NYC Token collapsed more than 80% shortly after launch, triggering allegations that liquidity linked to wallets associated with Eric Adams’s circle had been withdrawn, causing multi-million-dollar investor losses.

Adams’s spokesperson denied any rug pull or personal gain, but this claim conflicts with on-chain data and prior team statements acknowledging “liquidity rebalancing” during the token’s initial trading surge.

Despite the controversy, the project maintains that NYC Token was designed as a charitable mechanism rather than an investment product, with proceeds intended to support nonprofit education initiatives and scholarships in New York City.

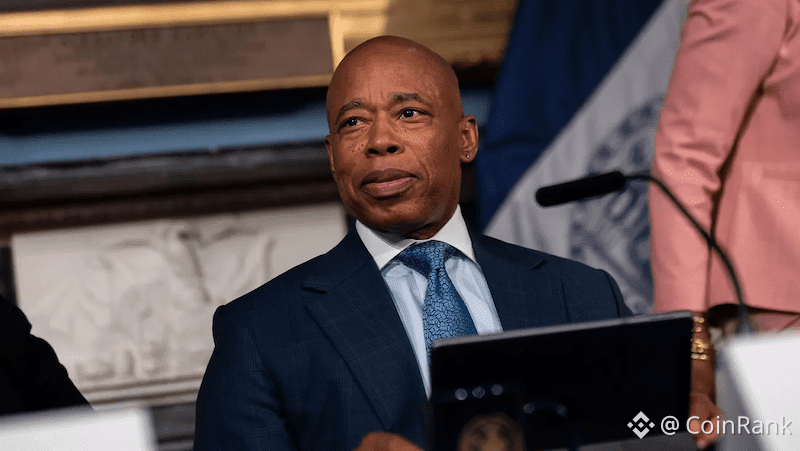

In response to recent allegations that the issuance of NYC Token involved a rug pull, a spokesperson for former New York City mayor Eric Adams has come forward to deny the claims, emphasizing that Adams neither transferred funds nor profited from the token.

NYC TOKEN “RUG PULL” INCIDENT

According to earlier reporting by Zombit, NYC Token plunged by more than 80% within its first hour of trading after launching on Monday, drawing intense scrutiny and skepticism from the crypto community. Some analysts accused wallets allegedly linked to Adams’s team of withdrawing liquidity, resulting in investor losses totaling more than USD 3.4 million. In response, Adams’s spokesperson Todd Shapiro issued a statement on X on Wednesday to clarify:

“It must be stated very clearly: Eric Adams did not transfer investor funds, nor did he profit from the issuance of NYC Token, and no funds from NYC Token were removed.”

Shapiro said the allegations were “unsupported by evidence and untrue,” attributing the token’s sharp price swings to market volatility and stressing that Adams’s involvement “was never intended for any personal or financial gain.”

DISCREPANCIES IN OFFICIAL ACCOUNTS: TEAM ACKNOWLEDGES ‘LIQUIDITY REBALANCING’

However, Shapiro’s assertion that “no funds were removed” appears to conflict with earlier statements from the official NYC Token account as well as on-chain data. The NYC Token team previously stated on X that, due to exceptionally strong early demand after launch, its partners had “rebalanced the liquidity,” while also claiming that additional funds were added to the liquidity pool.

At the same time, multiple on-chain analysts raised warnings about fund flows following the token’s launch. Analyst Rune Crypto noted that approximately USD 3.4 million in liquidity was removed shortly after issuance and described the behavior as resembling a rug pull.

On-chain visualization platform Bubblemaps also flagged anomalous activity, reporting that a wallet linked to the token deployer (address: 9Ty4M) withdrew roughly USD 2.5 million in USDC near the price peak, and after the price fell by more than 60%, replenished only about USD 1.5 million.

Bubblemaps further estimated that around 4,300 traders participated in NYC Token’s early trading, with approximately 60% incurring losses. Most investors lost less than USD 1,000, but about 200 individuals suffered losses between USD 1,000 and USD 10,000, while a small number lost tens of thousands of dollars. At least 15 investors reportedly lost more than USD 100,000.

EMPHASIS ON CHARITABLE PURPOSE, NOT AN INVESTMENT VEHICLE

The statement added that NYC Token was not intended as an investment product, but rather as a means to support nonprofit organizations, funding educational programs to raise awareness of antisemitism and anti-American sentiment, with proceeds earmarked for scholarships for underprivileged students in New York City. Shapiro concluded that the controversy has not shaken Adams’s stance on “responsible innovation”:

“Adams remains committed to using emerging technologies to strengthen trust, education, and shared civic values.”

Read More:

Messari’s 2026 Crypto Theses: Power Struggles, Stablecoins, and Skepticism (Part 2)

〈Political Figure Meme Coin Implodes: NYC Token Liquidity Withdrawal Controversy Spreads, Former New York City Mayor Denies Allegations〉這篇文章最早發佈於《CoinRank》。