There is a kind of blockchain progress that does not try to be seen. It does not arrive with strong claims or loud narratives. Most of the time, it simply continues in the background. It moves forward through decisions that might look minor at first, but gradually shape the direction of the system. Dusk fits into that pattern. While much of the market continues to swing between experimentation and speculation, Dusk has stayed focused on a narrower concern. The idea has remained steady: to build privacy-preserving financial infrastructure that can function inside regulatory systems instead of pretending those systems are temporary.

At a basic level, Dusk is not trying to reinvent finance. It is working within a problem that already exists. Financial markets need privacy. They also rely on accountability. Most blockchain systems struggle to handle both at the same time. Full transparency creates obvious problems for regulated use. Full privacy creates different problems around oversight. Dusk does not try to soften this tension. It accepts it and builds with both requirements in mind.

That approach becomes clearer when you look at how privacy actually works on the network. Privacy on Dusk is not about hiding everything. It is about deciding what should be visible, who should see it, and when that visibility is necessary. Transactions can remain confidential to the public while still being verifiable by authorized parties when compliance requires it. This sounds simple when written down, but it is not easy to implement. Financial institutions do not need secrecy for its own sake. They need controlled access. Dusk’s design reflects that reality.

The modular structure of the chain supports this way of thinking. Instead of forcing every application into the same execution model, Dusk offers components that developers can put together based on specific regulatory and confidentiality needs. This matters for tokenized assets, regulated decentralized finance, and institutional financial products. These environments do not leave much room for improvisation. Data handling, permissions, and enforcement rules need to be precise. Dusk treats those constraints as part of the design process rather than something to work around.

The teams that build on Dusk tend to think in similar terms. The ecosystem is not dominated by consumer applications or short-term incentive experiments. It attracts builders working on infrastructure, issuance systems, settlement layers, and financial primitives meant to stay in use. These teams think about maintenance, legal clarity, and long-term operation. That mindset shapes the network’s culture. It feels deliberate. Sometimes cautious. Rarely rushed.

Dusk’s relationship with regulation is another part of this. Many blockchain projects treat regulation as something to avoid or delay. Dusk does not. It assumes regulation is permanent and designs with that assumption in mind. This does not mean giving up decentralization. It means accepting that decentralized systems have to interact with legal and institutional frameworks if they are going to be used seriously. Dusk positions itself as an interface rather than a confrontation.

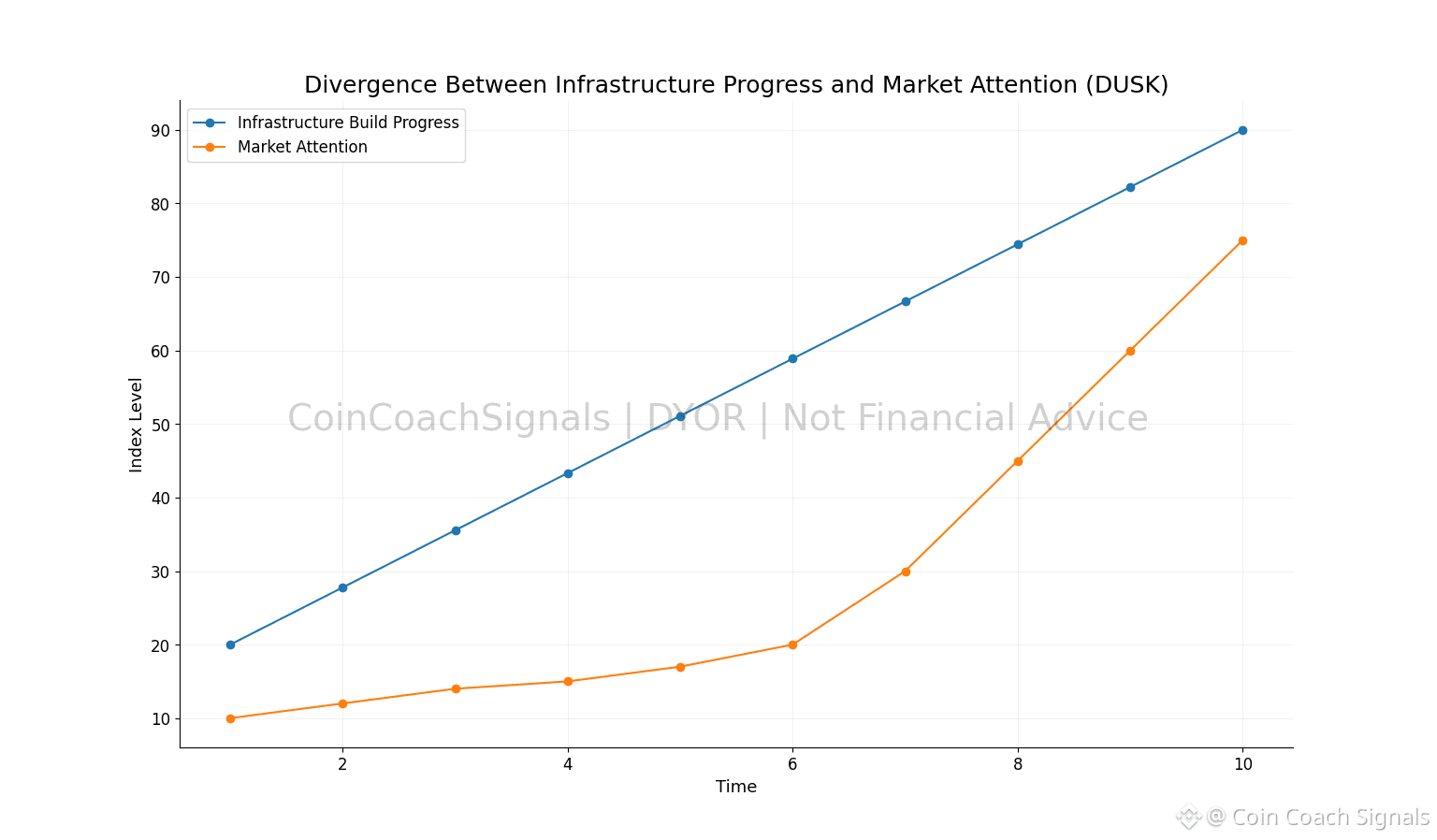

This way of thinking also affects how activity develops on the network. Instead of chasing rapid growth through incentives, Dusk appears to be preparing for capital that values predictability and compliance. That kind of participation moves slowly. It also tends to stay. It is connected to actual financial activity rather than short-lived yield cycles. Over time, this leads to a growth pattern that favors durability over momentum.

The technology behind this vision is focused by choice. Zero-knowledge cryptography plays a central role, but it is not treated as something to showcase. It is treated as a tool. The goal is not complexity. The goal is usability in real financial workflows. Smart contracts on Dusk are built to manage confidential state while still allowing verification when it is required. That balance is difficult to maintain, and it explains why progress can appear slow. Shortcuts would undermine the system being built.

As the market continues to mature, Dusk’s role becomes easier to recognize. There is a growing understanding that complete transparency is not appropriate for every financial use case. Institutions, enterprises, and even public-sector actors are beginning to explore tokenization, onchain settlement, and programmable finance, but they are doing so with real constraints in mind. They cannot operate in environments where every transaction is exposed by default. Dusk aligns with this reality by embedding compliance into the protocol itself rather than trying to add it later.

This also helps explain why Dusk feels less reactive to market cycles. Its development is not driven by short-term narratives. It is shaped by infrastructure requirements that do not change quickly. Each upgrade reinforces the same underlying idea instead of redefining it. Over time, that consistency matters. Trust builds slowly, through alignment between design and execution.

What ultimately defines Dusk is not speed or scale. It is intent. Every architectural decision traces back to a single question: how can a blockchain support regulated finance without giving up privacy or decentralization? There are no easy answers to that question. Dusk’s pace reflects an understanding of that.

As onchain finance continues to move beyond experimentation, systems like Dusk become more relevant. They do not promise disruption for its own sake. They offer infrastructure that respects how finance actually works while allowing it to evolve. In a market often filled with noise, Dusk is building something quieter, and likely more durable.

For educational purposes only. Not financial advice. Do your own research.

@Dusk $DUSK #Dusk #dusk