HODL Play That's Shaking Markets

Hey fam, Ibrina here from

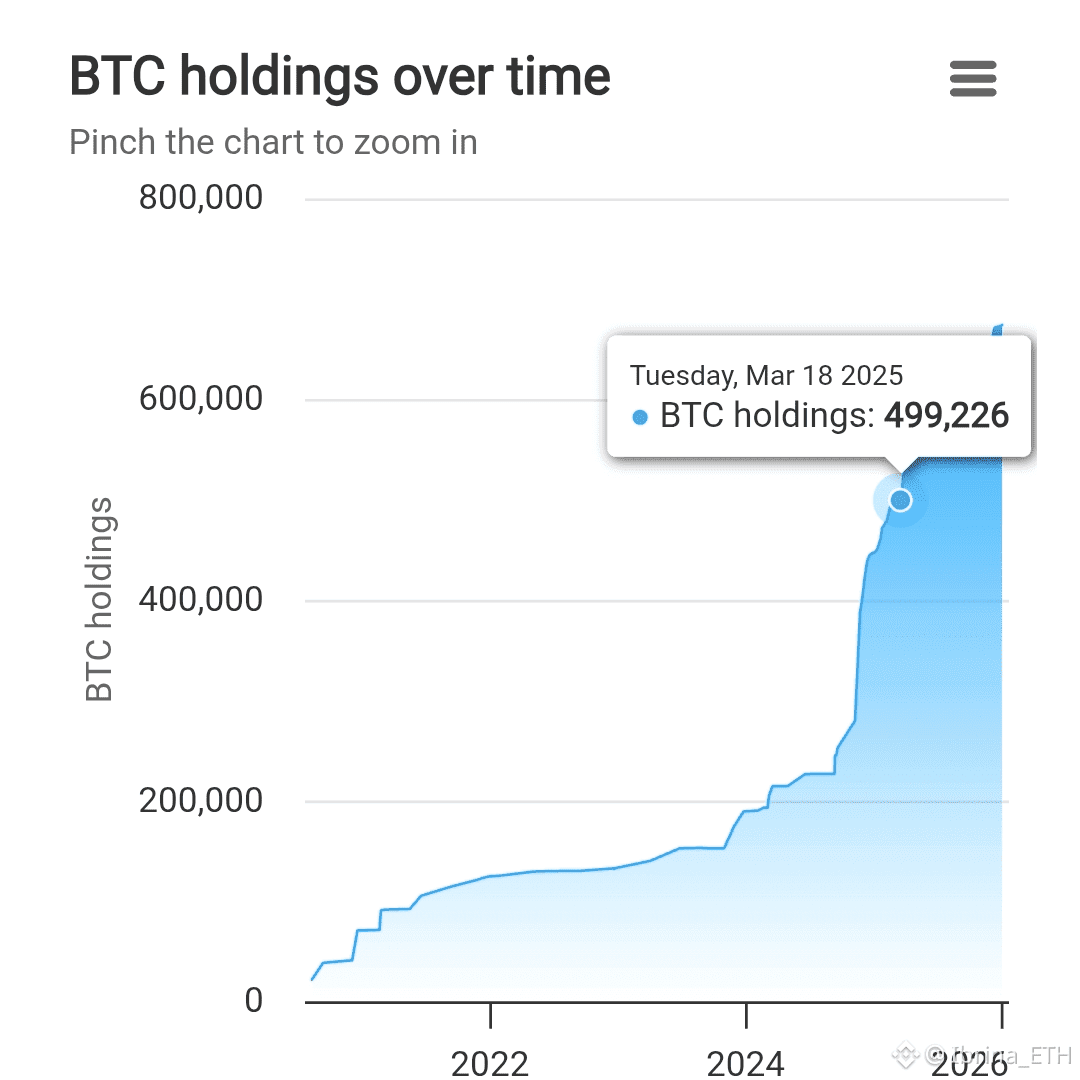

Ibrina_eth diving deep into the crypto waves like always. You know me I'm all about that ETH life, but when Bitcoin makes moves that shake the whole market, I gotta chime in. Today, we're talking about MicroStrategy's latest Bitcoin binge. Yeah, you heard that right – they're stacking sats like it's going out of style, and it's got me hyped for what 2026 could bring. If you're trading on Binance or just HODLing, this is the kind of news that screams opportunity. Let's break it down in my signature style: real talk, no fluff, and a sprinkle of my own spice on why this matters for us retail warriors. Buckle up, because this ain't your grandma's market update – it's mindshare gold that'll have you rethinking your portfolio game.Why MicroStrategy's Bitcoin Stack is the Ultimate Flex in 2026Picture this: It's early 2026, Bitcoin's flirting with six figures, and Michael Saylor – that BTC evangelist we all love to meme about – drops another bombshell. MicroStrategy just scooped up 13,627 BTC for a cool $1.25 billion. Average price? $91,519 per coin. That's not pocket change; that's a statement. Completed on January 11, this buy pushes their total holdings to a whopping 687,410 BTC. Fam, that's like owning a small country's GDP in digital gold. Their all-in cost? Around $51.8 billion, with an average entry of $75,353 per BTC. Even with these high buys, their balance sheet is rock-solid because they've been accumulating through highs, lows, and everything in between.

I mean, come on – while the rest of us are timing dips and chasing pumps on Binance spot markets, Saylor's out here playing 4D chess. It's not just about the numbers; it's about commitment. In a world where fiat's inflating faster than a bad meme coin, MicroStrategy's turning Bitcoin into their treasury backbone. And let's be real, with BTC trading above their historical averages, this screams "scarcity play" more than "quick flip." If you're on Binance, keep an eye on those BTC futures – moves like this could ignite the next leg up.The Numbers That'll Make Your Wallet Jealous: Keypoints BreakdownAlright, let's get granular because details are where the alpha hides. I'm not just regurgitating headlines; I'm serving up the juicy bits with my take on each. Here's the keypoints that'll have you nodding like, "Damn, Ibrina's onto something":

Total Holdings Hit God-Tier Levels: 687,410 BTC. That's up from previous stacks, and at current prices (hovering around $90k+ as we speak), their unrealized gains are through the roof. My take? This isn't gambling; it's institutional conviction. If corps like this are all-in, why aren't more of us diversifying our Binance portfolios beyond alts?

Latest Buy Deets: 13,627 BTC at $91,519 avg. Total spend: $1.25B. Done on Jan 11, right as 2026 kicked off with market rebounds. Key insight: They're buying during consolidation, not just dumps. Pro tip for Binance traders – watch for similar patterns in order books; it signals long-term bulls are loading up.

Average Entry Price Magic: $75,353 per BTC across all holdings. Even with pricier recent adds, it stabilizes everything. My spin: This proves dollar-cost averaging (DCA) works on steroids. If you're new to Binance, set up those recurring buys – it's how you beat volatility without losing sleep.

Overall Cost Basis: $51.8B invested. In a scarcity-driven asset like BTC, this positions them for moonshots. Hot take from me: Forget short-term noise; focus on exposure building. I've been stacking ETH similarly, and it's paid off big time in past cycles.

These aren't just stats – they're a roadmap. In the Binance ecosystem, where liquidity is king, moves like MicroStrategy's ripple into our trades, pumping volumes and sparking FOMO.My Own Take: Why This is Bigger Than Just One Company's WalletYo, let's keep it 100 I'm Ibrina, not some suit in a boardroom, so here's my raw vibe on this. MicroStrategy's strategy (pun intended) isn't about timing the market perfectly; it's about owning the narrative. In 2026, with institutional adoption ramping up, this is the blueprint for balance-sheet Bitcoin. We've seen headlines scream "BTC to 100k next?" and yeah, with buys like this, it's not if, but when. But here's where I differ from the echo chamber: It's not just about top performers like Saylor stealing the show. Long-term wins come from structural plays think supply shocks, halvings, and yes, even ETF inflows that Binance users can front-run.For us on the ground? This screams "upgrade your game." I've been writing to earn on platforms like this, turning insights into income, and trust me – sharing takes like this on Binance Square or feeds can skyrocket your visibility. #WriteToEarnUpgrade , anyone? It's organic growth: Post detailed breakdowns, tag #StrategyBTCPurchase or #MarketRebound , and watch engagement soar. My advice? Don't chase every pump build exposure like MicroStrategy. Mix BTC with ETH for that diversified edge that's my portfolio secret sauce.If BTC hits 100k soon (#BTC100kNext? ?), credit goes to steadfast accumulators like these. What's your move, fam? Hit me up in the comments Let's stack together in 2026 because in crypto, the real winners are the ones who stay committed, not the flippers. Peace out, and trade smart! $BTC $ETH