfers, voting rights, dividends), regulators can audit when needed via selective disclosure, and investors enjoy true self-custody without middlemen.

Here's the visual vibe of that unbreakable privacy shield protecting your assets:

Why XSC is a Game-Changer in 2026

Traditional finance hates public blockchains because everything's transparent. DeFi loves speed but ignores regs. XSC bridges both worlds perfectly:

Privacy by Default - Sensitive terms, amounts, and identities stay encrypted. No front-running, no competitor spying.

Built-in Compliance - Supports MiFID II, GDPR, MiCA - automated KYC/AML via Citadel (Dusk's identity layer), dividend distribution, voting, ownership caps.

Full Lifecycle Management - Issue, trade, settle, redeem securities trustlessly. Instant DvP (delivery vs payment) in seconds.

Self-Custody Superpower - Holders control their tokens directly - no custodians = lower risk of hacks/theft.

Programmable Magic - Smart contracts handle complex rules (e.g., "only accredited investors", "lock-up periods") without revealing data.

Powered by Dusk's Zedger hybrid model (best of UTXO + account-based), XSC tokens settle privately while proving everything's legit.

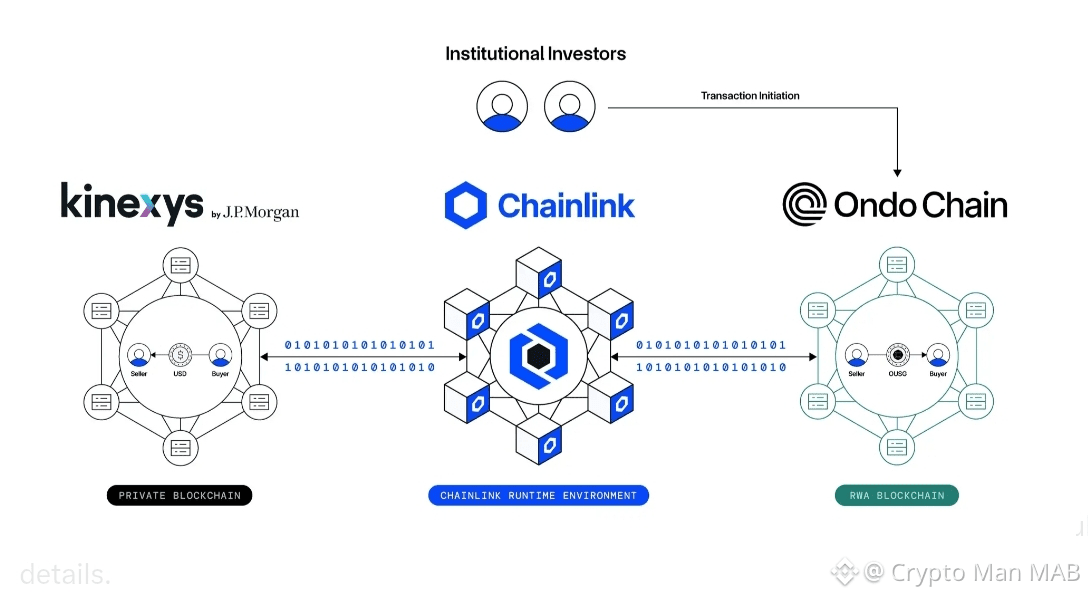

Check this clean illustration of tokenized RWAs flowing securely on-chain:

Real-World Wins (Why Institutions Are Buzzing)

Banks & funds tokenize private equity, real estate, bonds - trade 24/7 with privacy.

No more weeks-long settlements - instant, compliant, confidential.

Selective disclosure: Prove to auditors "this trade followed rules" without exposing full details.

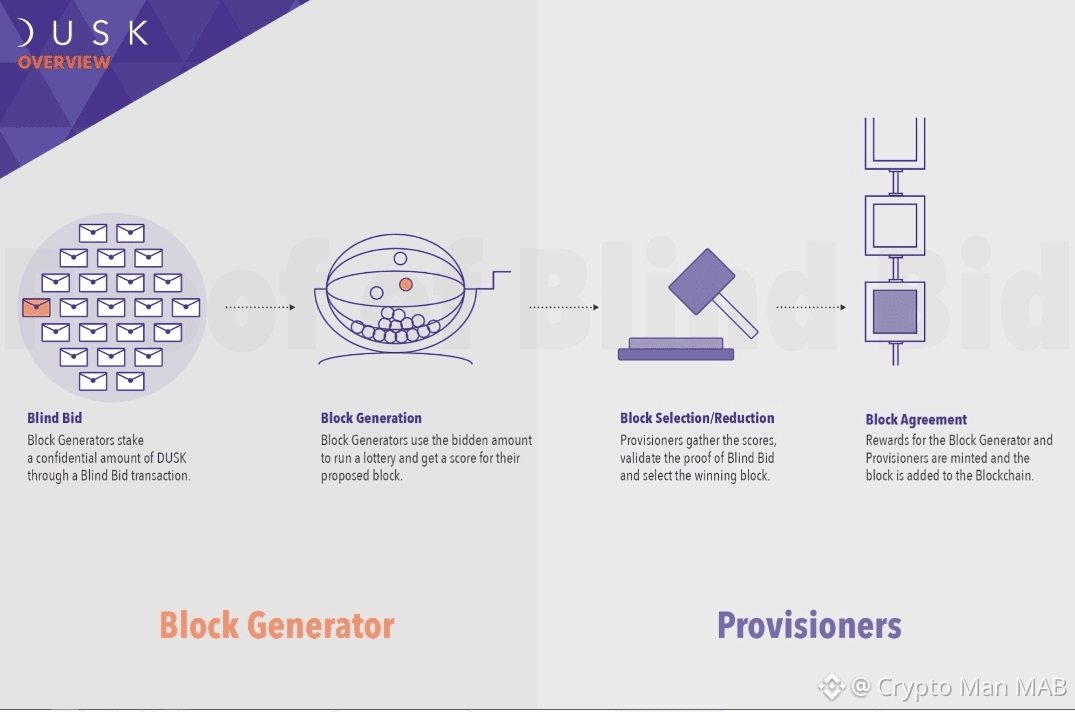

Ties perfectly into Dusk's SBA consensus & confidential smart contracts for enterprise DeFi.

Dusk isn't chasing hype - it's building the regulated infrastructure Wall Street actually needs. XSC launched years ago but in 2026? It's maturing into the go-to for compliant RWAs.

Here's a futuristic take on secure, glowing tokenized assets in the blockchain era:

XSC = Privacy + Compliance + Programmability in one open, permissionless standard.

If you're eyeing the next wave of finance (tokenized everything, RegDeFi boom), Dusk's XSC is the privacy shield making it all possible. Stack some $DUSK, explore the docs on dusk.network, and get ready - the confidential future is here.

What do you think, MAB - ready to tokenize some real assets privately? Drop your thoughts below!