Most people open Polymarket with the same goal in mind:

Be right.

Right about direction.

Right about timing.

Right about whether Bitcoin will go up or down.

That mindset feels logical.

It also quietly destroys accounts.

Because prediction markets are not designed to reward accuracy alone.

They reward pricing errors.

What Actually Happened

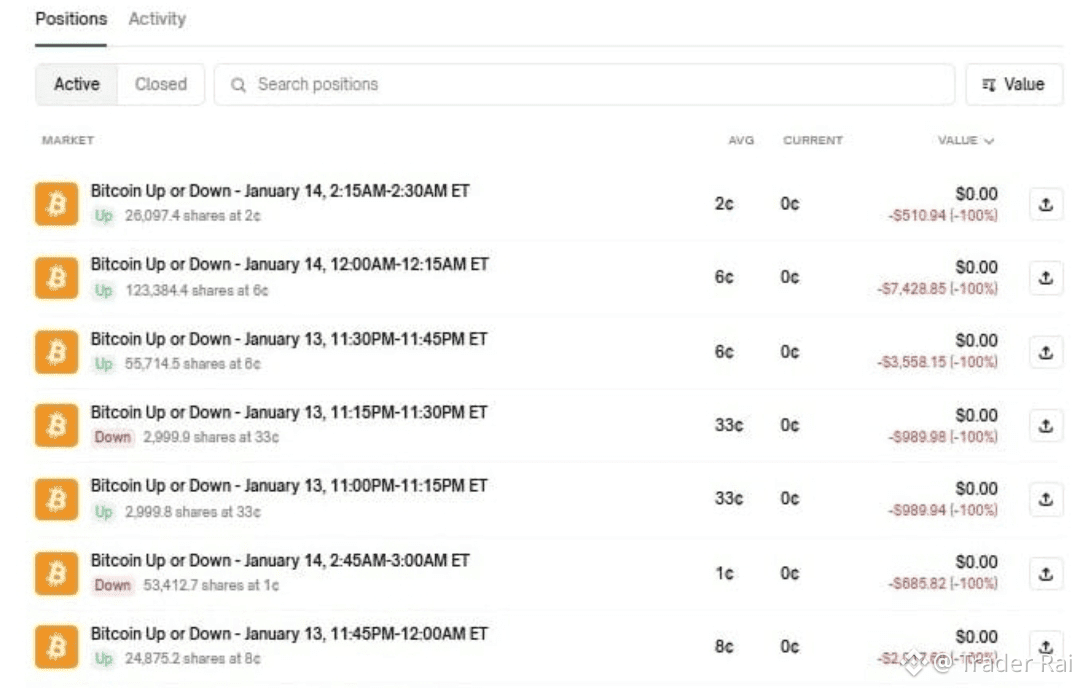

A wallet named hai15617 joined Polymarket and immediately began trading ultra-short-term Bitcoin markets.

No long-term thesis.

No macro storytelling.

No public analysis.

Just execution.

Ten predictions were placed.

Several of them went straight to zero.

Total losses.

The kind of streak that usually forces traders to stop or emotionally downsize.

But this trader didn’t flinch.

The One Trade That Changed Everything

Then one position hit.

Not a recovery trade.

Not a small win.

A single position generated $99,779.51 in profit — an 887% return.

In seconds, every previous loss disappeared.

The account flipped aggressively green.

Final result: over $92,000 in profit in just a few hours.

That wasn’t luck.

And it wasn’t prediction.

The Real Edge: Trading Mispriced Probability

Here’s the critical insight most people miss:

He wasn’t betting on Bitcoin’s direction.

He didn’t care about narratives.

He didn’t care about sentiment.

He didn’t even care about being “right.”

He cared about probability being wrong.

Short-term markets are emotional by design.

Fear pushes odds too far one way.

Greed stretches pricing beyond reality.

Crowds overreact to tiny moves.

When that happens, probabilities detach from truth.

That gap — that error — is where money is made.

Why One Win Was Enough

In markets like Polymarket, you don’t need a high win rate.

You need:

• Patience

• Size

• Conviction when pricing breaks

When the inefficiency appears, you lean — hard.

One properly sized trade at extreme mispricing can erase ten bad ones instantly.

That’s exactly what happened here.

The Lesson Most Traders Miss

Win rate is vanity.

Accuracy feeds ego.

Being “right” feels good.

But alpha comes from spotting flawed pricing.

Some traders chase outcomes.

Some chase momentum.

The sharp ones trade the weakness in the system itself.

This trader didn’t beat the market.

He let the market misprice reality —

and got paid for noticing.