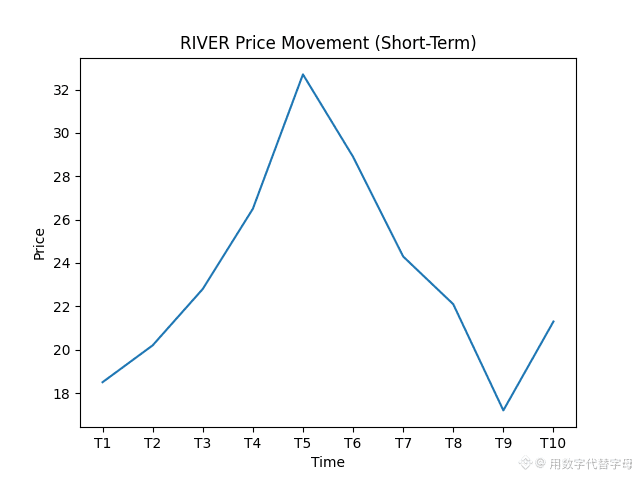

RIVER saw a sharp drop after a strong upside move. The rejection from the top was aggressive, but price is now trying to stabilize after touching a key demand zone. This kind of move usually means the market is cooling down, not finished.

🔍 What the market is showing

Short-term (1H):

Heavy selling pressure already played out

RSI moved into lower range and is slowly recovering

Buyers are defending the lower zone instead of panic exiting

This hints at short-term relief attempts, not a straight dump.

Structure & zones:

Strong support: around 19–20

Major resistance: around 24–26

Upper rejection area remains near 32

Price respecting these levels keeps the structure valid.

⏳ Forward View (Multiple Methods)

⏳ Forward View (Multiple Methods)

Short term:

If support holds, price may attempt a slow bounce toward the mid-range.

Mid term:

Sustained trading above resistance can bring trend recovery.

Failure to hold support may lead to sideways consolidation instead of another sharp fall.

Tools used:

Price action, support–resistance, momentum behavior, RSI reaction.

⚠️ Reminder

This is personal market observation, not financial advice.

Always manage risk and plan your trades carefully.#WriteToEarnUpgrade