WAL isn’t built for thrill seekers chasing quick gains. In a crypto world obsessed with speed and the latest hype, WAL just does its own thing. It’s not for people who watch charts all day, hoping for green candles or jumping on whatever’s trending this week. WAL is about conviction. You need patience, some real understanding, and a belief in the long game—especially when it comes to infrastructure, not just speculation.

Momentum trades live off attention. They feed on hype, viral tweets, flashy exchange launches, and that constant back-and-forth between narrative and price. WAL lives in a different world. It’s all about decentralized storage—actual infrastructure. Growth here is slow and steady. Developers plug away, data pipelines get stronger, and real use starts to beat out the “what ifs.” There’s no overnight explosion. Just quiet, steady progress.

That difference matters.

WAL’s pitch isn’t about price echoing hype. It’s about sticking around and being useful. Storage is the backbone, not a passing trend. It doesn’t need crowds of retail buyers to stay relevant. As long as the world keeps creating more data—and let’s be honest, that’s not stopping—storage will always matter. That’s the whole idea behind WAL. It’s a structural play, not a cyclical one. People buy WAL not because it’s pumping, but because they’re betting that decentralized storage will be even bigger in five years.

That’s where conviction comes into play.

Conviction means you’re focused on why something should exist, not when others will finally pay attention. WAL holders are basically backing a future where decentralized storage either replaces or works alongside today’s big, centralized players. This isn’t a bet that plays out in weeks. It’s years in the making—usage grows, developers trust it more, and the whole thing becomes economically sound.

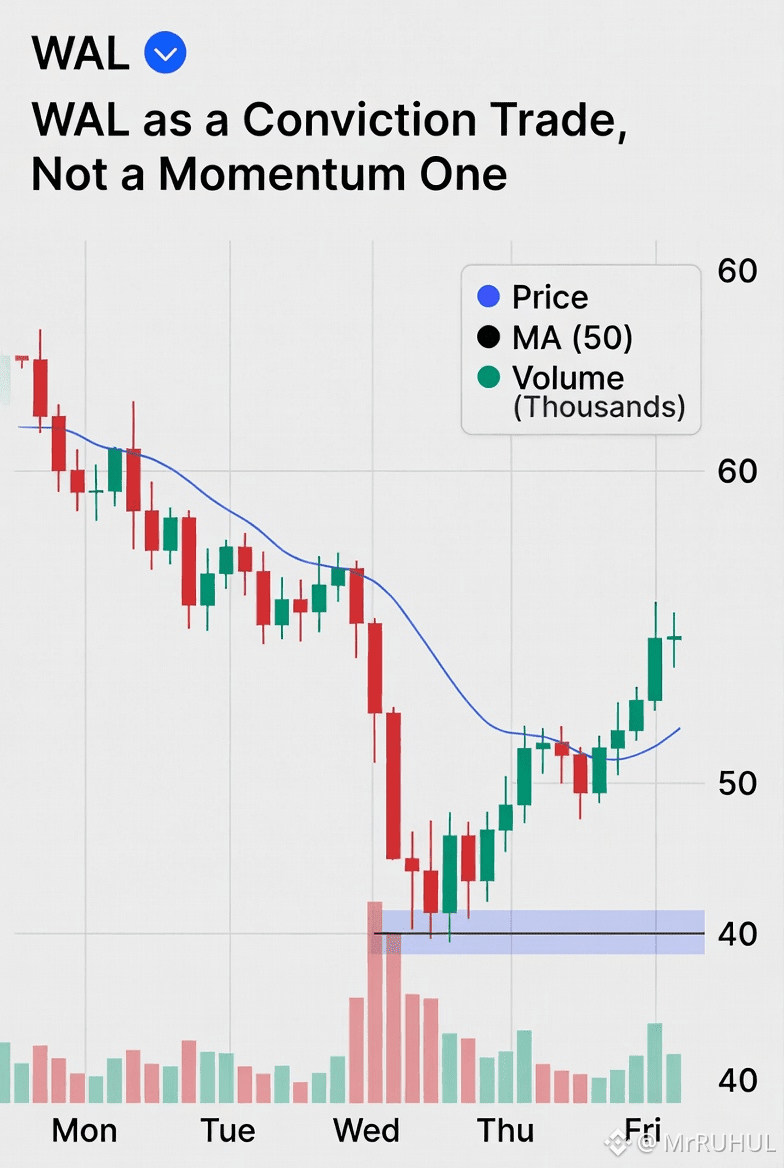

Momentum traders usually get WAL wrong. When the price doesn’t move much—when everyone’s chasing AI tokens, memes, or the next hot DeFi project—they call it boring or dead. But flat prices don’t mean the idea failed. With conviction assets, it’s normal to see prices go nowhere during the building phase. Infrastructure comes first. The party comes later.

WAL also resists momentum trading because of how it’s built. Its token value follows real network use, not just speculation. So, you get this lag between progress and price action. Traders hate that, but long-term believers don’t mind—they know what they own. They focus on the network’s health, not the latest chart pattern.

There’s a psychological side, too. Momentum trading is all about constant moves—buy, sell, rotate, repeat. Conviction trading is about holding steady. WAL holders have to deal with boredom, underperformance compared to hype coins, and stretches where nothing happens. That’s actually the point. It filters out people who aren’t serious and leaves a stronger, more aligned holder base.

But let’s be clear—conviction isn’t blind faith. You still have to check: Is adoption growing? Is the tech getting better? Are incentives working? WAL has to deliver. But conviction investors watch progress, not pumps. They care about the fundamentals, not who’s talking about it on social media.

This way of thinking is everything. If you treat WAL like just another momentum play, you’ll probably end up disappointed—getting in late, bailing early, or losing patience at the worst time. But if you see it as a conviction trade, the ups and downs don’t rattle you. Big dips turn into moments to rethink your thesis, not reasons to panic.

WAL doesn’t fit into the usual “narrative rotation” game that drives most crypto cycles. It doesn’t need to be the hot story. It just has to be solid, reliable, and—honestly—a little boring. The best infrastructure plays always seem dull until suddenly, everyone needs them.

So, WAL is less like a lottery ticket and more like a long bet on digital infrastructure. It rewards people who think about systems, not just sentiment. It comes down to a simple question: Do you believe decentralized storage will matter at scale down the road?

If you do, then WAL doesn’t need momentum. Time will handle the rest.

That’s why WAL is a conviction trade—not a momentum one.@Walrus 🦭/acc #Walrus $WAL