Central banks aren't just buying gold... they're stacking it relentlessly — and it's fueling gold's epic bull run into 2026!

As of mid-January 2026, spot XAU/USD hovers near $4,580–$4,600 after smashing records above $4,643 earlier this week. The biggest driver? Official sector demand that's turned structural. Emerging markets lead the charge in diversifying reserves away from the USD amid sanctions risks, geopolitical flashpoints, and fiat uncertainty.

🚨Key Highlights from the Latest Data (World Gold Council, Jan 2026):

✅Net central bank purchases hit 45t in November — momentum strong despite slightly lower than October peaks.

✅YTD reported buying through Nov: 297t (solid, though below prior record years' pace).

✅Top buyers: Poland (leading with 95t YTD, now ~28% of reserves), Kazakhstan, Brazil (added 11t in Nov), Uzbekistan, and more.

China's PBOC extended its streak to 14 consecutive months (latest +30k oz in Dec), with holdings now ~2,300t+ officially (many suspect even higher "shadow" buys).

Here's a stunning look at what central bank gold vaults really look like — massive, secure stacks of physical bullion fueling this trend:

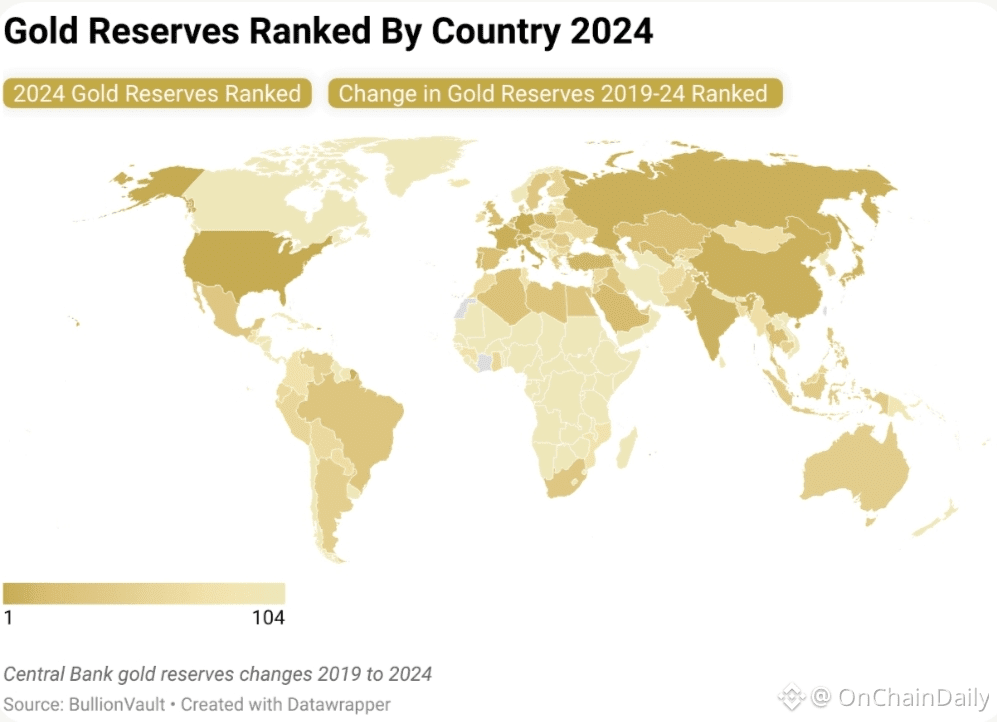

And the global distribution? Emerging markets are catching up fast — check this map of top holders (US still #1, but EMs surging):

Why the Frenzy in 2026?

De-dollarization acceleration — USD share in global reserves at multi-decade lows (~57%), as banks hedge against weaponization risks.

Geopolitical insurance — Post-Russia sanctions, gold seen as neutral, seizure-proof asset.

Forecasts bullish → JPMorgan: ~755t central bank buys in 2026; Goldman Sachs eyes $4,900+; others call $5,000–$5,055 by year-end. Structural support = no major selling expected (95%+ of surveyed banks plan increases).

Crypto Tie-In — This institutional shift validates hard assets like BTC as digital gold. If fiat trust erodes further, expect more flows into non-sovereign hedges (PAXG, BTC, etc.).

My Take:

Central banks are voting with their vaults — gold isn't hype; it's strategic survival. With Powell probe chaos adding fuel, $5,000+ feels realistic. This could be the decade's biggest macro trade!

What do you think?

Central banks push gold to $5K+ in 2026? 🚀

Or slowdown if tensions ease? 📉

Stacking physical, PAXG, or BTC as your hedge? Share below! 👇$BTC $XAU $PAXG

#CentralBanks #GoldReserves #DeDollarization #XAUUSD #GoldRush #CryptoHedge #BinanceSquare